KT-CJ ENM Partnership

Studio Gini Produced Content

Likely Distributed on Individual Channels and TVING

Popular Among 2030s on SKT-Wave

LG Uplus Collaborates with Netflix and Disney

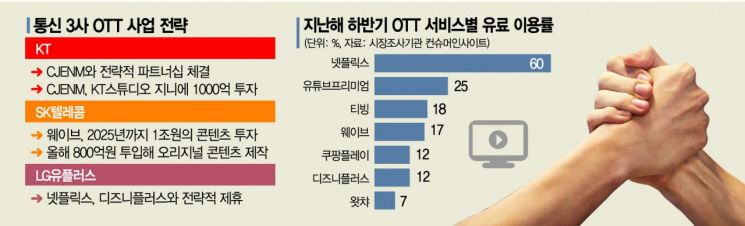

[Asia Economy Reporter Cha Min-young] As the domestic content supply channel shifts to a ‘mobile’-centered platform, the telecommunications industry is also joining forces with content industry giants to build an ‘online video service (OTT) alliance.’ With the center of content distribution channels shifting from home TVs to mobile devices, and from the 50s-60s age group to the 20s-30s, the driving force for enhancing content competitiveness is being sought through ‘external alliances.’

All Three Major Telecom Companies Partner with OTT Providers

According to the telecommunications industry on the 23rd, KT and CJ ENM signed a strategic partnership for content business cooperation on the 21st. KT Studio Genie plans to expand its content distribution network by having CJ ENM purchase and schedule content produced in-house. It is likely that the content will be broadcast through individual channels owned by CJ ENM such as tvN and OCN, as well as the OTT service ‘TVING.’ In the future, they will engage in broad cooperation ranging from joint content production to music business and immersive media business. Yoon Kyung-rim, President of KT Group Transformation Division, emphasized, "With CJ ENM secured, KT Studio Genie will accelerate securing original intellectual property (IP) and production capabilities, which will give it wings."

KT Studio Genie’s self-produced content has expanded beyond its affiliated IPTV and OTT service ‘Seezn’ to external platforms. Jang Dae-jin, CEO of KT Seezn, the specialized OTT corporation, expressed his ambition to "grow it into the top domestic OTT" at the time of its separate corporation launch in August last year, but the results have been modest. According to Mobile Index, Seezn ranks fifth among major domestic OTT applications in terms of monthly active users. Although Seezn has steadily accumulated over 30,000 titles since its predecessor ‘Olleh TV Mobile,’ it has been evaluated as lacking influence. However, a KT official explained, "From the launch of Studio Genie, we have aimed for an ‘open structure’ rather than a closed one," adding, "We have consistently emphasized openness to external cooperation and collaboration beyond KT affiliates in the content chain."

SKT’s Wave Sailing Smoothly, LG U+ Cooperates with Netflix and Disney

Previously, SK Telecom was the first in the telecommunications industry to adopt an external alliance strategy. Instead of continuing its own OTT service ‘Oksusu,’ which was a ‘sore spot,’ SK Telecom merged it with the terrestrial broadcasters’ ‘Pooq’ to launch ‘Wave.’ Currently operated through Content Wave, Wave is the native OTT with the second-largest monthly user base after Netflix. In particular, by relaying real-time broadcasts of the three terrestrial broadcasters and exclusively acquiring their premium content, it has captured future customers in their 20s and 30s who do not prefer watching TV at home or subscribing to IPTV. It is also a fierce rival competing closely with CJ ENM’s TVING for the top two spots in the domestic OTT market.

In the case of LG Uplus, it is evaluated to have a somewhat different approach from SK Telecom and KT, as it pursues an independent path in mobile content distribution. LG Uplus has supplied a kind of proprietary OTT service through ‘U+ Mobile TV.’ However, LG Uplus has focused on producing and distributing content that crosses IPTV and mobile platforms by nurturing its own content such as ‘Idol Nara’ and ‘Idol Live.’ Although it was the first to partner with Netflix when it entered the Korean market in 2016, the industry evaluates that LG Uplus emphasizes its own channels as distribution channels.

There are also expectations for various synergistic changes brought about by the collaboration between KT and CJ ENM. Kim Hoe-jae, a researcher at Daishin Securities, said, "It’s a meeting of giants," and predicted, "Although CJ ENM is investing in KT in the form of equity, ultimately, the integration of the two companies’ OTT platforms will proceed." However, since Yang Ji-eul, CEO of TVING, has consistently expressed to the market that there are no plans for alliances among domestic OTTs, the possibility of immediate integration is considered low. A telecommunications industry insider said, "Considering that CJ, which has overwhelming influence in content distribution and production, is investing in KT, which has weaker content power, it seems they are looking at investment value after the listing of Studio Genie," he said.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.