[Asia Economy Reporter Lim Hye-seon] On April 5, 2021, LG Electronics held a board meeting and decided to withdraw from the smartphone business. One year later, Samsung Electronics' market share surged in the domestic market, while Motorola gained a reflective benefit by ranking third in market share for the first time in the U.S. market.

Samsung Smartphone Market Share at 72%

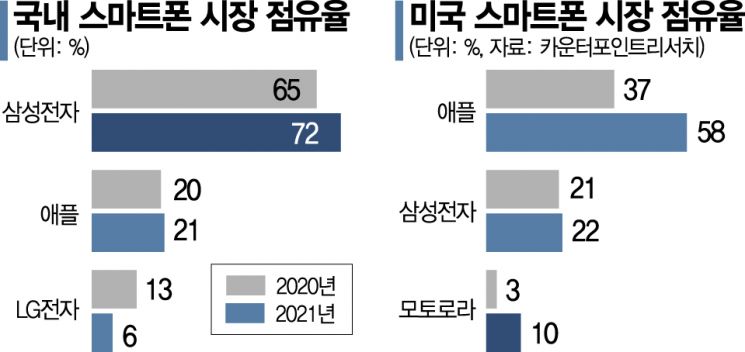

According to market research firm Counterpoint Research on the 4th, last year’s domestic smartphone shipments were recorded at 16.4 million units. Samsung Electronics' market share surged to 72%, up 7 percentage points from 65% in 2020. During the same period, LG Electronics' market share dropped from 13% to 6%. It is analyzed that Samsung Electronics absorbed this share following LG Electronics' withdrawal from the smartphone business.

After launching foldable phones such as the Galaxy Z Flip3 in the second half of the year, Samsung Electronics' market share soared to as high as 89%. Apple, the only remaining competitor, saw its market share rise by 1 percentage point from 20% to 21%. Considering that the 5G subscriber rate among all mobile carriers increased from 48% in 2020 to 78% in 2021, Samsung Electronics' market share is expected to rise further.

Motorola Recovers Double-Digit Market Share

In the U.S. smartphone market, Motorola filled the gap left by LG Electronics. Motorola captured a 10% market share in the U.S., ranking third. Motorola's sales last year increased by 131% compared to the previous year. Apple held 58%, and Samsung Electronics held 22% of the market share. Previously, LG Electronics recorded over 15% market share in the U.S. market.

While Samsung and Apple competed fiercely in the premium phone market, Motorola targeted the mid-to-low-end smartphone market priced under $400. In the under $400 market, Motorola ranks second. Jeff Fieldhack, lead analyst at Counterpoint Research, explained, "Motorola took over LG's vacancy and increased its market share to over 10% in the U.S. smartphone market," adding, "Motorola's products under $300, such as the Moto G Stylus, Moto G Power, and Moto G Pure, led its success in the U.S. market."

Motorola Preparing to Target Korean Market

This year, the domestic smartphone market is expected to slightly increase to 16.8 million units in shipment volume. Although challenges such as parts supply shortages and slow economic recovery remain, growth is expected to begin in the second half of the year. While the two-horse race between Samsung and Apple remains solid, attention is focused on the strategies of Motorola, Xiaomi, and others targeting the mid-to-low-end smartphone market.

Motorola, which withdrew from the Korean market in 2012, is preparing to re-enter the domestic market after 10 years. Chinese smartphone maker Xiaomi also opened its first official offline store in Korea at Yongsan I'Park Mall in Seoul. It plans to release the mid-range phone series ‘Redmi Note 11’ as well.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)