Longer Lease Periods Receive Greater Tax Benefits

Tenant Housing Stability Must Be Ensured

[Asia Economy Reporter Kim Min-young] The Presidential Transition Committee’s plan to revive the ‘Private Rental Business Registration System’ has raised concerns that a mid- to long-term institutional design is necessary to resolve the side effects initially raised when the system was abolished and to properly establish it. It is suggested that long-term leasing should be encouraged through guaranteeing appropriate rental yields and expanding tax incentives.

On the 30th, Lee Eun-hyung, Senior Researcher at the Korea Construction Policy Institute, said, "The Private Rental Business Registration System effectively acts as a measure that eases comprehensive real estate tax and capital gains tax for multi-homeowners, which is positive in terms of expanding housing supply."

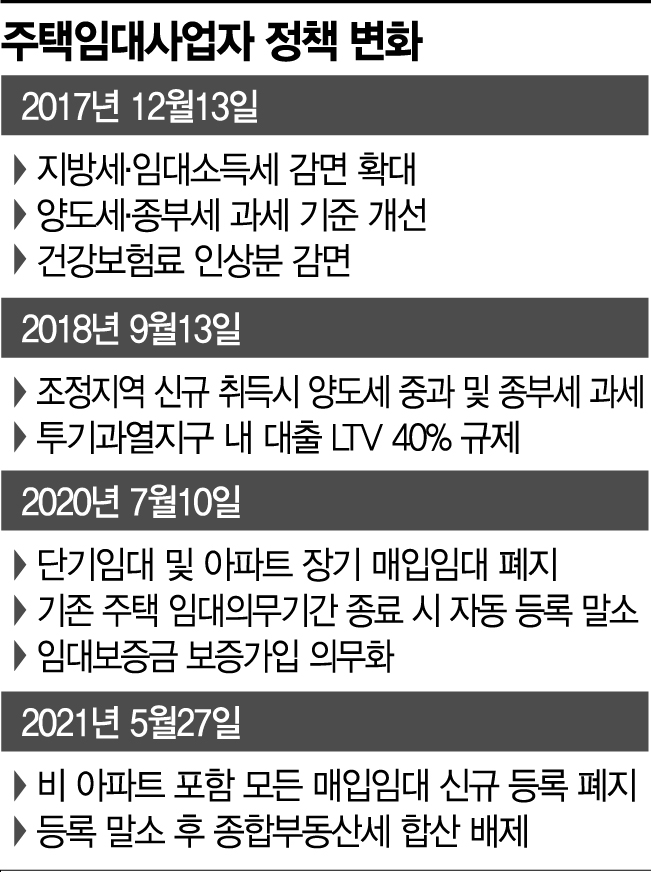

The day before, the Transition Committee announced the revival of this system, which the Moon Jae-in administration had effectively abolished in July 2020. The government had earlier, in 2017, announced measures to activate rental housing registration to encourage multi-homeowners to register as rental business operators, but due to criticism that the benefits were excessive, it was effectively abolished after two years. The main reason was that the system reduced the incentive for multi-homeowners to sell their houses, causing a shortage of listings and leading to housing price increases. However, the Transition Committee has brought back the registration system as a market stabilization measure amid concerns that the rental market could become unstable after August, the second year of the implementation of the three rental laws. Since the original purpose of this system was to stabilize the rental market and protect tenants, it is recognized as a necessary system for the market. Multi-homeowners who register as rental business operators cannot sell their houses for 4 or 8 years but receive tax benefits in return. This ensures a stable supply of rental properties in the market and thus promotes housing stability for tenants.

Concerns about housing price increases due to the shortage of listings can be referenced in the 2020 report by the Korea Research Institute for Human Settlements titled ‘Performance Review and Improvement Measures of the Private Rental Housing Registration Activation System.’ According to the report, new rental registrations surged after the government announced activation measures in December 2017. The number of registrants increased from 259,000 people and 980,000 households at the end of 2017 to 481,000 people and 508,000 households in 2019.

The report pointed out, "While there is a possibility of a shortage of listings, there is insufficient empirical evidence that this contributed to a sharp rise in prices," and "Since there were already 980,000 registered rental households before the activation measures, it is difficult to see that the increase after the activation measures significantly affected the overall market." According to the Korea Real Estate Board, the nationwide apartment sales price index rose by 1.5% from 87.6 in October 2017, when the rental housing activation measures were announced, to 88.9 in June 2020. From July 2020 to February 2022, it rose by 18% from 89.7 to 106.3, showing a larger increase.

However, since the purpose of the registration system is to supplement the limitations of insufficient public rental housing supply, various complementary measures are also necessary. The report suggested the need to review whether landlords are guaranteed an appropriate rental yield and proposed increasing the reduction rates of property tax, comprehensive real estate tax, and rental income tax as the rental period lengthens to encourage long-term leasing. Regarding strengthening tenant protection measures, it stated, "Measures should be devised to provide tenants with information on the landlord’s rights and credit information changes during the lease period," and "It is also necessary to consider making it mandatory for landlords or brokers to notify tenants that the property is a registered rental housing and to guide tenants on their benefits from the rental contract stage."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)