Eugene Investment & Securities Report

[Asia Economy Reporter Lee Myunghwan] As the partial amendment bill of the "Act on the Promotion of Hydrogen Economy and Hydrogen Safety Management (Hydrogen Act)," which focuses on fostering the hydrogen power generation business, has passed the relevant subcommittee, securities firms have forecasted that the hydrogen industry and renewable energy sectors will greatly benefit.

On the 8th, Eugene Investment & Securities analyzed that "since the ruling Democratic Party led the passage of the Hydrogen Act amendment bill through the National Assembly's Industry, Trade, Energy, Small and Medium Enterprises Committee on the 4th, its passage in the plenary session should not be difficult."

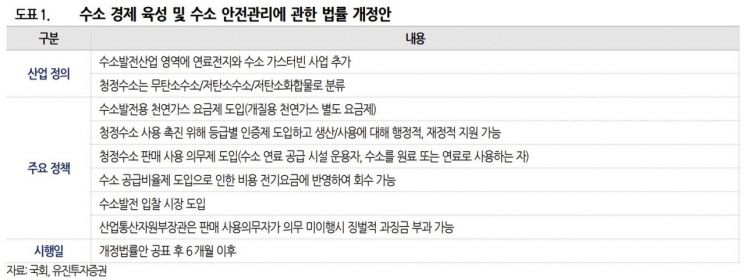

The basic purpose of the Hydrogen Act amendment bill is to foster the hydrogen power generation business based on clean hydrogen. According to the amendment, electricity providers must fulfill a certain ratio of hydrogen power generation as prescribed by presidential decree. During the transitional period, hydrogen produced by natural gas reforming can be used, and a special natural gas tariff system will also be established. Considering the six-month enforcement period after promulgation, it is explained that from next year, a bidding market for hydrogen power generation will be opened domestically.

Domestic hydrogen-related stocks have recorded a significant decline in stock prices since the second half of last year. This was due to concerns about discontinuity in hydrogen industry support policies amid delays in the passage of the Hydrogen Act and the upcoming regime change, but Eugene Investment & Securities evaluated that both concerns have been resolved. Meanwhile, the global hydrogen industry is accelerating its growth, compounded by the impact of the Ukraine war. As a natural gas supply shortage occurred, hydrogen has emerged as a key energy source that can replace it while achieving carbon neutrality.

The next government is also evaluated to be proactive in fostering the hydrogen industry. The Presidential Transition Committee announced that it will promote the hydrogen industry as a key national agenda. The main contents of the Hydrogen Act amendment bill are to be determined by presidential decree or the Minister of Trade, Industry and Energy. Considering the composition of the next administration, which has a high understanding of hydrogen-related companies, Eugene Investment & Securities believes that the growth speed of the hydrogen industry will accelerate. The Transition Committee has also announced support for the hydrogen vehicle industry through its future mobility promotion plan.

Researcher Han Byunghwa of Eugene Investment & Securities said, "The reason why the next government's energy policy will inevitably balance renewable energy while focusing on nuclear power is that securing clean hydrogen and green hydrogen is essential for the development of the hydrogen industry," adding, "Hydrogen and renewable energy-related stocks, which have a high domestic business ratio, are positive."

Hydrogen power generation-related beneficiary stocks include Doosan Fuel Cell, Iljin Hysolus, and Hyosung Advanced Materials. Renewable energy-related stocks such as CS Wind, Hanwha Solutions, and Hyundai Energy Solutions are also predicted to benefit.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)