[Asia Economy Reporter Lee Seon-ae] As international oil prices, which had been soaring, plummeted due to concerns over an economic recession, attention is focused on whether foreign investors will return to the Korean stock market. Looking at past records where foreign investors returned to the Korean market 4 to 6 months after the peak of international oil prices, there is a forecast that foreign buying momentum could be expected in early Q4. This is a reason to pay close attention to advice on structuring stock portfolios in line with the full-scale decline in international oil prices.

The major cause of this year's plunge in the domestic stock market is the withdrawal of foreign investors from the Korean market. This was driven by trade deficit and high oil prices. On the 14th, Shin Jung-ho, a researcher at Ebest Investment & Securities, said, "The cause of the worsening trade balance is high oil prices," adding, "The strong rise in international oil prices reflected concerns about profit margin declines, which became the basis for large-scale selling of Korean stocks by foreign investors." He continued, "International oil prices above $100 cause profit margin erosion for domestic companies, but the positive aspect is that the peak-out of international oil prices provides, with a time lag, grounds for profit margin improvement and foreign investors' buying of Korean stocks," and forecasted, "Considering that foreign investors returned to the Korean market 4 to 6 months after past international oil price peaks, foreign buying momentum can be expected around September to October."

Foreign investors continuously sold domestic stocks in the first half of this year. They consistently net sold for six consecutive months from January. Last month alone, they sold stocks worth 3.701 trillion KRW and 172 billion KRW in the KOSPI and KOSDAQ markets, respectively. The total net selling of domestic listed stocks for six consecutive months from January reached 19.903 trillion KRW. The securities industry expects this foreign net selling streak to come to an end around September to October.

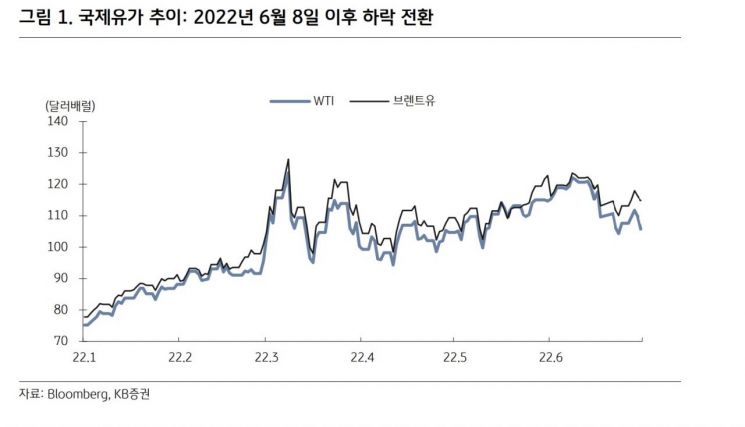

As the decline in international oil prices is anticipated, advice is emerging that investment strategies should be established accordingly. Since June, international oil prices, which had been rising sharply, have started to decline. The cause is concerns over a global economic recession. Jeon Gyu-yeon, a researcher at Hana Securities, said, "International oil prices are likely to gradually decline until the end of the year reflecting economic sluggishness, but will maintain a higher level compared to pre-COVID-19 times."

If the economic recession expands, the decline in international oil prices is expected to be larger. Oh Jae-young, a researcher at KB Securities, forecasted, "Due to recession concerns, international oil prices have entered a correction phase. If the recession is mild, $83 is expected by year-end, but in the case of a strong recession, it will trend down to $66."

As short-term beneficiaries of the oil price decline, oversold growth stocks are promising, and for the mid-term, margin spread sectors (food and beverage) are favorable. Lee Eun-taek, a researcher at KB Securities, advised, "In past economic slowdowns, oil prices inevitably peaked and then declined. Considering this, attention should be paid to sectors where margin spreads will expand." He added, "Especially in food and beverage, prices have already been raised while costs are falling, and this cycle tends to last for about 2 to 3 quarters," recommending, "Chemicals, construction, and automobiles are also sectors to watch."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)