Wage Increases Centered on IT Spread

Inflation → Wage Increase → Additional Inflation

Bank of Korea Actively Reviews Price-Wage Interaction

US Also Sees Double-Digit Wage Increases

Acts as Inflationary Pressure

[Asia Economy Reporter Seo So-jung] "Wage increases are the biggest risk factor for inflation this year."

As 'controlling inflation' emerges as the top priority in the United States, where wage increases are becoming a factor that intensifies inflationary pressures, concerns are growing in Korea that a 'wage-price spiral' phenomenon could also occur. There are fears that if the recent wage increases spreading mainly in the IT industry expand to all industries, the vicious cycle of 'price increase → wage increase → further price increase' could accelerate.

According to the business community on the 25th, the Bank of Korea is closely analyzing the impact of domestic wage growth on expected inflation, mainly through its Research Department. A Bank of Korea official from the Price Trends Team said, "Until early this year, Korea's wage-driven inflationary pressure was still relatively low compared to major advanced countries, but the situation has changed recently after the Ukraine crisis," adding, "We are actively considering preparing a report analyzing the interaction between wages and prices."

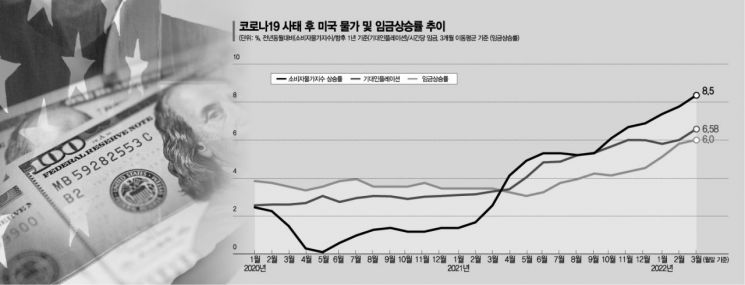

In the United States, which is suffering from record-high inflation, double-digit wage increases are fueling inflation. In particular, post-COVID-19, employment has recovered faster than before, intensifying labor shortages and accelerating wage hikes. According to data from the Federal Reserve Bank of Atlanta, the average annual wage increase rate in March was 6%, far exceeding 3.4% in the same period last year. In an early this month survey by The Wall Street Journal (WSJ), 27% of economists identified wage increases as the biggest inflation risk this year.

The Federal Reserve's monetary policy report released in February also stated, "Wage increases in the service sector are acting as inflationary pressure centered on services," and forecasted, "If the labor supply shortage worsens, wage growth will accelerate, spreading inflation and sustaining high inflation rates."

The domestic situation is also serious. Despite the spread of COVID-19, wage increases are continuing mainly in the IT industry. Kakao raised the annual salary of all employees by 15% this year, and Samsung Electronics and SK Hynix, which prepared an 8% increase plan, are engaged in a cautious competition due to concerns about losing talent to competitors. Baedal Minjok and Danggeun Market, which grew rapidly due to the COVID-19 impact, are actively recruiting talent by offering starting salaries in the 60 million KRW and 65 million KRW range respectively for university graduate developers.

This wage increase trend is rapidly spreading across industries recently. This is why many companies, facing wage negotiations scheduled from late April to early May, are expressing difficulties amid the domino effect of wage hikes.

Professor Sung Tae-yoon of Yonsei University's Department of Economics said, "From the workers' perspective, although wages have increased, the strong inflationary trend makes it hard to shake the feeling that real wages have decreased," adding, "With inflation above 4%, expected inflation is rising, which is used as a basis for wage increases, creating a vicious cycle that further increases inflationary pressure." Last month, expected inflation reached 2.9%, the highest since April 2014.

A Bank of Korea official said, "When expected inflation rises, a secondary effect occurs where wage increases lead to actual price increases," adding, "This year, the impact of wages and prices is expected to expand further, and wages will be a key factor considered in monetary policy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.