70% Plunge in Q1 Derivative-Linked Securities Redemption

Major Indices Plummet, Causing Redemption Delays

Securities Firms' Hedge Assets Suffer 2.7 Trillion Won Loss

[Asia Economy Reporter Ji Yeon-jin] Since the beginning of this year when US monetary tightening started, major countries' stock markets have continued to decline, resulting in a sharp decrease in redemptions of equity-linked securities (ELS). Securities firms also suffered significant losses in ELS hedge investments, but as the amount of investment to be redeemed is expected to decrease, the valuation gains recorded net profits, contrasting with investors' anxiety over principal loss.

According to the Financial Supervisory Service's announcement on the first quarter of this year, the issuance amount of derivative-linked securities was 14.5 trillion KRW, and the redemption amount was 9 trillion KRW, down 39.83% and 69.28% respectively compared to the same period last year. ELS issuance amounted to 12 trillion KRW, a 36% decrease from a year ago, while during this period, DLS issuance sharply dropped by 52.5% to 2.5 trillion KRW.

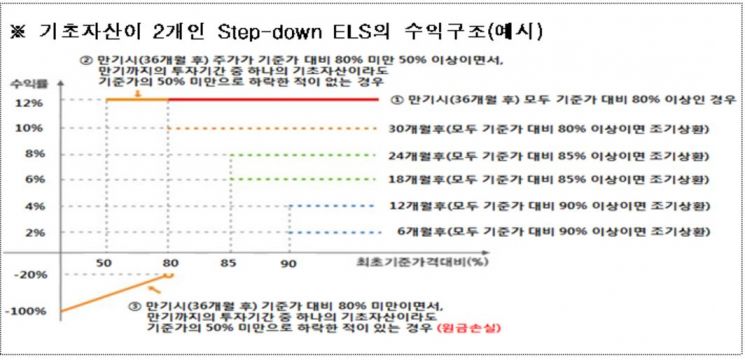

ELS are derivative products whose returns are linked to stocks or stock indices. If the underlying asset price does not fall below the predetermined reference point set by the securities firm at issuance, investors can receive early redemption with the promised return, making it a kind of probability game financial product. For example, if an index currently at 100 does not fall below 90 within six months, the investor receives the principal back along with a 2% return. Most ELS issued domestically are 'step-down type,' which conduct early redemption every six months; if the early redemption criteria are not met, investors must hold until maturity. If the underlying asset plunges and enters the 'Knock-In' zone, there is a risk of principal loss.

This year, with major stock indices such as the Hong Kong H Index plunging, many ELS failed early redemption, resulting in the outstanding balance of derivative-linked securities increasing by 6.5 trillion KRW to 89.4 trillion KRW in the first quarter compared to the same period last year. In particular, ELS redemption amount sharply decreased by 71.4% to 6.8 trillion KRW, while the outstanding issuance balance increased by 11.0% to 61.9 trillion KRW.

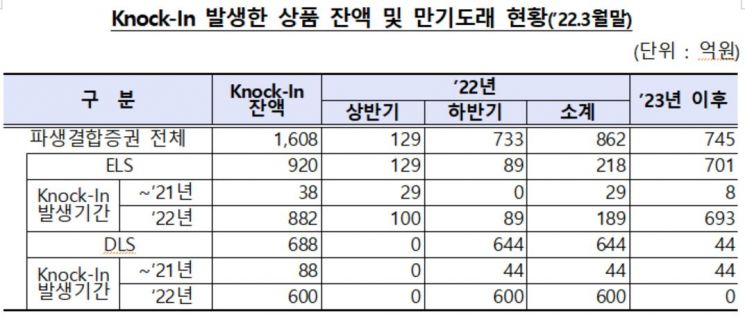

As of March this year, derivative-linked securities that have triggered Knock-In amount to 160.8 billion KRW, with more than half (86.2 billion KRW) maturing this year. Most of these ELS include the Hong Kong H Index.

The ELS investment return rate in the first quarter of this year was 3.7% per annum, up 0.8 percentage points from the same period last year. The Financial Supervisory Service explained that this was due to improved coupon rates on derivative-linked securities as volatility increased in underlying assets such as overseas stock indices.

As of the end of March, the total valuation of hedge assets used to manage funds from derivative-linked securities issuance was 92.8 trillion KRW, with liabilities valued at 84.6 trillion KRW. Hedge assets consisted of bonds at 73.2 trillion KRW (78.9%), deposits and escrow funds at 11.2 trillion KRW (12.1%), other assets at 10.2 trillion KRW (11.0%), and cash at 2.3 trillion KRW (2.5%).

During this period, securities firms' profit and loss from issuing and managing derivative-linked securities was 60.2 billion KRW, a 79.5% decrease from 293.3 billion KRW a year ago. Due to the global index decline and interest rate hikes, hedge assets such as derivatives and bonds incurred operating losses of 2.7 trillion KRW. However, as the expected amount to be redeemed to investors decreased, valuation gains reached 2.9 trillion KRW.

A Financial Supervisory Service official said, "Since many ELS products mature next year, even if the current indices fall significantly, as long as they do not enter the Knock-In zone, the risk of principal loss is not high." However, "With an increase in non-principal-guaranteed ELS products that are highly volatile and stock-type, and with the expansion of financial market volatility due to US interest rate hikes and recession concerns, we plan to continuously monitor the risk of investor losses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)