"Group Tours to Japan + Yen Weakness Present Bargain Buying Opportunity"

"High Oil Prices and Exchange Rates Still Pose Significant Cost Burden"

Jeju Air Investment Opinions Remain Divided

[Asia Economy Reporter Hwang Yoon-joo] As reopening sectors draw attention to airline stocks, investment opinions on Jeju Air are sharply divided. There is a strong debate between the view that early normalization of international flights presents a buying opportunity at the bottom and the perspective that more time is needed for a turnaround.

"Jeju Air, the Airline with the Greatest Leverage from Reopening Benefits"

International passengers in May increased by 45% compared to the previous month. The number tripled within three months after the mandatory self-quarantine for overseas arrivals was lifted. In June, quarantine regulations are also being smoothly eased. The Ministry of Land, Infrastructure and Transport advanced the existing phased plan for daily recovery and lifted slot restrictions and flight curfews at Incheon Airport from the 8th. This means additional flights are possible during this summer's peak season.

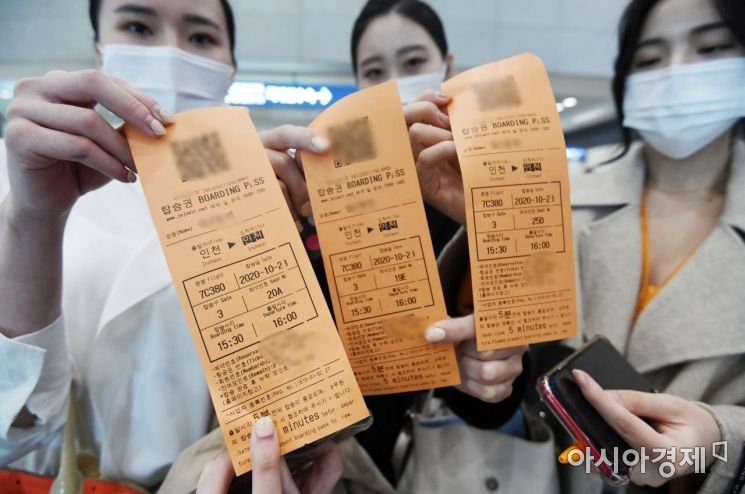

Jeju Air 'Incheon to Incheon' sightseeing flight passengers show their boarding passes to reporters at the ticketing counter of Terminal 1, Incheon International Airport on the 23rd. On this day, Jeju Air operated a sightseeing flight for the general public that circled over domestic airspace before returning. Photo by Moon Honam munonam@

Jeju Air 'Incheon to Incheon' sightseeing flight passengers show their boarding passes to reporters at the ticketing counter of Terminal 1, Incheon International Airport on the 23rd. On this day, Jeju Air operated a sightseeing flight for the general public that circled over domestic airspace before returning. Photo by Moon Honam munonam@

Among short-haul routes, expectations for tourism demand to Japan are growing. Japan allowed group tourists starting from the 10th. The next step is expected to be approval for individual tourism, with attention focused on whether the visa exemption system will be reinstated. Japan was one of the cost-competitive short-haul routes before COVID-19. Especially, due to the weak yen, there is an analysis that demand for travel to Japan will surge.

Ko Un Choi, a researcher at Korea Investment & Securities, said, "In particular, demand for travel to Japan will be supported by the weak yen," adding, "We recommend buying Jeju Air, which has the greatest profit leverage from reopening."

"Jeju Air Continues to Post Losses... Turnaround Expected in Early 2023"

On the other hand, Mirae Asset Securities maintained a 'Sell' rating on Jeju Air. While agreeing on the reopening benefits, they analyzed that the burdens of high oil prices and high exchange rates are significant.

Generally, a $10 increase in jet fuel prices raises annual costs by 12 billion KRW. According to the Korea National Oil Corporation, the price of Dubai crude oil, the raw material for jet fuel, surged 54.7% from $76.88 per barrel at the beginning of this year to $118.94 on the 10th. The strong dollar used for oil payments also adds to the burden.

Researcher Ryu Je-hyun of Mirae Asset Securities forecasted, "Jeju Air's operating loss in Q2 this year is expected to reach 60.7 billion KRW," and "Fixed costs will increase due to high exchange rates and high oil prices, but operating margin is expected to improve to -49.3%."

While loss reduction is expected in the second half, the turnaround is anticipated in 2023. Researcher Ryu analyzed, "Although the loss reduction will continue with the recovery of international routes, cost burdens remain due to high oil prices and the suspension of employment retention subsidies," adding, "Operating profit turnaround is expected from late 2022 to early 2023."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)