"China Dominates Upstream Solar Panel Manufacturing... Supply Chain Risk Vulnerable"

[Asia Economy Reporter Oh Hyung-gil] It is pointed out that South Korea's solar power value chain has been broken, leading to a supply chain crisis. China has dominated the solar power value chain, controlling price leadership and even leading technology standards, according to analysis.

On the 24th, Jo Il-hyun, a research fellow at the Korea Energy Economics Institute, stated in the report "Solar Power Costs and Supply Chain Risks in the Manufacturing Sector," "As solar power expands, equipment supply has become important, but China is leading the upstream manufacturing sector of solar power."

Currently, silicon-based solar modules dominate the market, but the upstream manufacturing sector of solar power is concentrated in specific regions under the leadership of Chinese companies, and the market has been reorganized around top companies.

Researcher Jo said, "In the case of polysilicon, about 40% of production facilities are concentrated in China's Xinjiang Autonomous Region, and a few Chinese companies dominate the ingot wafer market," adding, "The reason Chinese companies are competitive is that electricity costs, which account for 40% of production costs, are low."

Chinese polysilicon factories are located in Xinjiang, Inner Mongolia Autonomous Region, Sichuan, and western Qinghai, where coal and hydropower are the main power sources, resulting in low electricity costs. Additionally, the government and local authorities provide policy support for electricity fees.

As China dominates the upstream manufacturing sector of solar power, the supply chain has become vulnerable to risks.

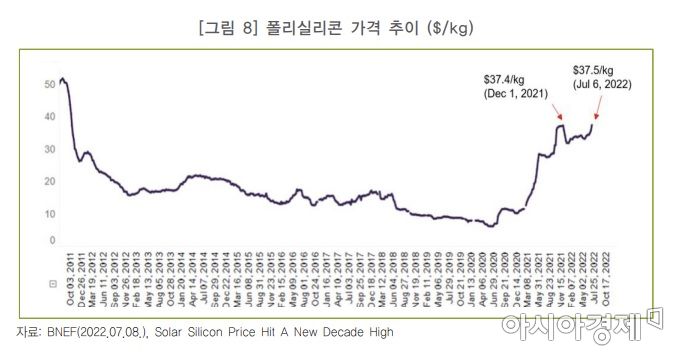

He argued, "In 2020, due to COVID-19 and issues at Chinese polysilicon factories, supply could not keep up with increased demand, causing a sharp rise in polysilicon prices," adding, "Although polysilicon and raw material prices rose together, module costs did not increase, worsening profitability."

This means that the concentration of the upstream solar manufacturing sector in a few Chinese companies led to price increases being passed on to module manufacturers.

On the other hand, South Korea possesses the highest level of technology along the solar power value chain but lacks competitiveness against Chinese companies in terms of price.

Researcher Jo evaluated, "Since 2018, the polysilicon, ingot, and wafer value chains have collapsed, and currently, the domestic value chain is broken," pointing out, "In 2018, OCI, Korea Silicon, and Hanwha Chemical were analyzed to have international competitiveness in polysilicon, but currently, the only domestic company producing polysilicon for solar power is OCI (Malaysia factory)."

However, efforts by the United States and the European Union (EU) to diversify the solar power supply chain are expected to have a positive effect on Korean companies.

He emphasized, "Diversification of the silicon-based supply chain can reduce supply chain risks for domestic companies," adding, "In the long term, it is necessary to diversify the supply chain by transitioning to next-generation solar power technologies such as tandem and perovskite, moving away from silicon-based systems."

Perovskite is evaluated as producing solar cells using organic-inorganic compounds, making its value chain different from the existing silicon-based one. Although it has advantages in terms of economy and efficiency, it currently faces challenges in durability and large-area application.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)