Experts: "Singer Demand Will Revive... But Won't Drive House Price Increase"

[Asia Economy Reporter Kim Min-young] The key phrase for this deregulation of restricted areas is 'pinpoint' adjustment. While maintaining regulation in areas where housing prices could overheat, such as the metropolitan area and Haeundae in Busan, the government has eased transaction restrictions in some local cities with stagnant real estate markets, such as Suseong-gu in Daegu and Yuseong-gu in Daejeon. This signals a relaxation of regulations to the market, but the government’s intention to thoroughly block any housing price stimulation resulting from deregulation is clear. Since only a few areas have had regulations lifted, the impact on the real estate market is expected to be minimal.

The Ministry of Land, Infrastructure and Transport announced on the 30th that it held the ‘2nd Residential Policy Deliberation Committee Meeting of 2022’ and deliberated and approved the ‘Adjustment Plan for Speculative Overheated Districts and Regulated Areas.’

At the meeting, private committee members judged that it was necessary to lift the designation of six speculative overheated districts in local areas, considering factors such as interest rate hikes stabilizing the housing market and an increase in unsold homes in local regions. Accordingly, six areas including Suseong-gu in Daegu, Dong-gu, Jung-gu, Seo-gu, and Yuseong-gu in Daejeon, and Changwon and Uichang-gun in Gyeongnam were removed from the speculative overheated district designation.

Previously, in December last year, the Ministry of Land, Infrastructure and Transport also held a residential policy deliberation committee meeting to discuss deregulating areas such as Daegu and Changwon in Gyeongnam, but decided to maintain all 161 regulated areas due to concerns about a ‘balloon effect’ from deregulation.

They also agreed to lift the designation of regulated areas in local cities and counties where short- and long-term housing prices have consistently stabilized. As a result, 11 areas including Dong-gu, Seo-gu, Nam-gu, Buk-gu, Jung-gu, Dalseo-gu, and Dalseong-gun in Daegu, Gyeongsan-si in Gyeongbuk, and Yeosu-si, Suncheon-si, and Gwangyang-si in Jeonnam will be removed from the regulated areas.

In the case of Sejong City, where housing prices have been declining since last year, the designation as a regulated area will be maintained. Although the recent housing price decline continues, the high competition rate for subscription indicates that potential buying demand remains.

In the metropolitan area, some parts of Ansan and Hwaseong, which were designated as regulated areas despite being island regions without apartments during the past designation process at the city and county level, will be removed from speculative overheated districts and regulated areas. The targeted areas include Daebudong, Daebunam-dong, Daebubuk-dong, Seongam-dong, and Pungdo-dong in Danwon-gu, Ansan, which were designated as speculative overheated districts. These areas, along with Seosin-myeon in Hwaseong, will be removed from regulated areas.

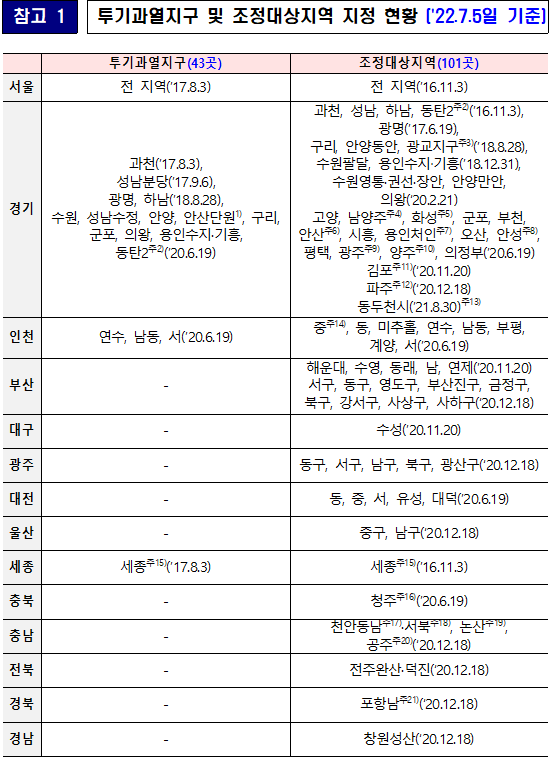

As a result of this deliberation, there are now 101 regulated areas and 43 speculative overheated districts. The approved adjustment plan for speculative overheated districts and regulated areas will take effect from 0:00 on July 5, after its publication in the official gazette.

Experts believe the impact of this deregulation on the market will be minimal. This is because the deregulation was limited to a 'pinpoint lifting' in some areas such as Suseong-gu in Daegu and Yuseong-gu in Daejeon, rather than a comprehensive relaxation including the metropolitan area. The government has carefully controlled the extent of deregulation to avoid stimulating housing prices.

Yoon Ji-hae, senior researcher at Real Estate R114, said, "Although some demand may revive for unsold and stagnant properties in the areas removed from regulated zones this time, it will not be a driving force strong enough to reverse the market."

Lee Eun-hyung, research fellow at the Korea Institute of Construction Policy, said, "The impact of this adjustment of regulated areas on the market is expected to be limited. The biggest reason is that areas of public interest such as Seoul, the metropolitan area, and Sejong were excluded from the adjustment."

He added, "Some raise concerns that deregulation might increase pre-sale prices, but this is not a problem. If the higher pre-sale prices lead to quick sales, the market judges the prices as reasonable; if there are unsold units, it means the prices were set too high. The government’s policy direction is to leave it to the market," he explained.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.