[Asia Economy Reporter Kim Hyunjung] Recently, an analysis has emerged suggesting that Japan may escape its chronic deflation due to the combined effects of soaring raw material prices and a sharp decline in the value of the yen.

Woojin Kim, a senior researcher at the International Finance Center, recently published an analytical report stating, "Unlike in the past, Japanese companies are passing on rising costs to consumers, making it highly likely that the Japanese economy will break free from chronic deflation."

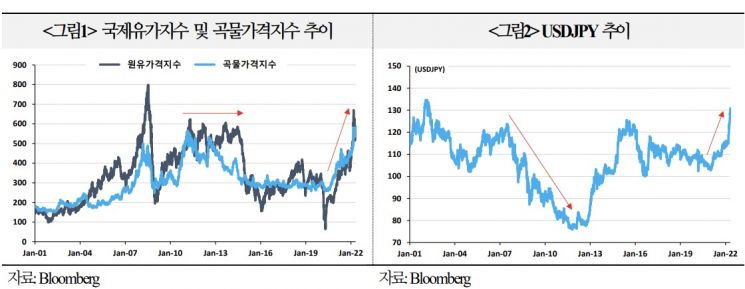

According to Bloomberg, concerns over supply disruptions caused by the Russia-Ukraine war have led to international oil and grain prices surging by 40% and 29%, respectively, compared to the beginning of the year. In particular, Western sanctions against Russia have restricted the supply of Russian crude oil and other raw materials, intensifying supply shortages. Additionally, global carbon neutrality policies have led to reduced oil production investments in some oil-producing countries, making it difficult for global oil supply to increase in the short term.

Meanwhile, the yen's value has plummeted by 12% against major advanced countries' currencies as of the 28th of this month due to differentiated monetary policies. The Bank of Japan has maintained an accommodative monetary policy stance by keeping negative interest rates and continuing unlimited purchases of long-term government bonds, diverging from the monetary tightening policies of the U.S. and Europe.

Senior researcher Kim believes that Japanese companies passing on rising costs to consumers, unlike in the past, significantly increases the likelihood that the Japanese economy will escape chronic deflation. Historically, Japan's deflation was entrenched because companies absorbed cost increases without reflecting them in prices, accepting reduced corporate profits instead.

However, the recent cost pressures faced by Japanese companies are expected to persist for some time rather than being temporary shocks, potentially leading to changes in corporate pricing decisions. Even if the Russia-Ukraine war ends, if Western sanctions against Russia are not lifted, raw material price instability could continue for a considerable period.

In the past, cost increases due to energy price shocks were partially offset by a strong yen, but this time, the added effect of yen depreciation is likely to further intensify cost pressures. If companies respond to rising costs by raising prices, the Japanese economy is expected to gradually escape deflation. Considering household savings accumulated over the past two years due to the COVID-19 pandemic, the environment is now conducive for companies to pass costs onto households.

Inflation expectations within the Japanese economy may form, potentially stimulating inflation through increased household consumption and corporate investment driven by lower real interest rates. Senior researcher Kim explained, "Recent rises in Japanese consumer prices also suggest that consumers are somewhat accepting companies' price increases," adding, "It is important to note that the Bank of Japan's accommodative monetary policy aimed at escaping deflation may continue, sustaining the yen's weak trend for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)