Lee Jae-myung's Second Proposed Bill

Introduces Amendment to 'Illegal Private Loan Nullification Act'

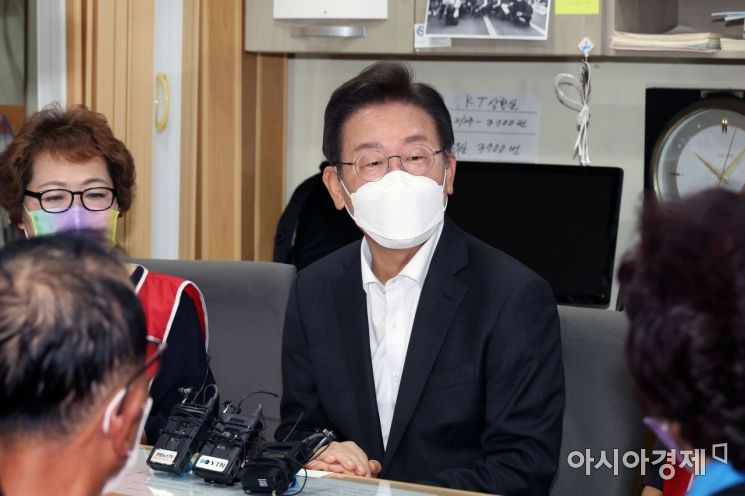

Lee Jae-myung, a member of the Democratic Party of Korea who declared his candidacy for party leader, holds an on-site meeting with cleaning workers at Yonsei University in the storage room of the outdoor theater at Yonsei University, Seodaemun-gu, Seoul on the 18th. Photo by the National Assembly Press Photographers Group

Lee Jae-myung, a member of the Democratic Party of Korea who declared his candidacy for party leader, holds an on-site meeting with cleaning workers at Yonsei University in the storage room of the outdoor theater at Yonsei University, Seodaemun-gu, Seoul on the 18th. Photo by the National Assembly Press Photographers Group

[Asia Economy Reporter Koo Chae-eun] On the 27th, Lee Jae-myung, a member of the Democratic Party of Korea, took the lead in proposing a revision to the 'Illegal Private Loan Nullification Act,' which invalidates interest contracts made under illegal loan agreements.

The main point is to nullify interest contracts when monetary contracts exceed the maximum interest rate, and to nullify the loan contract itself when the interest rate exceeds twice the maximum legal interest rate.

Lee's office announced in a press release that they had taken the lead in proposing partial amendments to the Interest Rate Restriction Act and the Act on Registration of Loan Business and Protection of Financial Consumers. Under current law, when a monetary contract exceeds the statutory maximum interest rate, only the excess interest contract is invalidated, and the excess interest paid is merely applied to the principal.

Lee stated that the bill was proposed with the intention that "money borrowed to live should not ruin life." Additionally, the bill includes provisions to prohibit advertising that causes confusion by using words or trademarks used by the government or public institutions to imply state-supported products, and to prevent double contracts that differ from the actual contract written.

Lee's office said, "With the recent stock and asset market crashes combined with interest rate hikes, household debt burdens are increasing, threatening people's livelihoods," adding, "There have been repeated cases of people giving up precious lives due to debt burdens, making urgent countermeasures necessary." They continued, "Especially, financially vulnerable groups with low credit ratings who find it difficult to use institutional finance are being driven to high-interest private loans, resulting in significant debt burdens," and said, "We will do our best to pass this bill so that money borrowed to live does not become a shackle that strangles life."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)