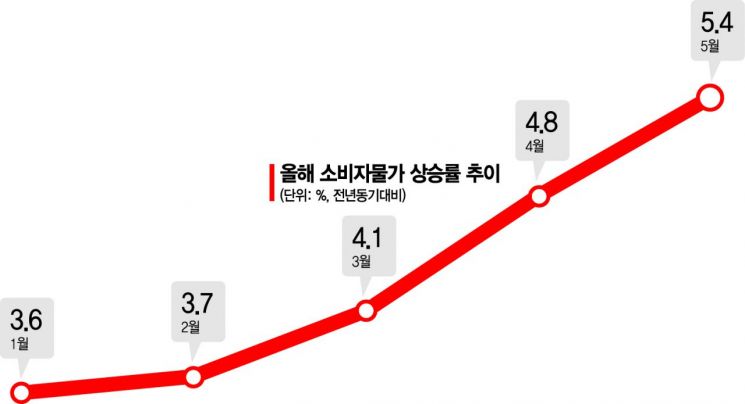

Consumer Price Inflation Exceeds 5%

BOK Expects Continued Rise for Now

Both Supply and Demand Pressure Increasing

Likely to Surpass Previous Surge Levels

Governor Lee Chang-yong: "Monetary Policy Focused on Inflation Until Trend Changes"

Indicates Rate Hike at Next Monetary Policy Meeting

Lee Chang-yong, Governor of the Bank of Korea, holds a briefing session on the status of inflation target management at the Bank of Korea press room in Jung-gu, Seoul on the 21st. / Photo by Moon Ho-nam munonam@

Lee Chang-yong, Governor of the Bank of Korea, holds a briefing session on the status of inflation target management at the Bank of Korea press room in Jung-gu, Seoul on the 21st. / Photo by Moon Ho-nam munonam@

[Asia Economy Reporters Seo So-jeong and Moon Je-won] The Bank of Korea forecasts that consumer prices will continue to rise sharply above 5% for the foreseeable future, bringing about a high inflation fear not experienced since the 2000s.

On the 5th of next month, the Statistics Korea will announce the June consumer price index, and if the increase rate reaches the 6% range, it will be the highest level since February 1998 (9.5%). Going forward, consumer prices are expected to maintain high inflationary pressures from both supply and demand sides, potentially surpassing past periods of rapid price hikes, which is likely to accelerate the pace of base interest rate hikes.

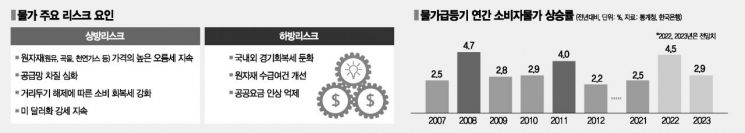

According to the Bank of Korea, the annual consumer price inflation rate exceeded 4% only in 2008 (4.7%) and 2011 (4.0%) over the past 20 years. Recently, international raw material prices have broadly surged, not only in crude oil but also in natural gas, metals, grains, and fertilizers, showing a trend similar to that of 2008.

However, the current situation is problematic because the factors driving inflation are more scattered than in the past. During previous inflation surges, the rise was driven by increased raw material demand due to China's expansion in manufacturing, real estate, and infrastructure investment. Recently, supply chain disruptions caused by infectious diseases, the Ukraine war, and China's lockdown measures, as well as sluggish investment in production facilities due to eco-friendly regulations, have had an impact.

In particular, international food prices have risen to record highs since the Ukraine crisis and are likely to remain at elevated levels for a considerable period. The Bank of Korea stated, "The rise in international food prices will spill over into domestic prices in our country, which heavily depends on food imports, adding upward pressure on inflation in the second half of this year," and added, "This inflationary pressure is likely to continue into next year."

Regarding the won-dollar exchange rate, unlike previous inflation surges, the recent upward trend has continued from the early stages. In 2008, despite the U.S. Federal Reserve's policy rate cuts, the exchange rate rose due to intensified global financial instability. Recently, however, the U.S. dollar has strengthened due to the Fed's accelerated policy rate hikes. Another difference is that demand-side pressures are stronger than in the past due to recent consumption improvements. The inflation diffusion index (core items), which indicates the proportion of items with rising prices, stood at 70.1 as of May this year, higher than December 2008 (69.1) and July 2011 (68.6).

From a liquidity perspective, recent increases resemble those during the 2008 surge, but concerns have grown because household loans have surged amid rising housing prices, combined with government fiscal support such as disaster relief funds that directly affect household consumption. In 2011, liquidity growth slowed as private credit expansion decelerated following the global financial crisis.

The Bank of Korea emphasized that although there is significant uncertainty regarding the inflation trend depending on the developments of the Ukraine crisis, international raw material prices, and wage increases related to inflation, it will operate monetary policy focusing on inflation as the high inflation situation is likely to persist long-term.

Bank of Korea Governor Lee Chang-yong stated, "In the current phase where inflation is continuously expanding, it is desirable to operate monetary policy focusing on inflation until the steep inflation trend changes," strongly hinting at an interest rate hike at the Monetary Policy Committee meeting next month. Governor Lee added, "Protecting vulnerable groups who face difficulties due to increased interest payment burdens amid rising prices and interest rates is also important, so we will strive to prepare support measures through policy coordination."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)