Korea Deposit Insurance Corporation 'Financial Product Trend Brief'

Deposit Assets Increase 10% in One Year to 2,295 Trillion KRW

Banks and Holdings' New Capital Securities Sold Out Consecutively

[Asia Economy Reporter Song Seung-seop] Deposit-type assets in the financial sector have increased by more than 10% in one year, approaching 2,300 trillion won. Various industries are continuously launching high-interest fully-sold products to absorb the liquidity released into the market following the base interest rate hikes.

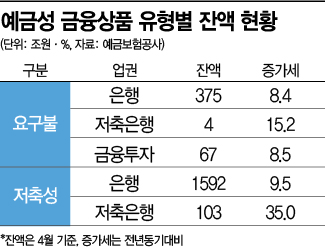

According to the ‘Financial Product Trend Brief’ by the Korea Deposit Insurance Corporation on the 7th, as of April, deposit-type assets in the financial sector totaled 2,295 trillion won, up 10.3% compared to the same month last year. Savings assets were the largest in scale and growth, at 1,695 trillion won with a 10.8% increase, while demand deposits rose 8.5% to 446 trillion won. Foreign currency and other assets increased by 10.6% to 154 trillion won. By sector, banks accounted for 2,119 trillion won, savings banks 109 trillion won, and financial investment 67 trillion won.

On the other hand, loan-type assets grew by only 8% to 2,688 trillion won. Household loans showed the lowest growth at 3.4%, totaling 1,228 trillion won. However, corporate loans increased by 10.6% to 1,335 trillion won. Among the total, loans issued by banks amounted to 2,308 trillion won, accounting for 85.8% of the total.

Investment-type assets also increased by about 9.3%, lagging behind the growth rate of deposit-type assets. Of the total investment funds of 4,143 trillion won, 2,869 trillion won were debt securities. Funds followed with 831 trillion won, money trusts at 335 trillion won, and derivative-linked securities at 108 trillion won. Notably, stock trading (KOSPI + KOSDAQ) saw a significant decrease of 37.2% year-on-year, with a trading volume of 390 trillion won.

"Pulling in liquidity"... Financial sector launches high-interest safe assets

The financial sector is launching new products likely to attract popularity to retain the massive deposit-type assets or convert them into investment funds. Hybrid capital securities issued by financial holding companies and banks are representative examples. Hybrid capital securities are financial products that have characteristics of both stocks and bonds. They are long-term bonds without maturity or with extendable terms like stocks, and they pay a fixed interest.

Hybrid capital securities are known to be relatively safe despite their high interest rates, and recently many banks have been selling them out completely. These securities generally have a high credit rating, mostly AA-, and the interest rates offered as of last month were between 4% and 5%. Although they have no maturity, a call option is usually exercised after five years, allowing investors to receive the principal back. Another advantage is that individuals can invest in small units.

High-interest products in the banking sector have also continued, with 9 products in February, 13 in March, and 10 in April. Most of these were special promotional products offering preferential interest rates upon new contract subscriptions for fixed deposits and installment savings. A representative example is the ‘Naver Pay X JB Savings’ account, which offers preferential interest rates when linking a Jeonbuk Bank demand deposit account to Naver Pay and using point charging or simple payments through the account. It provides a preferential interest rate of 3 percentage points, allowing a maximum annual interest rate of 6%.

Sports-themed unique savings products launched to coincide with the start of the professional baseball season also gained popularity among fans. Shinhan Bank’s ‘2022 Shinhan Professional Baseball Savings’ offers a basic interest rate of 1.70% per annum, but with preferential rates, it can increase up to 3% even though it is a flexible savings account. A preferential interest rate of 0.01 percentage points is added each time the team chosen by the subscriber wins. The monthly savings limit ranges from 1,000 to 500,000 won. Gwangju Bank also offered a KIA Tigers victory wish deposit and savings product with a 2.15% interest rate, and Kyongnam Bank launched a 2.30% BNK Baseball Love Fixed Deposit product.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.