Among Major Global Stock Markets, the Poorest Performance "Global Investors' Avoidance"

US Recession Signal, Sharp Drop Could Shake KOSPI "Direct Descent to the Basement"

[Asia Economy Reporter Lee Seon-ae] "The U.S. stock market rebounded, so why is the domestic stock market struggling?" Despite the technical rebound in the U.S. stock market, the KOSPI and KOSDAQ indices both hit new yearly lows the previous day, causing a sharp decline in the domestic stock market. The domestic market, influenced by the U.S. stock market, now shows little reaction to positive news (rebound) but is more severely shaken by negative news (economic recession), making it the most prominent in terms of decline among major global stock markets. This is why individual investors on stock communities complain that "only KOSPI is being left out" during the global market correction phase. The reason for this market differentiation is attributed to global investors viewing the domestic market pessimistically and withdrawing funds. Analysts suggest that the stigma effect on the domestic economy and financial markets, along with an 'excessive fear-driven investment sentiment' outweighing recession concerns, are weighing down the domestic stock market. The problem lies in the signals of a U.S. economic recession. If the U.S. stock market falls, the domestic market is likely to fall further. Ultimately, the conservative forecast of the research centers predicting the KOSPI's descent to the basement (around the 2200 level) may become a reality.

Why Is KOSPI 'Left Out' and Falling Faster?

In the global correction phase, major stock markets worldwide are all declining. The issue is that the domestic market's decline is more pronounced, effectively making it the 'last place' among major global markets. According to the financial investment industry on the 23rd, as of the previous day's closing, the KOSPI's year-to-date decline rate reached 21.3%. This is relatively the worst compared to major markets such as Euro Stoxx (-19.4%), Emerging Markets Index (-19.4%), Dow (-16.1%), Taiwan (-15.8%), Australia (-12.6%), India (-11.0%), Shanghai (-10.2%), Nikkei (-9.2%), Brazil (-5.1%), and the UK (-4.0%). When considering the decline rate for June, the 'left out' status becomes even more evident. The KOSPI's decline rate this month is 12.8%, which is the worst compared to the single-digit declines recorded by all major markets.

The domestic market typically shows synchronization with the U.S. and Chinese stock markets, but recently, despite rebounds in the U.S. and Chinese markets, the domestic market continues to decline. Park Sang-hyun, a researcher at Hi Investment & Securities, described this as a 'unique phenomenon.' Kim Hak-gyun, head of the Shin Young Securities Research Center, diagnosed that "the domestic market is not showing orderly movement." Despite rebounds in the U.S. and Chinese markets, the KOSPI and KOSDAQ hit new yearly lows (2342.81, 763.22) the previous day, raising alarm bells about the domestic market's differentiation.

The cause of this differentiation is that global investors have been pessimistic about the domestic market, selling off billions of won daily and withdrawing funds. This is due to the structure of the Korean economy. Park said, "The deepening relative underperformance of the domestic market is due to the weakening domestic economic fundamentals and the stigma effect on the financial market and economy." The stigma effects include ▲High oil prices: Korea's economy is highly dependent on energy ▲Tech stock adjustment: Korea's economy and export structure heavily rely on semiconductor exports ▲China's economic hard landing: Korea's export structure is highly dependent on exports to China, all of which affect real economic indicators.

The negative impact of soaring energy prices like oil is leading to a widening trade deficit, which is bad news for the stock market. Concerns over tech stock adjustments are further fueling the domestic market's weakness. Korea's semiconductor exports entered a stagnation phase in June, and clear rebound signals are unlikely in the near term, leading to an expanded adjustment range for major domestic IT stocks. This is also why foreign investors' selling has concentrated on semiconductor sectors like Samsung Electronics recently. Foreigners are 'betting' on a worsening outlook for Korea's semiconductor industry. Despite China's economic stimulus policies, the domestic economy is not benefiting. The Chinese government's stimulus strength falls short of expectations. Park emphasized, "To resolve the relative underperformance of the domestic market, it is necessary to alleviate the three stigma effects through reduced external uncertainties, especially a drop in oil prices. The easing or resolution of stigma effects depends on signals of price stability and trade balance improvement."

U.S. Recession 'Warning Signs' and KOSPI's Descent to the Basement

Excessive fear-driven investment sentiment is also holding back the domestic stock market. Lee Kyung-min, head of investment strategy at Daishin Securities, said, "Since the beginning of the year, the global financial market has largely priced in recession variables, but the recent sharp decline in the domestic market was significantly influenced by extreme fear during the process of amplifying existing negative factors." He diagnosed that "the fear sentiment has surpassed the level seen during the COVID-19 pandemic in March 2020 and even the 2008 financial crisis." Kim Dae-jun, a researcher at Korea Investment & Securities, also judged that "fear about the domestic economic outlook is overwhelming fundamentals."

Due to fear, forced liquidation sales are pouring in, increasing downward pressure on the market. Currently, credit loans estimated to have losses exceeding 20% amount to about 7.8 trillion won. This accounts for 38.9% of the total credit loan volume (about 20.3 trillion won). Choi Yoo-jun, a researcher at Shinhan Investment Corp., said, "The reason the domestic market has underperformed globally during the recent decline phase is also due to increased forced liquidation selling pressure," adding, "If further declines occur, the market could experience a drop greater than its resilience."

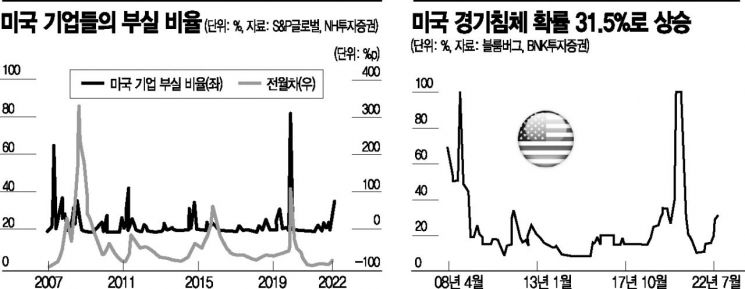

Warning signs of a full-fledged U.S. recession are growing, which is expected to weigh further on the domestic market. The probability of a U.S. recession continues to rise. Currently, the probability that the U.S. economy will enter a recession within the next year has been revised upward to 31.5%. Kim Sung-no, a researcher at BNK Investment & Securities, diagnosed, "In the first half of this year, both U.S. stocks and bonds experienced double-digit declines, which is the first time since the 2000s that declines in both stocks and bonds could lead to a slowdown in household consumption, making it a cause for concern."

Jo Yeon-ju, a researcher at NH Investment & Securities, pointed out, "The fear of stagflation due to the Federal Reserve's tightening policy is expanding, increasing the default risk of U.S. companies." She noted, "The default rate of U.S. companies surged sharply from 2.7% in the previous month to 4.3% in June, and the more difficult it becomes to raise funds, the more likely the default rate will rise significantly." She added, "U.S. corporate profits are also showing signs of change," warning, "Since Q1 2022, U.S. companies have lowered their Q2 earnings guidance, and consensus estimates are being revised downward. Even if there is a Q2 earnings surprise at the lowered expectations, attention should be paid to Q3 guidance."

Consequently, conservative forecasts suggesting the domestic market's bottom could fall to 2200 are emerging one after another. Oh Tae-dong, head of NH Investment & Securities Research Center, expects the KOSPI at 2300, Yoon Ji-ho of Ebest Investment & Securities Research Center at 2200, and Kim Ji-san of Kiwoom Securities Research Center at 2280, all leaving room for lower lows.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.