Bank of Korea's Aggressive Rate Hike Outlook

Corporate Bond Investment Sentiment Gauged

Credit Spread at 66bp

Inflation Surge Drives Sharp Increase

Rising Rate Anxiety Adds Pressure

Institutions Reluctant to Inject Funds

Corporate Bond Issuance Likely to Face Difficulties

[Asia Economy Reporter Minji Lee] As expectations grow that the Bank of Korea will aggressively raise interest rates, liquidity in the corporate bond market is also sharply declining. It is anticipated that the funding environment for companies will become even more challenging.

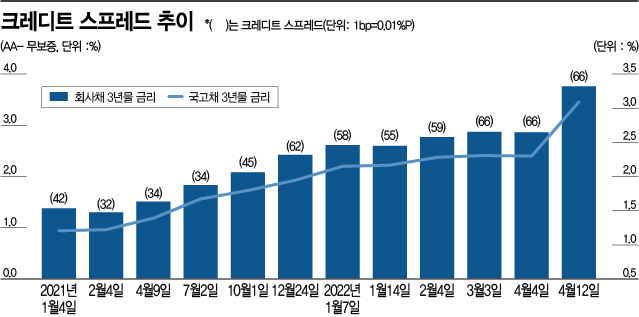

According to the bond evaluation industry on the 13th, the credit spread, which gauges investor sentiment toward corporate bonds, stood at 66 basis points (bp) as of the 12th (1bp = 0.01%p). The credit spread, which hovered around 40bp at the beginning of last year, has surged to 66bp in just over a year. Earlier this year, it rose to around 60bp amid concerns over interest rate hikes, and the figure climbed further due to inflation driven by the Russia-Ukraine war. The credit spread is calculated by subtracting the 3-year government bond yield from the 3-year corporate bond yield rated ‘AA-’; a higher figure indicates a more difficult environment for bond issuance.

With the likelihood of a benchmark interest rate hike in South Korea increasing this month, the credit spread is gradually rising. The bond market highly anticipates that the Bank of Korea will raise the benchmark rate at the Monetary Policy Committee meeting scheduled for the 14th. There is growing speculation about an ‘April hike’ as the U.S. is expected to implement a ‘big step’ by raising its benchmark rate by 0.5 percentage points at once. Initially, the market expected the hike to occur in May, but the pace has accelerated.

When the benchmark interest rate rises and market interest rates increase, the burden on companies seeking to raise funds in the corporate bond market grows heavier. They must offer higher interest rates and pay more than before to issue corporate bonds. For example, in April last year, LS Electric (AA-) issued 3-year bonds with a winning bid rate of -0.06% (public offering target rate -0.2% to 0.2%), resulting in under-subscription. However, this year, Lotte Rental (AA-) saw its 3-year bond (public offering target rate -0.3% to 0.3%) winning bid rate form high at 0.12%, close to the upper limit of the target rate. Kim Dae-jun, a researcher at Korea Investment & Securities, explained, "Looking at the AA- rated corporate bond interest rates this month, they have risen by more than 120 basis points compared to the same month last year, which means the interest burden on companies has increased by more than half."

During times of high uncertainty about the magnitude of interest rate hikes, institutions are reluctant to release funds, making smooth issuance difficult to expect. In an environment of rising market interest rates, institutions avoid investing due to potential valuation losses caused by bond price declines. A bond management official said, "Since there are cheaper bonds available in the secondary market, there is no reason to enter the primary market and sign contracts. Issuance tends to focus on short-term bonds with high interest rates or high-credit-quality bonds (AA grade), but even these are not attracting sufficient demand."

Moreover, the scale of bond issuance is expected to increase, which is predicted to further exacerbate the supply-demand imbalance in the corporate bond market. Typically, issuance volume decreases in March due to report submissions and other issues, but it sharply increases in April. This year, many companies are expected to seek the corporate bond market before interest rates rise further. Kim Eun-gi, a researcher at Samsung Securities, analyzed, "There is a rush to issue corporate bonds before the May Monetary Policy Committee meeting, and if issuance increases significantly this month, the burden of issuance will grow again. While a decline and stabilization in interest rates will affect the credit spread, the scale of corporate bond issuance will also have a significant impact."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.