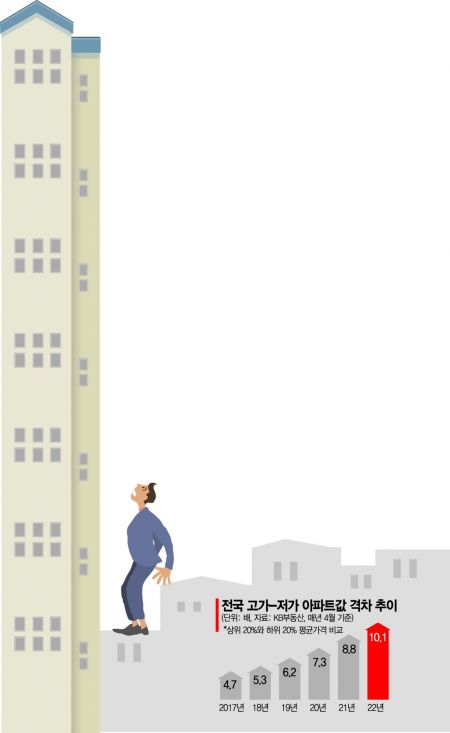

[Asia Economy Reporter Kim Hyemin] The price gap between high-end and low-end apartments nationwide has exceeded 10 times. Not only is there a gap between Seoul and non-Seoul areas, but polarization within regions is also becoming more pronounced. As the desire to own a ‘smart single property’ grows stronger, concerns are rising that polarization will worsen as apartment transactions decrease due to loan regulations and the burden of high interest rates.

According to the monthly housing market trend time series statistics from KB Kookmin Bank on the 17th, the price gap between high-end and low-end apartments nationwide last month was 10.1 times. This means that apartments in the top 20% by price are more than 10 times more expensive than those in the bottom 20%. The average sale price of apartments in the bottom 20% nationwide was 123.13 million KRW, while the top 20% averaged 1.24707 billion KRW.

This is the first time since the survey began in December 2008 that a gap of more than 10 times has appeared. From 2013 to 2017, the gap remained at around 4 to 5 times, but it has gradually widened since then, rising by 4.8 percentage points over the past five years. While the bottom 20% apartments increased by 4.92 million KRW, the top 20% rose by as much as 625.58 million KRW.

This appears to be due to the significant rise in apartment prices in the metropolitan area, which pulled up the average sale price of the top 20% nationwide and widened the gap with the lower end. As of last month, the average apartment sale price nationwide was 560.45 million KRW, whereas in Seoul it was 1.27722 billion KRW, showing that the gap between Seoul and other regions remains unchanged. Meanwhile, investment is pouring into high-end apartments in non-regulated areas, deepening polarization within regions. The price gap between high-end and low-end apartments in other provinces excluding Seoul and the six metropolitan cities rose to 7.3 times last month. This is a 1.5 percentage point increase from 5.8 times in April last year.

Recently, even within Seoul, demand has become concentrated around Gangnam, Seocho, and Yongsan, showing signs of widening price gaps. This is because the housing price rise has stalled and the heavy capital gains tax on multi-homeowners has been temporarily deferred for one year, strengthening the desire to find a ‘smart single property.’ Park Hapsu, an adjunct professor at Konkuk University Graduate School of Real Estate, said, “Gangnam area apartments are steadily rising in price despite loan regulations and interest rate hikes, unlike mid-to-low priced apartments on the outskirts of Seoul,” adding, “The polarization phenomenon could become even more severe.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)