"Even if the Base Interest Rate Rises, Bank Net Interest Margin Can Decrease"

[Asia Economy Reporter Minwoo Lee] The introduction of a periodic disclosure system for the interest rate spread between deposits and loans, a financial pledge by President-elect Yoon Seok-yeol, is gaining momentum. The banking sector is already considering lowering loan interest rates. As a result, with the full-scale competition in loan interest rates beginning, there is an analysis that banks' net interest margin (NIM) may decrease.

As the introduction of the periodic disclosure system for the interest rate spread between deposits and loans, one of the related pledges, gains momentum, voices of dissatisfaction are emerging in the banking sector. There are concerns that the system could be an excessive market intervention, and criticisms that due to the loan system where interest rates are calculated differently for each borrower, its effectiveness may not be significant.

According to the industry on the 26th, the Presidential Transition Committee (Transition Committee) is considering the introduction of such a disclosure system for the interest rate spread between deposits and loans. The Financial Services Commission is also reported to have included an implementation plan for the disclosure system regarding the interest rate spread in its briefing to the Transition Committee the day before.

Banks already disclose the average interest rate, base interest rate, and additional interest rate of loans handled in the previous month to the Korea Federation of Banks every month, but President-elect Yoon's side is demanding the disclosure of the 'cost' of business expenses such as risk management costs, which are the basis for the additional interest rate. Related bills have also been proposed in the National Assembly. In January, Representative Song Eon-seok of the People Power Party introduced the 'Banking Act Amendment' bill, which includes mandatory disclosure of the interest rate spread between deposits and loans and recommendations for improvements by the Financial Services Commission.

Considering the relaxation of total loan volume regulations and loan-to-value (LTV) ratio regulations on mortgage loans, as well as the promotion of mandatory disclosure of the interest rate spread, there is an analysis that the financial policy stance is shifting from quantity (total loan volume) regulation to price (interest rate) regulation. Youngsoo Seo, a researcher at Kiwoom Securities, explained, "Although there is an opinion that the effectiveness is not significant, the expansion of disclosure during the policy stance change means something different," adding, "As the ranking of banks by interest rate spread was disclosed, banks feeling the burden began to consider lowering loan interest rates."

With the total loan volume regulation already becoming ineffective and the easing of restrictions on non-face-to-face loans for jeonse deposit funds, the loan market conditions are rapidly changing. Kakao Bank is lowering the interest rate on jeonse deposit loans to about 2.88%, the lowest in the industry, and is expected to actively promote newly launched mortgage loan services. As loan interest rate competition among banks is rekindled, led by internet-only banks, banks' net interest margins (NIM) may decrease.

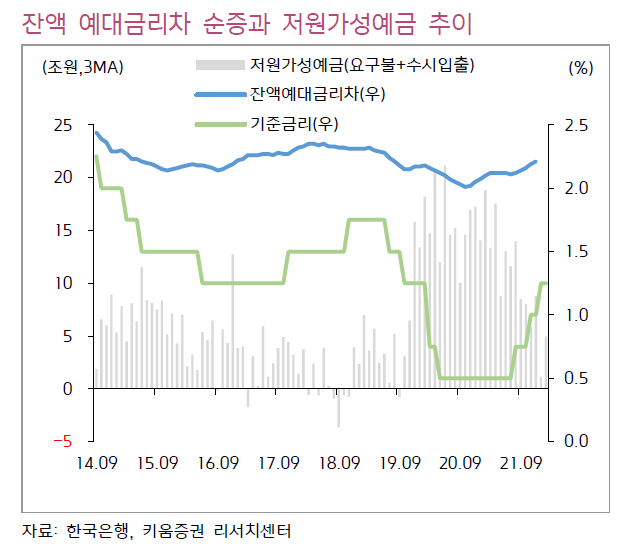

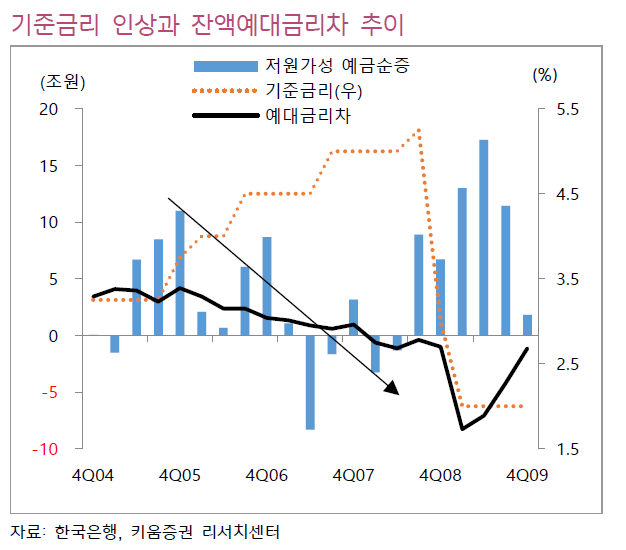

Researcher Seo said, "Until now, net interest margins have increased during most periods of base interest rate hikes, but at times when government intervention makes it difficult to raise loan interest rates or when the absolute level of loan interest rates is high, making it hard to raise loan interest rates further despite rising funding costs, net interest margins have rather fallen," adding, "A flexible approach based on understanding the current financial conditions and policy changes is necessary rather than a fragmentary or schematic response."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)