Bank of Korea Publishes Overseas Economic Focus

[Asia Economy Reporter Seo So-jeong] This year, China's real estate market is expected to see some easing of its sluggish trend due to government market stabilization measures, but recent expansions in domestic and international uncertainties make it difficult to enter a full recovery path.

The China Economy Team of the Bank of Korea's Research Department stated in the report "Current Status and Outlook of China's Real Estate Market" on the 27th, "The strengthening of lockdown measures due to the spread of the Omicron variant and the rise in raw material prices caused by the Ukraine crisis are restricting the recovery of the real estate market, making it likely that the market downturn will be prolonged, unlike in the past."

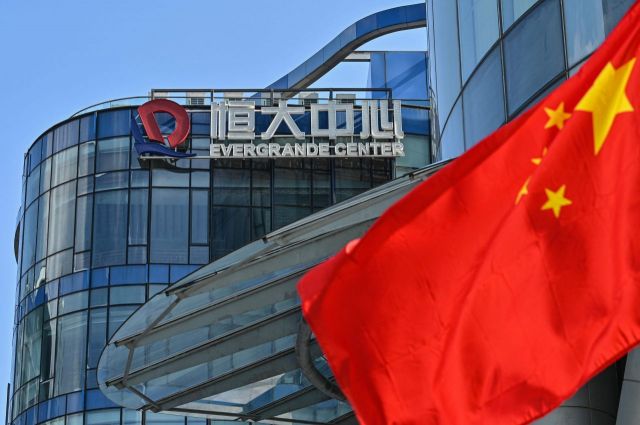

Since the Evergrande crisis in September last year, China's real estate market has seen deteriorating business conditions for real estate companies due to a decrease in corporate bond issuance, stock price declines, and poor earnings caused by market stagnation. The total corporate bond issuance by Chinese real estate companies last year was $255.2 billion, a 5% ($13.5 billion) decrease compared to the previous year. Although the decline in housing prices in China during January and February this year has somewhat eased mainly in first- and second-tier cities, the number of transactions continues to sharply decrease.

Among the top 10 Chinese real estate companies, the market capitalization of eight companies listed on the Hong Kong Stock Exchange at the end of last month was about HKD 1.1 trillion, down 28.3% from a year ago. By company, Evergrande Group decreased by 90%, while Longfor (-77.5%) and Vanke (-40.5%) also showed significant declines.

Since the fourth quarter of last year, when the Evergrande crisis intensified, more than ten real estate companies have declared defaults on bonds maturing.

The Chinese government is implementing deregulation measures at both central and local government levels in response to the market downturn and is also promoting industry restructuring. This year, it has consecutively announced measures to improve corporate liquidity, such as easing loan regulations, raising the loan-to-value ratio (LTV) for mortgages, and improving the management system for pre-sale funds. Additionally, while managing the Evergrande crisis stably, it is promoting restructuring of the real estate industry through merger and acquisition (M&A) financial support.

The report forecasted, "The strengthening of lockdown measures due to the spread of the Omicron variant and the rise in raw material prices caused by the Ukraine crisis may restrict the recovery of the real estate market," adding, "While real estate market easing policies will continue for the time being, there is concern that structural risks to the Chinese economy will further expand due to the accumulation of debt and credit risks during this process."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)