Pent-up Travel Demand Remains Strong

Korean Air and Jin Air Passenger Revenue Expected to Recover Faster

[Asia Economy Reporter Minji Lee] Amid a significant drop in global airline stocks, an analysis suggests that it is still reasonable to maintain a positive outlook on domestic airlines.

According to the financial investment industry on the 28th, as of the 24th, the Arca Global Airline Index on the New York Stock Exchange fell more than 14%, from 1349.8 to 1118.3 over the past month. On the 16th, it dropped to 1025.8, marking the lowest level this year.

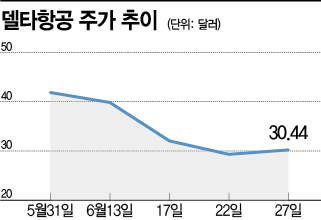

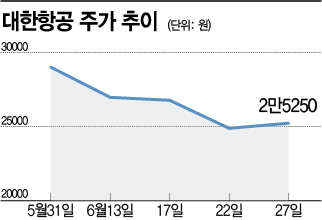

Looking at the stock price trends of major global airlines, Delta Air Lines plummeted 27% during the same period, while United Airlines (-21%) and American Airlines Group (-24%) also showed steep declines. Domestic airlines also continued their downward trend. Korean Air fell sharply by 14%, and Asiana Airlines (-15%), Jin Air (-20%), and Jeju Air (-25%) also declined.

The biggest reason triggering the decline in global airline stocks is the burden of oil prices. Jet fuel is the most sensitive cost for airlines and greatly influences their profits. According to the International Air Transport Association (IATA), the average annual jet fuel price is high at around $142.8 per barrel. With the continued surge in oil prices, it has exceeded $175 this month.

Accordingly, airfares are also rising. According to Statistics Korea, last month’s international airfare increased by about 20% compared to the same month last year. The rise in jet fuel prices has led to an increase in fuel surcharges. Concerns about demand evaporation have also added pressure. With excessive inflation and growing fears of a recession, the outlook that travel demand could sharply decline has been reflected in stock prices.

However, securities experts unanimously say it is reasonable to maintain expectations for the performance of domestic airline stocks. This means they are likely to continue a stock price trend different from that of global airlines. Although travel demand tends to shrink during stagflation periods?when inflation rises amid economic recession?it is analyzed that it will be difficult to suppress the demand that has been pent up for two years.

Park Sooyoung, a researcher at Hanwha Investment & Securities, said, "In the case of the U.S., passenger traffic has recovered to 90% of 2019 levels, which can be interpreted as most people who want to fly have already done so." He added, "In Korea, passenger traffic has recovered to about half, so there is significant latent travel demand." In fact, looking at last month’s Consumer Sentiment Index (CSI), Korean citizens’ travel expenditure scored 104 points, higher than 91 points at the end of 2019. The CSI uses 100 as a baseline, with scores above 100 indicating optimistic consumption trends. Those planning to spend more than 5 million won scored 118 points.

Among major domestic airlines, Korean Air and Jin Air are expected to recover sales relatively quickly. Korean Air is expected to maintain a performance advantage by absorbing premium demand even if severe stagflation deals a fatal blow to the travel industry. Jin Air is predicted to benefit from the expansion of travel demand to Southeast Asia. Choi Go-woon, a researcher at Korea Investment & Securities, explained, "Jin Air has a relatively high proportion of Southeast Asia routes. Since Japan has not fully reopened, overseas travel demand will concentrate mainly on the U.S. and Southeast Asia."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)