March Inflation Rate 4.1%... Largest Increase in Over 10 Years

Impact of Ukraine-Origin Raw Material Price Surge... Petroleum Prices Up 31.2% Compared to Last Year

Government Proposes 30% Fuel Tax Cut, but Impact Minimal

Bank of Korea: Inflation to Remain in 4% Range for Now... Annual Inflation Forecast (3.1%) Significantly Exceeded

[Asia Economy Sejong=Reporters Kim Hyewon and Son Seonhee] The domestic consumer price inflation rate has surpassed the 4% mark for the first time in about 10 years. This reflects the full impact of the surge in international oil prices and raw material costs following Russia's invasion of Ukraine on the real economy. The government has launched an all-out effort to control inflation, including expanding the fuel tax cut rate to 30%.

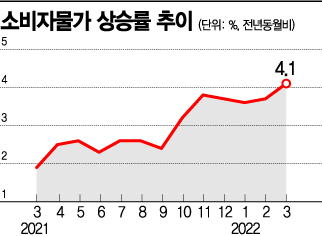

According to the consumer price trend for March announced by Statistics Korea on the 5th, the consumer price index last month was 106.06 (2020=100), up 4.1% from the same month last year. The consumer price inflation rate rose to the 3% range for the first time in 9 years and 8 months in October last year (3.2%), then maintained the 3% range for five months from November (3.8%), December (3.7%), January this year (3.6%), and February (3.7%), before finally exceeding 4% last month. The consumer price inflation rate has been in the 4% range for the first time in 10 years and 3 months since December 2011 (4.2%). The Bank of Korea hinted at a significant upward revision of this year's inflation forecast (3.1%).

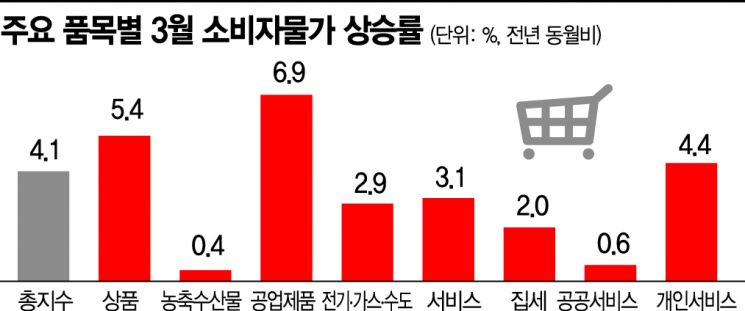

The main culprits for last month's price increase were petroleum products and other industrial goods, as well as personal services such as dining out. Due to the impact of the Ukraine crisis, petroleum prices rose by 31.2%, and industrial products including processed foods increased by 6.9%. Service prices rose by 3.1%, with dining out among personal services surging 6.6%, the largest increase since April 1998 (7.0%). The core inflation rate (excluding agricultural products and petroleum) that shows the underlying trend of prices rose by 3.3%, the largest increase since December 2011 (3.6%).

The government, which 'touched' the 4% consumer price inflation rate for the first time in 10 years and 3 months, has poured out price stabilization policies focusing on responding to fuel and raw material prices. A representative measure is expanding the fuel tax cut rate from 20% to 30%. With this measure, assuming driving 40 km per day and fuel efficiency of 10 km/liter, fuel costs can be reduced by 30,000 KRW for gasoline. Compared to the 20% fuel tax cut, the cost burden is reduced by 10,000 KRW.

The diesel fuel price-linked subsidy and the reduction of the vehicle LPG sales surcharge focus on supporting the livelihoods of low-income households. In terms of raw material response, the list of items subject to 0% tariff allocation has been expanded to include secondary batteries and automobile processes, and additional quantities of feed wheat and corn, which had supply concerns, were secured through alternative bidding until January next year at the latest. To ease the burden on the processed food industry, chip potatoes will be subject to 0% tariff allocation during the non-seasonal tariff period (May to November). Hong Namki, Deputy Prime Minister and Minister of Economy and Finance, said, "The high inflation in March is a full-fledged reflection of the unexpected impact of Russia's invasion of Ukraine," adding, "Major advanced countries are also experiencing the highest inflation rates of 6-7% in 30 to 40 years."

Ukraine-triggered high oil prices, full response in inflation... Bank of Korea may accelerate rate hikes

The consumer price inflation rate in March rose the most in 10 years and 3 months due to the full reflection of the high oil price trend that has continued since the second half of last year. Added to this is the recent Russia-Ukraine war, making the situation even more challenging. The Bank of Korea expects the consumer price inflation rate to remain in the 4% range for the time being and forecasts that the annual inflation rate this year will significantly exceed the previous forecast (3.1%). Market analysts also predict that the Bank of Korea will raise the base interest rate to the 2.0% range this year to manage inflation. There are concerns about the contraction of the real economy due to interest rate hikes.

