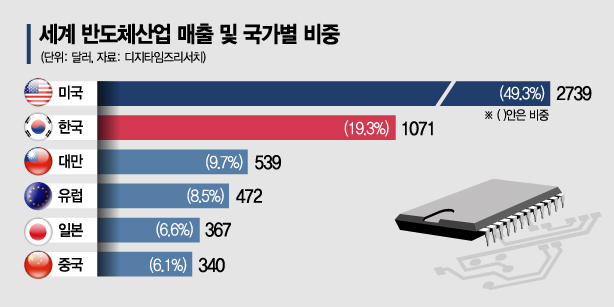

Analyzing the $555.9 Billion Global Semiconductor Market: Contributions by Country

[Asia Economy Reporter Park Sun-mi] Korean semiconductor companies, strong in memory, have secured a 19.3% share of the global market, confirming their position as the world's second most influential by sales. Although the gap with the top-ranked United States remains large, the clear identification of Korea's semiconductor industry's weaknesses suggests that with active semiconductor industry promotion policies from the new government, catching up is possible.

According to the "2022 Semiconductor Industry Report" released on the 21st by Taiwanese market research firm Digitimes Research, the global semiconductor market grew to $555.9 billion in sales last year.

The market was led by the United States. Semiconductor companies such as Intel, TI, Nvidia, AMD, and Qualcomm recorded sales of $273.9 billion last year, making the U.S. the most influential country in the global semiconductor market. This accounts for 49.3% of the total semiconductor market. Except for memory specialist Micron, most companies focus on chip design and are analyzed to hold leading positions in the global market.

The semiconductor market can be broadly divided into memory and non-memory sectors. Memory products, where Korea has strengths, contribute about 35-40% to the global semiconductor market, with the remaining more than half belonging to the non-memory sector. Korea secured the second position globally thanks to Samsung Electronics and SK Hynix, which focus on memory semiconductor production. Korea's overall semiconductor market share reaches 19.3%.

Korea is striving to strengthen its position in chip design and wafer fab sectors, essential materials for semiconductor production, to overcome the weakness of its semiconductor industry being limited to memory semiconductor production.

Taiwan, strong in chip design as well as maintaining the world's number one foundry (semiconductor contract manufacturing) position, exerts the world's third-largest influence with semiconductor sales of $53.9 billion. Europe ranks fourth with semiconductor sales of $47.2 billion, accounting for 8.5%, and Japan ranks fifth with sales of $36.7 billion and a 6.6% share.

However, the report emphasized that China, ranked sixth with sales of $34 billion and a 6.1% share, is rapidly growing despite being a latecomer in the semiconductor industry, thanks to the government's bold policy and capital support. Given that more than half of electronic products are produced in China, China's semiconductor demand accounts for 60% of the global market, reflecting strong government-level industrial promotion intentions.

Meanwhile, looking at individual semiconductor companies, Samsung Electronics is undisputedly the world's number one by sales. Recently, another market research firm, Gartner, announced that last year, global semiconductor sales increased by 26.3% to $595 billion, and Samsung Electronics reclaimed the number one spot globally for the first time in three years, overtaking Intel. Samsung Electronics' semiconductor sales last year rose 28% to $73.197 billion, with a market share of 12.3%. SK Hynix ranked third with sales of $36.352 billion and a 6.1% market share.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)