Hana Financial Investment "20-Year Grain Price Cycle Averages 2 Years 7 Months"

Uptrend Expected to Continue Until Second Half of This Year

Buy Stocks with Potential for Price Increases

Ramen Performance Limited by Sharp Rise in Palm Oil and Wheat Prices

[Asia Economy Reporter Ji Yeon-jin] There is a forecast that the international grain price uptrend will continue until the second half of this year. Amid the recent surge in grain prices causing weakness in food stocks, the advice is to buy stocks that can raise their selling prices.

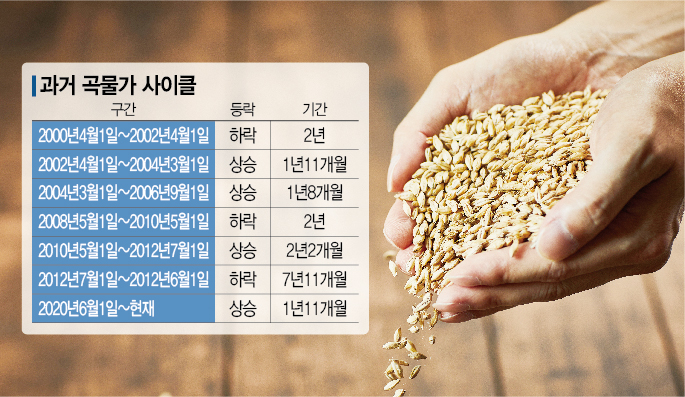

On the 27th, Hana Financial Investment analyzed the grain price index from 2000 and found that the index fluctuation cycle was relatively clear. Over the past 20 years, there have been eight cycles of rising and falling trends, with the average grain price cycle lasting 2 years and 7 months. Based on this, the current grain price increase is expected to continue until the second half of this year.

According to the financial investment industry, the combined sales of 13 food and beverage companies in the first quarter of this year reached 15.7432 trillion KRW, a 13% increase compared to the same period last year, and operating profit rose 9% to 1.2186 trillion KRW. The average international grain prices in the first quarter of this year compared to the first quarter of 2020, the early stage of the COVID-19 pandemic, increased by 77% for wheat, 120% for corn, 83% for soybeans, 87% for raw sugar, and 138% for palm oil. Accordingly, food companies collectively raised product prices in the first quarter to defend their performance. However, additional price hikes in the second quarter are burdensome. For this reason, most food stocks have struggled since last month.

However, CJ CheilJedang is analyzed to still have room for price increases. The company is divided into food, bio, and feed business units, and amino acids such as lysine in the bio division can actually raise prices as substitutes for soybean meal. It is explained that processed foods can also achieve stable performance in the second half of the year through additional price increases. The Korea Rural Economic Institute estimated that a 10% increase in grain import prices causes a 3.4% rise in processed food prices.

However, in the case of ramen, price increases may be burdensome due to its nature as an affordable food for the general public. Additionally, the main ingredients of ramen are wheat and palm oil, and prices may rise further due to resource nationalism in exporting countries. Sim Eun-joo, a researcher at Hana Financial Investment, said, "Although Nongshim is the number one ramen market share company, the nature of ramen as a product limits premiumization," and forecasted that "small and medium-sized processed food companies such as Daesang and Dongwon F&B are also likely to have limited profitability improvement until the second half of this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)