Individuals Invest 2 Trillion Won in Samsung Electronics This Month

Supporting the 'Semiconductor Bottom Theory' with Focused Buying of US and Taiwan Companies

Direxion Daily Semiconductor 3x ETF Records 506.3 Billion Won Net Purchase This Month

[Asia Economy Reporter Minji Lee] Domestic investors' 'affection' for semiconductor stocks is being replicated in overseas stock markets. Retail investors, who have purchased more than 2 trillion KRW worth of Samsung Electronics shares this month alone, are backing the semiconductor 'bottoming theory' and are focusing on buying major semiconductor stocks in the US, Taiwan, and other key markets.

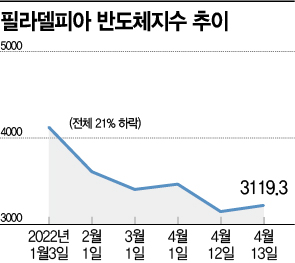

According to the Korea Securities Depository's securities information system, SEIBRO, as of the day before yesterday this month, the most purchased overseas stock by investors was the Direxion Daily Semiconductor 3x ETF (SOXL). This ETF bets on the rise of the Philadelphia Semiconductor Index and aims to deliver triple the returns. Investors bought 506.3 billion KRW worth of this ETF over about ten days. As the Philadelphia Semiconductor Index fell approximately 9% this month due to declines in major semiconductor stocks, it is analyzed that many investors expecting a rebound in the index have entered the market.

Among the top 10 stocks in the portfolios of overseas Korean investors, four were major semiconductor companies. They also heavily purchased stocks known as 'MANGO' (Marvell Technology Group, AMD, Nvidia, GlobalFoundries, ON Semiconductor), which are promising US semiconductor stocks. They bought Nvidia and AMD, semiconductor design companies, worth 141.2 billion KRW and 51.5 billion KRW respectively, and also acquired ON Semiconductor, a power semiconductor manufacturer, worth 27 billion KRW. Additionally, they made significant net purchases of the iShares Semiconductor ETF (27 billion KRW) and TSMC, a semiconductor manufacturing company, worth 12.3 billion KRW.

Recently, semiconductor stocks have shown sluggish price trends. Nvidia's stock price plunged 18% this month, and AMD fell 10%. Even looking at Samsung Electronics' stock price trend in the domestic market, global semiconductor companies' stock prices appear to be heading toward a bottom.

The reasons are complex. The US Federal Reserve (Fed) has made hawkish remarks this month, raising expectations of a 'big step' of a 0.5 percentage point hike in the benchmark interest rate at once, which triggered a sharp rise in government bond yields and dampened investor sentiment. Concerns also arose that prolonged inflation could weaken front-end demand. Moreover, as China's local smartphone shipments continue to weaken monthly and the government has implemented lockdown measures in major cities to maintain 'zero-COVID' policy, major Taiwanese semiconductor companies (TSMC -2.6%) have also continued to experience sluggish stock price trends.

Although the scale of bargain hunting by domestic investors is increasing, securities firms weigh the outlook that the weak stock price trend may continue for the time being. Despite the positive factor of record-high sales in the first quarter, concerns about a decline in IT demand in the second half and external variables are being more heavily reflected in stock prices. However, considering the stock prices have already factored in these concerns, further declines until the second half are not expected. Sungmin Hwang, a researcher at Samsung Securities, analyzed, "Many forecasts expect memory semiconductor prices to fall because customers are likely to reduce orders considering demand slowdown," adding, "Although there are concerns about economic slowdown, server demand is linked to data consumption, and since data consumption is accelerating, server demand is not expected to shrink significantly."

Meanwhile, domestic investors also purchased quantum computing startup IonQ (38.1 billion KRW), electric vehicle manufacturer Rivian (31.2 billion KRW), and Twitter (23.8 billion KRW) in overseas stock markets. In Rivian's case, as the stock price fell nearly 20% this month due to forecasts that supply chain disruptions would prevent meeting production targets, funds flowed in expecting bargain buying. For Twitter, the news that Elon Musk, CEO of an electric vehicle company, had acquired shares was seen as a positive factor.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)