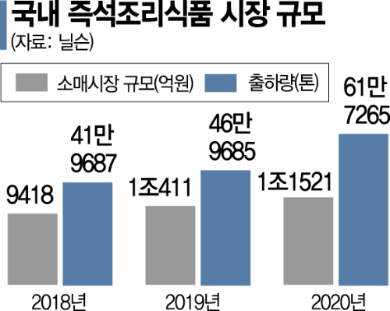

2020 Retail Market Size 1.1522 Trillion KRW... 10.7% Growth

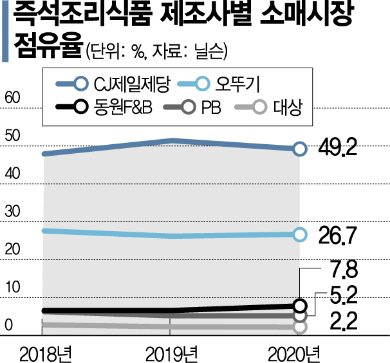

CJ CheilJedang Leads with 49% Market Share... Ottogi Maintains 26% Range for 3 Years

Instant Rice, Cup Rice, Porridge, and Other Types Lead Shipments at 1.4665 Trillion KRW

[Asia Economy Reporter Eunmo Koo] The instant meal market, which emphasizes convenience, is rapidly growing. As the number of single-person households increases and demand for home-cooked meals rises due to COVID-19, lifestyle changes are accelerating shifts in eating habits.

According to Nielsen Korea on the 12th, the domestic instant meal retail market size in 2020 was recorded at 1.1522 trillion KRW. This represents a 10.7% increase from the previous year (1.0411 trillion KRW) and a 22.3% increase compared to 2018 (941.8 billion KRW), showing an annual growth trend of around 10%. This survey did not include retail sales through online channels.

By company, CJ CheilJedang ranked first with 49.2% of total sales, followed by Ottogi (26.7%), Dongwon F&B (7.8%), PB brands (5.2%), and Daesang (2.2%). CJ CheilJedang increased its market share from 47.9% in 2018 to 51.4% in 2019, capturing more than half of the market, but slightly declined to 49.2% in 2020, showing a somewhat hesitant performance.

On the other hand, Ottogi, ranked second, maintained a steady market share around 26% for three consecutive years. Dongwon F&B, ranked third, recorded a 6.6% share for two consecutive years since 2018 and advanced to 7.8% in 2020. Private brand (PB) products from large supermarkets and convenience stores consistently held a 5-6% share, while Daesang maintained around 2% market share.

By type, other categories such as instant rice, cup rice, porridge, and sauces accounted for 1.4665 trillion KRW in shipment value, representing 72.9%. This was followed by sundae (Korean blood sausage) at 205.6 billion KRW (10.2%), soups and stews at 185 billion KRW (9.2%), and broth at 116.7 billion KRW (5.8%).

The instant meal product perceived to have increased in purchase compared to before COVID-19 was the convenient cooking set (meal kit), with 66.0% being the highest, followed by soups, stews, and jjigae (54.2%), and instant rice (42.5%). Additionally, meal kits (51.2%) were also expected to see the highest increase in future purchases among instant meal products.

Unlike other instant meal products, meal kits include fresh raw ingredients and are positively received by consumers because they allow for recreating a certain level of cooking at a relatively affordable price. The domestic meal kit market, which was around 20 billion KRW in 2018, is expected to grow to 700 billion KRW by 2024.

Professor Eunhee Lee of Inha University’s Department of Consumer Studies said, "The tendency to seek convenience is becoming stronger, especially among the MZ generation (Millennials + Generation Z), so the related market is expected to continue growing steadily."

Meanwhile, exports of instant meal products are also rapidly increasing. Shipment volume, which was about 419,687 tons in 2018, rose by 47.1% to 617,265 tons in 2020.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)