Federation of Korean Industries Analyzes Labor Costs and Performance Trends of Listed Companies from 2011 to 2021

"Excessive Wages Compared to Productivity Improvement"

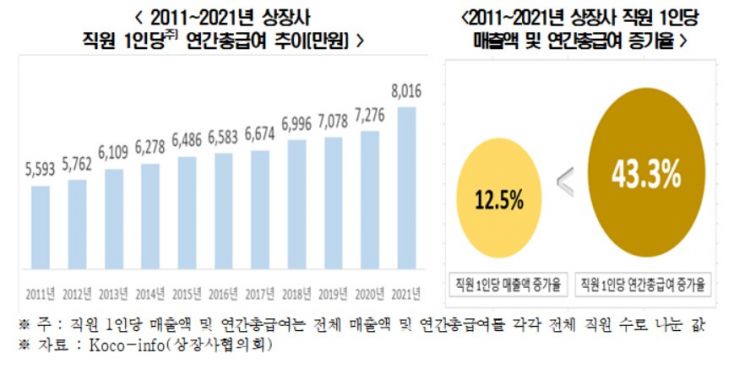

[Asia Economy Reporter Park Sun-mi] Over the past decade, the wage increase rate per employee at listed companies was 43.3%, which is 3.5 times the sales growth rate of 12.5%. This indicates that the rise in labor costs is steeper than labor productivity, suggesting that wage increases are excessive compared to productivity improvements.

On the 20th, the Federation of Korean Industries (FKI) analyzed the trends in labor costs and performance of listed companies from 2011 to 2021. The average annual total salary per employee at listed companies rose from 55.93 million KRW in 2011 to 80.16 million KRW in 2021. The wage increase rate during this period was 43.3%, which is 3.5 times higher than the sales increase rate per employee of 12.5% (960 million KRW in 2011 → 1.08 billion KRW in 2021).

Notably, during 2013?2016 and 2019?2020, even though sales per employee recorded negative growth rates, the annual total salary per employee still increased compared to the previous year.

Due to the high downward wage rigidity in Korea’s labor market, wages often rise during recessions with negative growth rates because of labor-management negotiations. The FKI explained, “Except for 2017, which was a semiconductor boom year, and last year, which showed strong performance in non-face-to-face sectors such as IT, gaming, and telecommunications due to the COVID-19 base effect, the labor cost increase rate has consistently outpaced the sales growth rate.”

The industry with the largest increase in labor cost (annual total salary) as a percentage of sales over the past decade was travel agencies and travel support services (10.1 percentage points). This was followed by ▲ film and broadcasting program production and distribution (9.6 percentage points) ▲ rubber product manufacturing (7.0 percentage points) ▲ architectural technology and engineering services (6.7 percentage points) ▲ printing and publishing (6.5 percentage points) ▲ electrical and telecommunications construction (6.1 percentage points) ▲ wholesale of food, beverages, and tobacco (5.8 percentage points) ▲ metal processed product manufacturing (4.0 percentage points) ▲ shipbuilding (3.8 percentage points) ▲ chemical fiber manufacturing (3.7 percentage points).

Among the top 10 industries with the largest increase in labor cost ratio to sales, nine experienced a decrease in sales per employee last year compared to 2011, due to the COVID-19 situation. Specifically, film and broadcasting program production and distribution (-67.7%), wholesale of food, beverages, and tobacco (-64.4%), and travel agencies and travel support services (-36.7%) ranked in that order.

Compared to other countries, Korea’s labor cost increase rate is also steeper than its labor productivity growth. According to OECD statistics, over the past decade (2009?2019), labor costs per manufacturing worker in Korea increased by 37.6%, while labor productivity per worker rose by 29.1%, meaning labor cost growth outpaced productivity growth.

During the same period, the labor cost increase rate and labor productivity growth rate for the G5 countries were 23.6% and 22.3%, respectively. Korea’s manufacturing labor cost increase rate (37.6%) was 1.6 times higher than that of the G5 (23.6%), and the gap between labor cost and productivity growth rates was 8.5 percentage points, larger than the G5’s 1.3 percentage points.

Choo Kwang-ho, head of the FKI Economic Headquarters, pointed out, “Excessive wage increases compared to productivity improvements not only reduce corporate competitiveness but also trigger a vicious cycle by pushing up product prices and causing inflation.” He added, “In an uncertain domestic and international business environment marked by global supply chain instability, rising prices, and rapid interest rate hikes, companies need to refrain from sharp wage increases and prioritize finding ways for labor and management to jointly improve productivity in order to survive and preserve jobs.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)