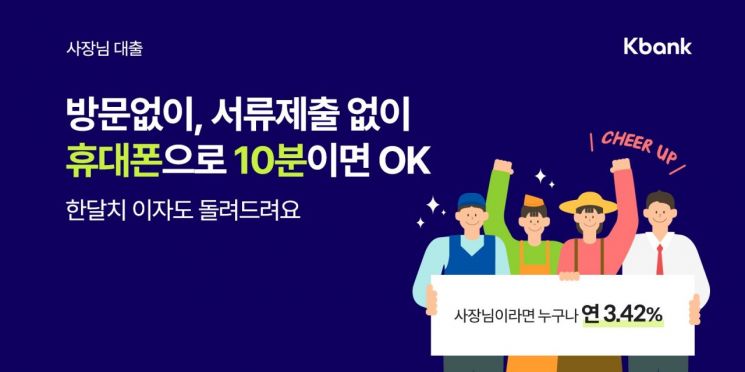

Lower Interest Rates Than Major Banks' High-Credit Personal Loans

Loan Approval Within 10 Minutes via Mobile Without Branch Visit or Document Submission

Launch Event Includes 'First Month Interest Cashback' Supporting One Month's Interest and More

[Asia Economy Reporter Sim Nayoung] K Bank has launched the first personal business owner guaranteed loan product among internet-only banks. On the 17th, K Bank (CEO Seo Hoseong) announced that it will release a 100% non-face-to-face 'Boss Loan' for personal business owners in partnership with the Credit Guarantee Foundation.

The 'Boss Loan' is an 'Ontact Special Guarantee' product in collaboration with the Credit Guarantee Foundation. The loan limit is 30 million KRW, the loan period is 5 years, and the repayment method is a 1-year grace period followed by equal monthly principal repayments over 4 years. There is no prepayment penalty for early repayment at any time.

Once the loan screening is passed, anyone can receive the same interest rate of 3.42% per annum regardless of credit rating. According to the Korea Federation of Banks, as of March, the loan interest rates for general credit loans for high-credit borrowers (grades 1-2) at commercial banks ranged from the mid-3% to 4% per annum. Considering this, despite being a personal business owner, the application of a 3.42% interest rate allows borrowers to enjoy an unprecedented interest rate benefit higher than that of high-credit salaried workers, which is a distinctive feature.

A key advantage is that busy personal business owner customers can apply for and execute loans within 10 minutes using their mobile phones without visiting a branch or submitting documents.

The target customers are personal business owners such as self-employed and small business owners who are actually operating a business and are eligible for a guarantee issuance from the Credit Guarantee Foundation. Personal business owners who have been registered for more than one year can apply. Even if there is an existing Credit Guarantee Foundation loan, overlapping loans can be obtained.

To commemorate the launch of the Boss Loan, a customer promotion is being conducted. First, all customers who execute a loan will receive a 'first month interest cashback.' Customers who take out a loan between May 17 and June 30 will receive one month’s interest refunded without a separate application. After paying the first month’s interest, 100% of the interest amount will be deposited the next day.

There is also a one-year free usage event for 'KT Semo Gage,' KT’s simple sales management application for small business owners. By accessing the application page through the banner displayed during the 'Boss Loan' application process, customers can apply for one year of free use of KT Semo Gage.

Kim Giduk, Head of Marketing at K Bank, said, "We created a product that allows small business owners and self-employed people affected by COVID-19 to easily use a single interest rate with just a mobile phone without visiting a branch." He added, "We plan to introduce various services that provide convenience and benefits to personal business owner customers in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)