Comparison of Monetary Policy Direction Statements

Including Addition of 'Geopolitical Risk' Phrase

Impact of Interest Rate Hike Variables

Joo Sang-young, Acting Chairman of the Monetary Policy Committee, is presiding over the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul, on the morning of the 14th. 2022.04.14. Photo by Joint Press Corps

Joo Sang-young, Acting Chairman of the Monetary Policy Committee, is presiding over the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul, on the morning of the 14th. 2022.04.14. Photo by Joint Press Corps

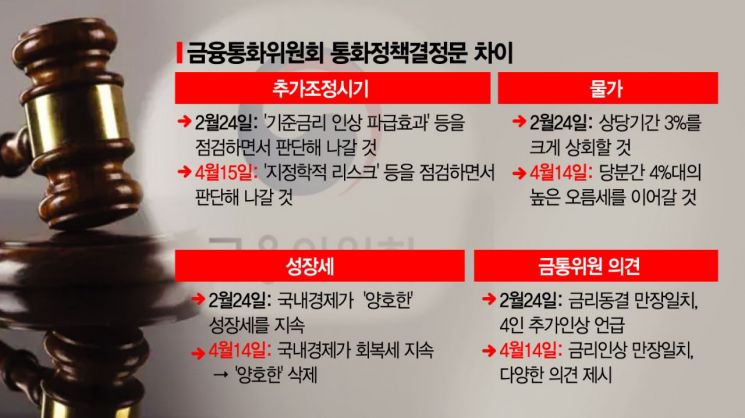

[Asia Economy Reporter Seo So-jung] As the Bank of Korea's Monetary Policy Committee raised the base interest rate to 1.5%, the main issues in upcoming monetary policy direction meetings are expected to be inflation, growth, and the Ukraine crisis. In the February MPC meeting, a majority of members supported further rate hikes, but in the April meeting, the range of considerations surrounding domestic and international economic conditions expanded, and diverse opinions among MPC members emerged, acting as variables for additional rate increases.

On the 15th, Asia Economy compared the monetary policy direction statements from February and April and detected that due to the prolonged Ukraine crisis, the pace of rate hikes in the remaining five monetary policy meetings this year may change. The impact of the Ukraine crisis and other factors have led to a downward revision of this year's domestic gross domestic product (GDP) growth rate to the mid-to-high 2% range, while consumer prices are expected to continue a high increase in the 4% range for the time being, requiring a delicate balancing act between inflation and growth.

In particular, the market places significance on the change in wording regarding the timing of additional rate hikes. The February statement mentioned that the timing of further rate increases would be adjusted after closely examining the COVID-19 developments, accumulated financial imbalance risks, the ripple effects of base rate hikes, changes in major countries' monetary policies, and trends in growth and inflation. However, in April, the phrase "ripple effects of base rate hikes" was removed and "geopolitical risks" were newly added. Since the Ukraine crisis occurred after the February MPC meeting and its impact has far exceeded expectations and is expected to continue, the need to include this wording has increased.

Accordingly, some interpret that the tightening stance of the U.S. Federal Reserve (Fed) may become stronger and that the pace of additional rate hikes could accelerate as the Ukraine crisis shows no signs of resolution. Regarding this, Acting Chair of the MPC Joo Sang-young stated, "It is true that the Ukraine crisis raises upside risks to inflation, but on the other hand, it also increases downside risks to growth, so going forward, we plan to comprehensively and balancedly consider not only the upside risks to inflation but also the downside risks to growth simultaneously." With inflation hitting the 4% range for the first time in about ten years, triggering warning signals, the April meeting prioritized inflation in deciding the rate hike, but going forward, the downside risks to growth will be closely monitored.

The downward revision of this year's GDP growth rate to the mid-to-high 2% range, below the February forecast of 3%, was also highlighted. The February statement noted that uncertainties related to COVID-19 remained but expected the domestic economy to maintain a favorable growth trend and inflation to exceed the target level for a considerable period. However, in April, the word "favorable" was removed.

Although the April MPC meeting unanimously decided on the rate hike, the presentation of diverse opinions marks a difference from February. In February, all members proposed holding rates steady, but among the six MPC members excluding the governor, four mentioned the need for additional hikes.

In April, even Joo, who had previously expressed a minority opinion for a hold, supported the hike, resulting in a unanimous decision. However, various opinions reportedly emerged regarding further hikes. On this, Joo said, "There have been significant changes in domestic and international conditions over the past month," adding, "While market expectations for rate hikes have somewhat increased, the range of MPC opinions seems to have diversified rather than converged narrowly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.