With the lifting of restrictions on private gatherings and operating hours, social distancing measures that lasted for over two years have come to an end. Along with expectations for the recovery of daily life and the resumption of travel, a positive breeze is expected to blow through the cinema industry as well. Many films produced during the COVID-19 pandemic have postponed their releases for years. Some chose to release on OTT (online video streaming services) as a last resort. This year, a series of these delayed films are scheduled to be released. Starting from the 25th, eating inside theaters will also be permitted, and the industry is looking forward to bustling, lively cinemas filled with audiences. Asia Economy analyzed Showbox and NEW, stocks related to the theater reopening (resumption of economic activities).

[Asia Economy Reporter Park So-yeon] Showbox is a film investment and distribution company that distributed movies such as Gwoemul (The Host), Assassination, and Taxi Driver. It also gained attention by producing dramas like Itaewon Class. The film industry, which accounts for 99% of Showbox’s sales, was one of the sectors most severely affected by social distancing regulations due to the spread of COVID-19. The number of viewers decreased, and new releases were continuously delayed, dealing a direct blow. According to the Korean Film Council, the film industry’s revenue in 2021 was 1.0239 trillion KRW, a 59.2% decrease compared to 2.5093 trillion KRW in 2019.

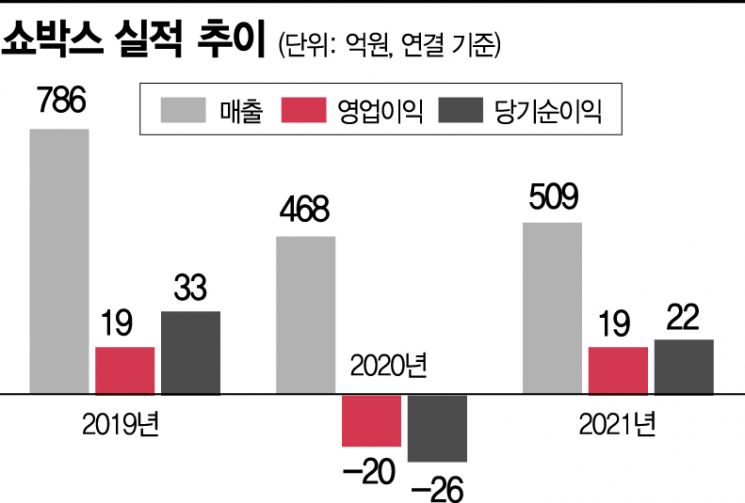

Showbox was also significantly impacted by social distancing measures. Last year, it recorded consolidated sales of 50.9 billion KRW and an operating profit of 1.9 billion KRW. Until 2017, Showbox’s sales reached 102.7 billion KRW, so its sales have been halved. Operating profit during the same period dropped to one-fifth. As the COVID-19 pandemic situation improved, recent results have shown signs of recovery. In 2020, when the pandemic began, it recorded an operating loss of 2 billion KRW, but last year it turned a profit. From last year, operating cash flow (OCF) also turned positive. It was -34.4 billion KRW in 2020 but improved to 25.5 billion KRW in 2021. As of the end of 2021, the debt ratio was 16.77%, and interest-bearing debt was 1.4 billion KRW, indicating a sound financial condition.

The atmosphere this year is even better. With the reopening of theaters, the number of films released (lineup) is increasing, and Showbox’s performance improvement is expected to accelerate. Showbox’s most anticipated release this year is Emergency Declaration, a new film by director Han Jae-rim, who directed Face Reader and The King. Emergency Declaration is an aviation disaster film starring Lee Byung-hun, Song Kang-ho, Jeon Do-yeon, and Kim Nam-gil. It is a blockbuster with a production budget exceeding 20 billion KRW. In addition, films such as Citizen Deok-hee, Apgujeong Report, Vacation, and Three Days are awaiting theatrical release.

Showbox is also making a mark in webtoon-based drama production. It has secured the rights to numerous webtoons including Witch, Hypnosis, Serial Killer’s Dilemma, Polar Night, Hero’s Variable, Relic Reading Appraiser, Uturi, and Moon Yoo, and plans to produce dramas. Leveraging the experience and networks accumulated from film production, it intends to produce dramas and OTT original series. It is expected to become a notable company producing webtoon-based dramas with diverse genres and themes transcending time and space. Lee Sang-heon, a researcher at Hi Investment & Securities, said, "As the global expansion potential of domestic drama content companies grows, their valuation could be adjusted upward."

LS Family’s Koo Bon-woong Investment Firm Becomes Second Largest Shareholder

Full-Scale Global Push to Secure K-Content IP

The expansion into new businesses and changes in business structure through the recruitment of a second-largest shareholder are also attracting market attention. Showbox recently decided on a paid-in capital increase worth 130 billion KRW targeting Maum Capital Group (MCG), a U.S. investment company led by Koo Bon-woong, the eldest grandson of the LS family. This amount corresponds to 30% of the total shares. Once the capital increase is completed, MCG Group will become the second-largest shareholder after Orion Holdings. At the extraordinary general meeting scheduled for the end of May, CEO Koo is expected to be appointed as an inside director. The business objectives will also be expanded to include planning, production, distribution, and marketing of content related to blockchain technology-based encrypted assets, advertising agency services, and planning and production related to virtual reality worlds.

MCG is a company established in Silicon Valley, USA, with the goal of broadly exporting Korean and Asian content overseas. CEO Koo leads the company, with shareholders including John Hennessy, former Google chairman; Marc Andreessen, founder of Andreessen Horowitz fund; and Jerry Yang, Yahoo co-founder. Showbox plans to maximize the use of MCG’s overseas networks. Taking advantage of MCG’s investment, Showbox will accelerate securing K-content IP (intellectual property) and cooperation in domestic and international production networks. It will also aggressively expand its global content business based on metaverse and NFTs. A Showbox official said, "We have secured various IPs such as films and series (dramas), so we will be able to present diverse works in line with the recovery of the content market. We also plan to enhance our capabilities through content collaboration essential for new IT platforms with MCG Group."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)