Inflation Accelerates Due to Lockdown Policies Amid COVID-19 Spread

Jet Fuel and LNG Consumption Decline, Car Sales Also Sluggish

[Asia Economy Reporter Kim Hyunjung] Strict lockdown policies to curb the spread of COVID-19 are delivering a domino effect on the Chinese economy. Coupled with inflation, consumers with reduced purchasing power have tightened their wallets, and construction activity and housing sales indicators are rapidly deteriorating.

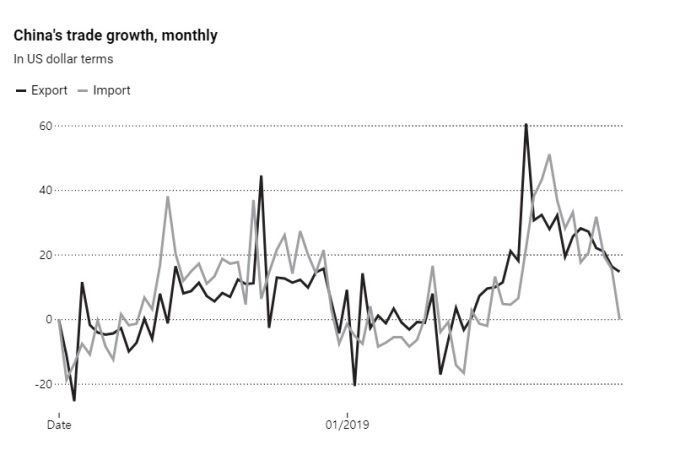

On the 13th (local time), Bloomberg reported that China has been under pressure across the entire economy?from manufacturing and trade to retail markets?due to strengthened quarantine measures and lockdowns in major cities such as Shanghai since last month. According to the General Administration of Customs of China, China's March imports recorded $228.7 billion (approximately 279.95 trillion KRW), down 0.1% year-on-year. This not only fell far short of the market forecast of a 10% increase but also marked the first decline since August 2020. Wang Jun, an economist at Zhongyuan Bank, told Reuters, "The collapse in import growth is due to domestic demand contraction," and forecasted, "April data will worsen further due to COVID-19 prevention measures."

◆Weak Raw Material Imports Amid Inflation Pressure= China’s raw material imports in March were particularly sluggish due to price increases caused by the Ukraine war and demand shocks from COVID-19 lockdowns.

According to the International Energy Agency (IEA), China’s jet fuel demand is expected to decrease by an average of 25,000 barrels per day (3.5%) this year. This is a significant downward revision from the previous forecast which anticipated an increase of 10,000 barrels. According to the real-time flight tracking site AirPortia, as of the 12th, China’s daily flights (7-day average) were below 2,700, marking the lowest level since 2020.

With prices soaring and domestic demand stagnating, China, the world’s largest liquefied natural gas (LNG) importer, is reducing its purchase volume. According to Bloomberg Hound Data, China’s LNG imports in the first quarter fell 14% year-on-year. Logistics system issues are also showing signs of prolonged disruption.

As of the 11th, the number of container ships waiting in Shanghai increased by 15% compared to a month ago. The report noted that a shortage of port workers is causing delays even in the delivery of cargo handling documents. Metal-carrying vessels such as those transporting copper and iron ore are also stuck near the coast due to difficulties in truck operations.

◆Severe Impact on Manufacturing... Factories at a Standstill= The manufacturing sector is also significantly affected. More than 30 Taiwanese companies including iPhone assembler Pegatron and MacBook manufacturer Quanta Computer, as well as domestic companies such as Nongshim, Orion, Amorepacific, and Cosmax, have halted operations at their factories in Shanghai or nearby areas.

Shanghai SMIC, China’s largest semiconductor manufacturer, has been operating a "closed-loop system" since the Shanghai lockdown on the 28th of last month, preventing employees from leaving the factory to maintain operations. Taiwanese companies TSMC and iPhone assembler Foxconn have also adopted closed-loop systems following production halts. Additionally, automobile and related parts manufacturers such as Tesla, Volkswagen, local electric vehicle maker Nio, and Bosch are experiencing production disruptions due to partial factory closures in China.

Consulting firm TrendForce estimated that some manufacturers, including Pegatron, Apple contract manufacturer Wistron, and laptop maker Compal Electronics, have raw material inventories sufficient for only a few weeks. The report warned, "If local manufacturing halts and inventories related to smartphones, servers, and electric vehicles run out, the global supply crisis could worsen."

◆Warning Signs Spreading Across China’s Consumer Market= Domestic economic indicators in China began to show warning signs starting last month. Passenger car sales in China fell 10.9% in March, and domestic sales of excavators, a leading construction indicator, plunged 64% year-on-year. The sluggish housing sales trend also worsened. According to China Real Estate Information Corporation (CRIC), the housing sales value of the top 100 real estate developers in China dropped 58% year-on-year in March. The decline deepened from 39.6% in February and 47.2% in January.

During the same period, inflation in the food sector intensified notably. According to data from the National Bureau of Statistics this week, fresh vegetable prices surged 17.2% month-on-month in March. With the spring planting season approaching and difficulties in securing sufficient grains and fresh food, the report forecasted that supply and demand conditions could worsen in China, which pursues "self-sufficiency."

Earlier on the 11th, Chinese Premier Li Keqiang warned repeatedly about the economic slowdown during a meeting with local officials, urging faster implementation of government policies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)