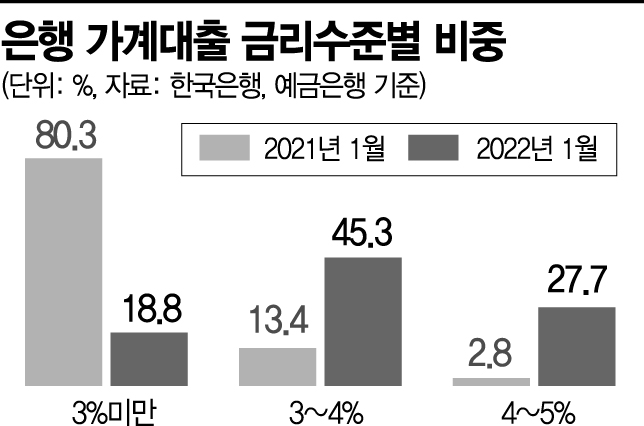

2.8% in January Last Year, 27.2% in January This Year

Proportion of Borrowers with 3% Interest Rates Tripled

Risk Increases if Loan Interest Rates Rise Further

President-elect Yoon Seok-yeol is arriving at the transition committee office in Tongui-dong, Jongno-gu, Seoul on the 25th. Photo by Kim Hyun-min kimhyun81@

President-elect Yoon Seok-yeol is arriving at the transition committee office in Tongui-dong, Jongno-gu, Seoul on the 25th. Photo by Kim Hyun-min kimhyun81@

[Asia Economy Reporter Sim Nayoung] Among new household borrowers in South Korea, the proportion of those borrowing at an annual interest rate in the 4% range increased from 2.8% in January last year to 27.7% this January, marking the highest level in 8 years and 1 month. Economic experts expressed concerns that, following the new government's easing of loan regulations, the increase in household loans is likely to reignite, and if loan interest rates rise further, the risks could escalate.

According to the "Proportion of Household Loans by Deposit Bank Interest Rate Level" (based on new loan amounts) from the Bank of Korea's Economic Statistics System, the proportion of borrowers with interest rates between 4% and less than 5% was 27.7% as of January. This is the highest record since December 2013 (28.6%), 8 years and 1 month ago. It also represents a vertical rise compared to 2.8% a year ago. A financial sector official said, "With the rise in interest rates, both unsecured loans and mortgage loan interest have increased, resulting in more high-interest borrowers." The proportion of borrowers with interest rates between 3% and less than 4% also rose from 13.4% to 45.3%.

The proportion of low-interest borrowers shrank. In January last year, the proportion of borrowers with interest rates below 3% was overwhelmingly 80.3%, but it dropped to 18.8% within a year. Looking more closely at this range: those with interest rates below 2% fell from 9.6% to 1.3%, those between 2% and less than 2.5% dropped from 26.2% to 7.5%, and those between 2.5% and less than 3% declined from 44.5% to 10.0%.

The loan situation for small and medium-sized enterprises (SMEs), including small business owners, is no different. Due to difficulties in management caused by COVID-19, they took out loans, but with rising interest, their burden has increased further. Looking at the proportion of SME borrowers by deposit interest rate, those below 3% decreased from 67.0% to 26.3%, while those between 3% and less than 4% increased from 23.5% to 52.0%, and those between 4% and less than 5% rose from 6.7% to 16.3%.

What economic experts worry about is that easing household loan regulations during a period of rising interest rates could have a significant impact on the domestic economy. President-elect Yoon has pledged to raise the loan-to-value ratio (LTV) to 80% for first-time homebuyers and young people. To this end, the Financial Services Commission is expected to abolish the total household loan volume regulation applied to banks and also ease the debt service ratio (DSR), which determines loan amounts based on individual income.

Professor Kim Sangbong of Hansung University’s Department of Economics said, "If interest rates rise further, borrowers’ interest burdens will grow like a snowball, and easing household loan regulations could cause serious side effects." He added, "Housing supply policies should be presented together to lower housing prices while easing loan regulations to prevent a sharp increase in household loans." Kang Jonggu, a research advisory committee member of the Bank of Korea, also said, "If the economy worsens in the future, asset prices will fall and incomes will decrease, making it difficult to repay the principal and interest on household loans, which could negatively affect the economy. Therefore, managing risks is important."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)