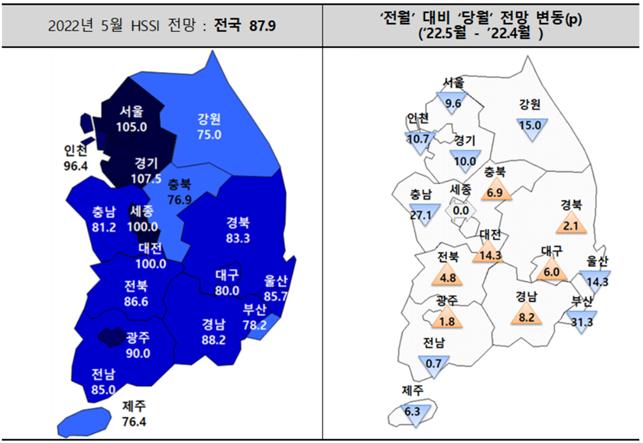

May Nationwide Housing Sales Sentiment Index Records 87.9

Down 5 Points Compared to April

May Housing Sales Sentiment Index (HSSI) Forecast / Data provided by Korea Housing Industry Research Institute

May Housing Sales Sentiment Index (HSSI) Forecast / Data provided by Korea Housing Industry Research Institute

[Asia Economy Reporter Hwang Seoyul] The nationwide housing market sales outlook for May is expected to be somewhat subdued due to rising loan interest rates and concerns over an economic downturn.

The Korea Housing Industry Institute (hereinafter referred to as KHII) announced on the 11th that the nationwide apartment sales outlook index for May recorded 87.9, down 5 points from last month (92.9). This index is compiled by surveying housing developers on their sales market outlook. A figure below the baseline (100) indicates a negative market outlook.

Regionally, generally low outlooks were recorded. The Seoul metropolitan area posted 102.9, down 10.1 points from last month (113.0), indicating a further contraction in the sales market. The provinces, including metropolitan cities and city/county areas, recorded 84.7, down 3.8 points from the previous month. In particular, Busan's outlook dropped sharply by 31.3 points from 109.5 last month to 78.2 this month, deepening the negative outlook.

KHII stated, "It appears that the perception of a somewhat subdued sales market has increased due to the cost burden from the sharp rise in loan interest rates and concerns over an economic downturn caused by the Russia-Ukraine war."

Although most regions showed a downward trend, some cities and provinces forecast an improvement in the sales market. Gwangju (90.0), Daegu (80.0), Daejeon (100.0), Chungbuk (76.9), Jeonbuk (86.6), Gyeongbuk (83.3), and Gyeongnam (88.2) posted slightly higher outlooks than in April. According to KHII, these regions have had relatively fewer apartment sales volumes over the past five years.

Meanwhile, the nationwide average sales price for May is expected to fall by 9.7% compared to April, and sales volume is projected to decrease by 17.4%. Unsold inventory is predicted to increase by 8.8%.

KHII pointed out, "During the five years of the Moon Jae-in administration, the nationwide housing shortage has accumulated to about 382,000 units. If the supply decrease continues due to temporary factors, there is a high risk of price surges caused by supply shortages. Policies for stable supply, such as deregulation and expansion of public land supply, are important."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)