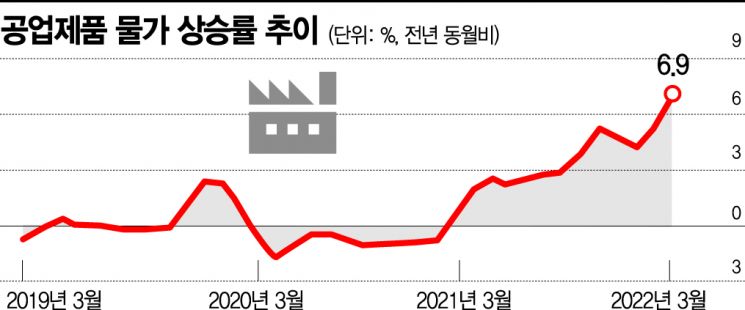

◆March Consumer Prices Hit by High Oil Prices= According to Statistics Korea on the 5th, the consumer price inflation rate in March was driven up significantly by a 6.9% increase in industrial product prices. This is the largest increase in 13 years and 5 months since October 2008 (9.1%).

The rise in industrial product prices was overwhelmingly influenced by petroleum products (31.2%) whose volatility increased after the Ukraine crisis. Compared to a year ago, gasoline rose 27.4%, diesel 37.9%, and kerosene 47.1%. Eo Unseon, Director of Economic Trend Statistics at Statistics Korea, explained, "The expanded price increase this month is mostly due to the rise in petroleum products."

The problem is that core inflation, excluding temporary supply factors like oil prices, is also on the rise. The core consumer price index, excluding agricultural products and petroleum, rose 3.3% last month, the largest increase since December 2011 (3.6%). Service prices also jumped 3.1%, centered on personal services (4.4%). This includes a 2.0% increase in rent compared to a year ago. Consumer demand has recovered this year, and various material costs have risen due to international grain prices and accumulated increases in agricultural, livestock, and fishery products.

◆Fuel Tax Cut Expanded to Maximum 30%... Business Sector Calls for Additional Measures= To reduce inflationary pressures caused by energy and raw materials, the government has also launched an all-out response but faces difficulties. On the same day, the government convened the second price-related ministerial meeting under the Moon Jae-in administration, chaired by Deputy Prime Minister and Minister of Economy and Finance Hong Namki, and announced a 'three-piece set' to ease the burden of high oil prices. From next month, the fuel tax cut rate will be expanded from the previous 20% to 30%, and the period extended until July. Temporary subsidies linked to diesel prices will be provided to commercial freight trucks, buses, and coastal cargo ships. In addition, items excluded from tariff allocation have been added to respond to raw material supply instability.

However, the business sector, which has been hit hard by rising raw material prices, still considers these measures insufficient. The Korea International Trade Association's International Trade and Commerce Research Institute appealed for increased stockpiling of key raw materials, prohibition of hoarding and re-exporting raw materials, and additional tariff and tax policies to suppress inflation in order to minimize the impact of rising international raw material prices. Do Wonbin, a researcher at the Trade Association, said, "In addition to expanding the fuel tax cut rate, measures such as abolishing import tariffs on crude oil and natural gas and freezing public utility charges are needed to reduce inflationary pressures."

◆Bank of Korea: "Annual Inflation to Exceed 3.1%"... Likely to Accelerate Rate Hikes= As the 'price shock' caused by oil prices becomes apparent, the Bank of Korea held a 'price situation review meeting' chaired by Deputy Governor Lee Hwanseok on the same day and began full-scale inflation response measures.

Deputy Governor Lee said, "The average annual oil price level this year is likely to significantly exceed the assumption made in the February forecast (Dubai crude at $83), and combined with the Ukraine crisis and supply chain disruptions caused by the resurgence of COVID-19 in China, upward pressure on domestic prices is inevitable," indicating that tightening will accelerate.

The market expects the Bank of Korea to raise interest rates two or three times this year in line with the rate hike trends of major countries such as the United States and the inflation trend. However, since the Monetary Policy Committee meeting scheduled for the 14th is likely to decide the base rate without a governor, the pace of tightening is expected to accelerate from May, with the base rate rising to the 2.0% range by the end of this year.

Chun Sora, a research fellow at the Korea Development Institute (KDI) Economic Forecasting Office, said, "Inflationary pressures are spreading not only to petroleum products but also to other items, and in advanced countries, this has already led to increases in housing costs and wages," adding, "Unless there is a 'big step' in monetary policy, there seems to be little chance of inflation falling."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)