Electric Vehicle Leadership Shifts Toward China

China's New Energy Vehicle Sales Nearly Reach 500,000 Last Month, a Record High

BYD Sales Quadruple from January to May

World's 3rd Largest Auto Company by Market Cap

New EV Startups Also Selling Globally, Including Europe

3347 to 0. This is the difference in the volume of electric vehicles imported from China and those exported from South Korea up to May this year. Although Hyundai Motor, which has factories in China, produces electric vehicles locally, only 42 units were sold up to May this year. The newly released Kia Niro electric vehicle uses batteries from the Chinese company CATL. Ssangyong Motor is also in talks to use BYD batteries for the Torres electric vehicle, which is under development and targeted for release in the second half of next year.

The relentless offensive by Chinese electric vehicle and battery companies is intensifying. Electric vehicles and batteries are considered key sectors for future mobility. This has led to fierce competition for dominance, especially among advanced countries worldwide, including South Korea. In particular, China is expanding its global influence based on massive domestic demand and policy support, engaging in leadership battles with Korean companies in various areas.

"500,000 units per month" - The Chinese Electric Vehicle Market Has Grown Larger

The Chinese electric vehicle market, which had slowed due to COVID-19 resurgence lockdowns and subsidy suspensions, has recently entered a new heyday. According to data recently released by the China Passenger Car Association (CPCA), sales of new energy vehicles (electric vehicles + plug-in hybrids) in China last month are estimated to have approached 500,000 units. This is the highest monthly sales volume ever recorded.

Considering that total electric vehicle sales in Europe are around 200,000 units per month and the U.S., where the market is just beginning to grow, sells less than 100,000 units monthly, this is a significant scale. South Korea sells just over 10,000 units per month. CPCA explained, "As the impact of the pandemic gradually eases and supply chains recover, the production capacity and market demand that were sluggish in April and May have improved since June."

A recent characteristic of the Chinese electric vehicle market is the dominance and increased competitiveness of domestic companies, excluding Tesla, which is boosting overseas exports. The leader in local electric vehicle sales this year is BYD, a company that manufactures both electric vehicles and batteries, consistently selling over 100,000 units monthly since March. The cumulative sales from January to May this year exceeded 500,000 units, more than four times the same period last year.

BYD ranks third in global automotive company market capitalization, following Tesla and Toyota. It is reported that BYD is considering establishing a passenger electric vehicle sales network in South Korea and may begin direct sales as early as next year. While Chinese manufacturers have frequently sold commercial vehicles such as buses and trucks or construction machinery in South Korea, Chinese-made passenger cars have not yet entered the market.

In Europe, where the electric vehicle market was established early, the rise of Chinese electric vehicles is also remarkable. According to data from EU-EVS.com, which tracks electric vehicle registrations in major European countries, the market share of China's Geely was 5.5% in the second quarter of this year. Geely is China's largest private automaker, holding shares in Volvo and Mercedes-Benz, and has cooperated with European brands in various ways since the past. It began local sales in the second half of 2020 and quickly established itself despite lacking a local production network.

Chinese Battery Companies "Expanding Beyond Domestic Market to Overseas"

Chinese battery companies are accelerating their overseas expansion, threatening Korean battery companies that have held leadership in major foreign markets. This is expected to trigger an investment battle to dominate the European electric vehicle market following the U.S.

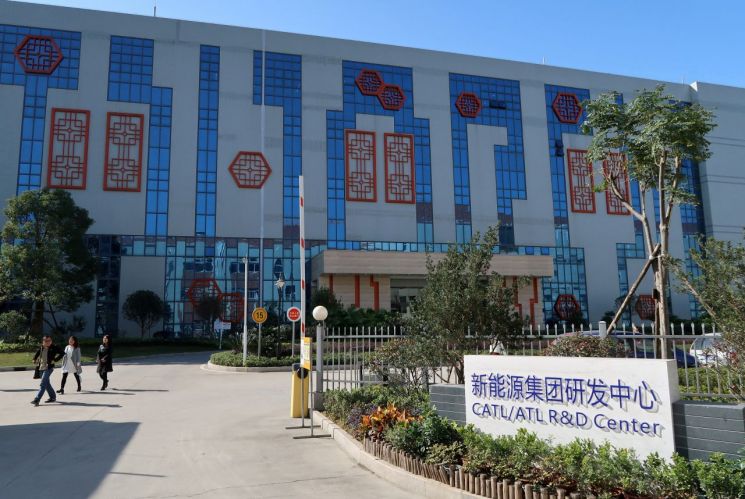

According to industry sources, Chinese CATL is planning to establish a new factory in Debrecen, Hungary. CATL is the world's number one company, maintaining its position based on demand within China. It is reported that CATL will purchase a 200-hectare site in the Debrecen area, where BMW and other automakers have factories. BMW, which has focused on prismatic batteries, has chosen CATL as a supplier as it plans to equip its new cylindrical batteries.

CATL is expected to supply cylindrical batteries for BMW's next-generation platform 'Neue Klasse' starting in 2025. Chinese EVE Energy is also constructing a cylindrical battery cell factory in Hungary. EVE Energy was selected last year as a battery supplier for BMW's order worth 8 billion euros (approximately 10.7 trillion KRW).

Domestic companies are also making strides to expand production facilities in Hungary. Samsung SDI has completed construction of its second plant in G?d, Hungary, and plans to start operations as early as the second half of this year. Samsung Electronics Vice Chairman Lee Jae-yong recently visited Samsung SDI's battery factory in Hungary during a European business trip and met with BMW, increasing interest in local battery business. SK On is scheduled to complete its second plant in Kom?rom, Hungary, this year following the first plant, and plans to secure production facilities in Iv?ncsa with the goal of starting operations in 2024.

Professor Park Cheol-wan of the Automotive Department at Seojeong University said, "Electric vehicles from Chinese startups such as Nio and Xiaopeng are being sold worldwide, including Europe, and various makers, including premium electric vehicles, are entering the domestic market's visible range. The rise of Chinese electric vehicle and battery companies is not sudden but something that was bound to happen."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)