Stock Prices Remain Weak Amid High Inflation and Recession Concerns

Focus on Theme Park Profit Improvement and Disney+ Subscriber Growth

[Asia Economy Reporter Minji Lee] Despite Walt Disney posting earnings lower than market expectations, there are opinions that maintaining a positive investment outlook in the mid to long term is advisable. This is based on the rapid recovery of profit resilience centered on theme parks and resort businesses, and the expectation that the increase in Disney+ subscribers could positively impact earnings.

Looking at Walt Disney's stock price on the 15th, it stood at $107.33 as of the 13th (local time). Amid sluggish stock prices due to inflation and recession concerns, the second-quarter earnings did not meet market expectations, so there was no significant stock price rebound.

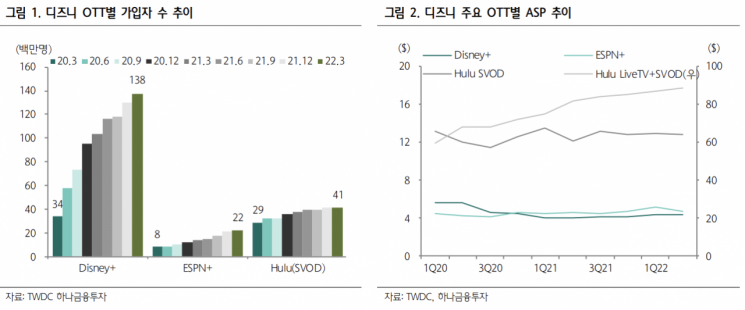

In the second quarter (January to March), revenue and operating profit recorded $19.2 billion and $3.7 billion respectively, growing 23% and 50% compared to the same period last year. Net income attributable to controlling interests was $470 million and EPS was $0.26, which decreased by 47.8% and 46.9% respectively compared to the same period. Revenue and EPS were 4% and 74.5% below estimates, respectively.

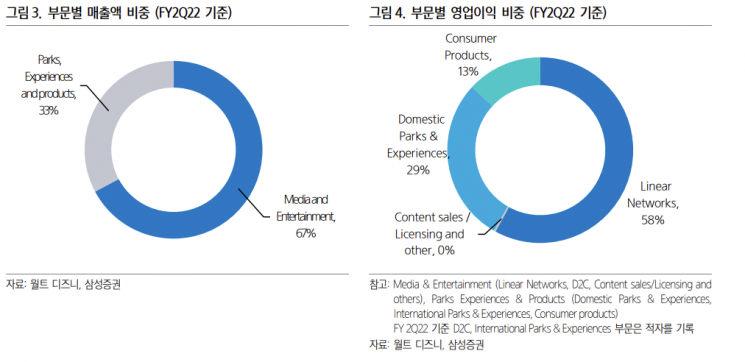

By business segment, 'Media & Entertainment' posted revenue of $13.62 billion, up 9.5% from the same period last year. Disney+ subscriber count increased by 7.9 million from the previous quarter to 138 million, surpassing the market expectation of 135 million. ESPN+ had 22.3 million subscribers, and Hulu had 45.6 million, growing 62% and 10% respectively compared to the same period last year. The DTC business expanded its operating loss to $890 million due to increased programming and production costs, as well as expanded marketing and technology expenditures, but this was in line with the previous quarter's guidance.

'Theme Parks & Products' recorded $6.65 billion in revenue, growing 109.6% year-over-year. Looking at the theme parks and products segment, domestic theme park revenue rose 182% to $4.9 billion, and operating profit turned positive to $1.39 billion, recovering to near pre-pandemic peak levels and showing significant growth. This was due to operational expansion following reopening, reflecting profit leverage effects from top-line growth. Hanwi NH Investment & Securities analyst said, “Spending per visitor increased by 40% compared to 2019,” adding, “This was driven by recovery in visitor numbers, increased room rates and admission fees, and overall sales growth within the facilities.”

Recently, intensified competition among OTT platforms and consumer subscription fatigue have raised concerns about the growth potential of streaming services. However, Disney is expected to achieve subscriber growth through high-quality content. Regarding this, Disney's CFO expressed confidence in the growth trend, stating, “Net subscriber additions will be greater in the second half than in the first half.” Disney+ plans to launch services in 53 markets in the third quarter and will introduce an ad-supported plan in the U.S. by the end of this year to attract more subscribers by offering diverse options.

Lee Ki-hoon, a researcher at Hana Financial Investment, explained, “Although there were concerns about the OTT industry due to Netflix’s paid subscriber decline, considering Disney+’s performance, it should be seen as intensified competition,” adding, “The guidance of 230 to 260 million subscribers in 2024 will be fully achieved.” Live revenue is also recovering, with Marvel’s ‘Doctor Strange 2,’ released in May, revitalizing global theaters, and plans to release multiple works consecutively.

Choi Min-ha, a researcher at Samsung Securities, noted, “Uncertain economic conditions such as inflationary pressures and recession concerns, as well as theme park shutdowns in Asia including Shanghai and Hong Kong, may weigh on operating margins in the third quarter,” adding, “The impact of the Asian theme park closures is estimated at $350 million.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)