Right After the 2020 Korea-US Currency Swap Announcement

Won-Dollar Exchange Rate Drops 3.1%

KOSPI Index Rises 7.4%

Extended Three Times Since COVID-19

Served as a Safety Net for Our Economy During the 2008 Global Financial Crisis

[Asia Economy Reporter Seo So-jeong] As the won-dollar exchange rate surges sharply, intensifying financial market instability, calls are growing to restore the Korea-US currency swap, which serves as an "exchange rate safety net." Despite recent verbal interventions by foreign exchange authorities to curb the soaring exchange rate, these efforts have been insufficient to counter the global strong dollar trend. Therefore, there is hope that reinstating the Korea-US currency swap agreement can act as a fire extinguisher to stabilize the domestic foreign exchange and financial markets.

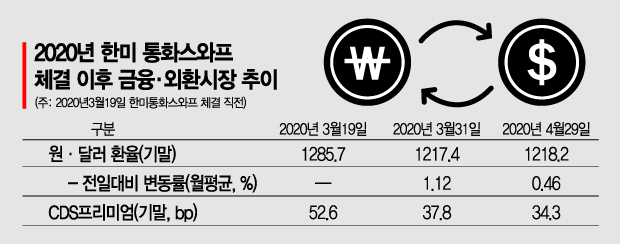

In fact, South Korea greatly benefited from the Korea-US currency swap in March 2020 when the won-dollar exchange rate surged and financial markets fluctuated due to the COVID-19 pandemic. On March 19, 2020, when the financial market was shocked by the initial spread of COVID-19, the won-dollar exchange rate closed at 1,285.7 won. As financial market instability grew, the Bank of Korea announced a currency swap agreement with the US Federal Reserve (Fed) for a limit of $60 billion on March 19, 2020. The financial and foreign exchange markets responded immediately after the announcement. With eased concerns over dollar funding, the won-dollar exchange rate fell by 3.1%, and the KOSPI rose by 7.4%, showing signs of market stabilization.

The Korea-US currency swap also served as a safety net for the Korean economy during the 2008 global financial crisis. After concluding the currency swap agreement, the Bank of Korea judged that domestic and international financial and economic conditions had stabilized and exited the crisis, leading to the scheduled termination of the temporary currency swap contract on December 31 last year. The recent surge in the exchange rate has increased the necessity of reinstating the Korea-US currency swap in the same context. On the 28th, the won-dollar exchange rate closed at 1,272.5 won, marking the first time in 2 years and 1 month that the rate exceeded the 1,270 won level.

On that day, the exchange rate declined as investment sentiment partially recovered following the overnight announcement that the US first-quarter gross domestic product (GDP) growth rate showed a negative figure for the first time in seven quarters, although personal consumption expenditures and corporate investments increased. However, with ongoing global inflationary pressures, the Fed's strong tightening stance, and the prolonged Ukraine war, the dollar's strength is expected to continue for the time being.

Moon Hong-chul, a researcher at DB Financial Investment, stated, "Since the psychological support level of 1,250 won has already been broken, the upper limit of the exchange rate in the first half of the year is expected to be in the 1,300 won range." The rising exchange rate is adding pressure to an economy already suffering from high inflation. Moon expressed concern, saying, "If the exchange rate rises by 15% compared to a year ago, domestic inflation faces a 1 percentage point upward pressure," and "exchange rate fluctuations affect domestic prices through changes in import prices."

The Bank of Korea also noted, "The time lag for exchange rate fluctuations to impact domestic prices is greatest one month later for both producer and consumer prices," adding, "It has a greater impact on producer prices than consumer prices." This is explained by the relatively high proportion of manufactured goods that use imported raw materials. Furthermore, it stated, "Assuming that the rise in import prices is passed on to domestic prices, a sharper increase in prices is expected."

Accordingly, experts advise that the Korea-US currency swap agreement should be a key agenda item during President Joe Biden's visit to Korea next month. Given the accumulation of global internal and external adversities, the Korea-US currency swap agreement could be a solution to stabilize the soaring won-dollar exchange rate.

Kim Jung-sik, emeritus professor of economics at Yonsei University, emphasized, "The Korea-US currency swap, which was extended three times after the COVID-19 crisis, should be restored," and added, "It is also important to maintain stability and increase foreign exchange reserves through the Korea-US currency swap."

However, some view that the recent exchange rate rise differs from past crises, suggesting that the effect of the currency swap may be limited. Researcher Moon pointed out, "Currently, the strong dollar phenomenon is due to the overall trend of US tightening, which differs from past financial crises and the COVID-19 pandemic situation," and cautioned, "The effect of the Korea-US currency swap may not be as significant as expected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.