[Asia Economy Reporter Changhwan Lee] Since the COVID-19 pandemic, the proportion of insurance premiums relative to income and consumption has increased more among lower-income groups.

According to the report "Characteristics of Recent Changes in Insurance Premium Expenditures by Household Characteristics" published by the Korea Insurance Research Institute on the 3rd, insurance premium expenditures of Korean households have generally shown a stable trend, maintaining a certain level relative to income after COVID-19.

The average monthly regular insurance premium expenditure of Korean households increased by 9.23% over two years (an average annual increase of 4.51%), from approximately 84,000 KRW in 2019 to 89,000 KRW in 2020, and 92,000 KRW in 2021.

During this period, the average monthly disposable income of households increased by 7.27% (an average annual increase of 3.57%), while consumption expenditure increased by only 1.53% (an average annual increase of 0.76%), indicating a severe consumption slump, yet insurance premium expenditures still rose.

Although insurance premium expenditures increased overall, the changes in insurance premium expenditures by household characteristics showed quite contrasting trends depending on the characteristics.

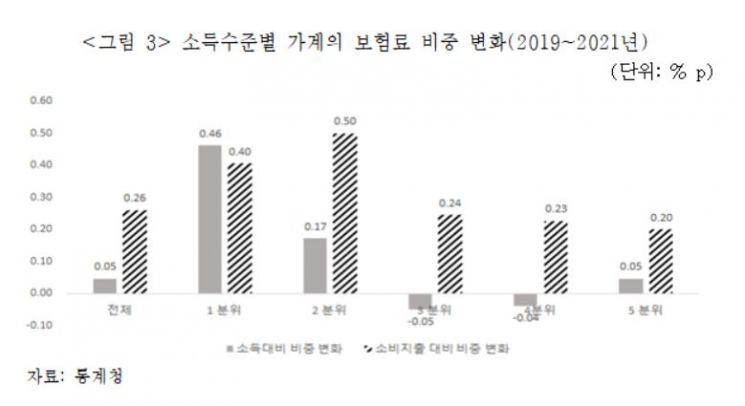

By income level, in the lower income groups (1st and 2nd quintiles), the proportion of insurance premiums relative to both disposable income and consumption expenditure increased significantly compared to all households.

The proportion of insurance premiums relative to disposable income rose from 2.94% in 2019 to 3.40% in 2021 for the 1st quintile, and from 2.78% to 2.95% during the same period for the 2nd quintile.

In contrast, for the middle class groups such as the 3rd and 4th quintiles, the proportion of insurance premiums relative to disposable income in 2021 decreased by 0.05 percentage points (2.86% → 2.81%) and 0.04 percentage points (2.75% → 2.71%), respectively, compared to 2019 levels.

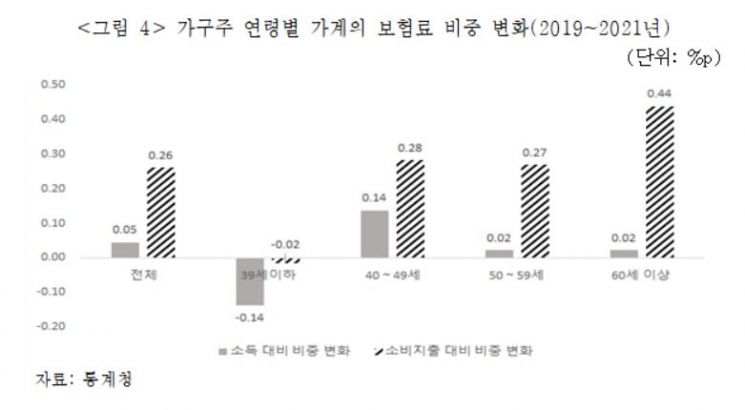

By household head age, although the proportion of insurance premiums relative to income and consumption expenditure increased in most households, those with household heads aged 39 or younger showed a decrease in the proportion relative to both income and consumption expenditure.

For households with heads aged 39 or younger, the proportion of insurance premiums relative to disposable income and consumption expenditure in 2021 decreased by 0.14 percentage points and 0.02 percentage points, respectively, compared to 2019.

Households with heads aged 39 or younger were the only group to show a decrease in insurance premium expenditure amounts in 2021 compared to 2019.

Examining changes in insurance premium proportions by housing type revealed that generally, the lower the housing stability, the greater the increase in the proportion of insurance premiums relative to income or consumption expenditure.

Senior Research Fellow Tae-yeol Lee of the Korea Insurance Research Institute explained, "The more difficult the economic conditions, the higher the dependence on mandatory insurance such as automobile insurance, so increases in renewal premiums may have resulted in a high growth rate of insurance premium expenditures. Conversely, in households with better economic conditions, expenditures on optional insurance types such as variable, whole life, personal pension, and long-term savings insurance may have declined, leading to a relative contraction in the proportion of insurance premium expenditures."

Research Fellow Lee emphasized, "It is important to note that the proportion of insurance premium expenditures relative to income or consumption expenditure mainly decreased among economically better-off and younger groups. The insurance industry needs to establish differentiated product development and channel strategies tailored to consumer characteristics to compensate for the weakened growth base."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.