KOSPI and KOSDAQ Indexes Plunge, Individual Investors Show 'Negative Returns'

Financial Sector: "Foreigners' Sell-Korea Pressure and Ongoing Uncertainties from COVID-19 and Ukraine Crisis"

Donghak Ants' Collective Action to Address Korea Discount... Petition Urging Capital Gains Tax Abolition

[Asia Economy Reporters Lee Seon-ae and Lee Myung-hwan] The current performance of Donghak Ants, who are aggressively net buying stocks in line with the market adage "buy when there is fear," cannot be considered good. Concerns are emerging in the securities industry. There is worry about hastily turning a crisis into an opportunity and rushing into investments.

However, Donghak Ants are expanding their activities beyond net buying to actively defending stock prices as shareholders. They are not simply buying stocks but raising their voices for institutional reforms to improve the chronic problem of the Korean stock market known as the "Korea Discount" (undervaluation of the Korean stock market), showing collective movements. This appears to be spreading as a more aggressive and systematic "Second Donghak Ant Movement" compared to the one that emerged in 2020 due to COVID-19.

◆ Donghak Ants Confident in the Bottom Despite Foreigners Selling Korea = According to the Korea Exchange, the KOSPI index, which was 2977.65 on January 3, fell 9.51% (283.14 points) to close at 2694.51 on the 17th. During the same period, the KOSDAQ index also dropped 11.59% (119.85 points) from 1033.98 to close at 914.13, breaking below the 1000 mark. When the index falls, most stocks tend to decline at a rate higher than the index.

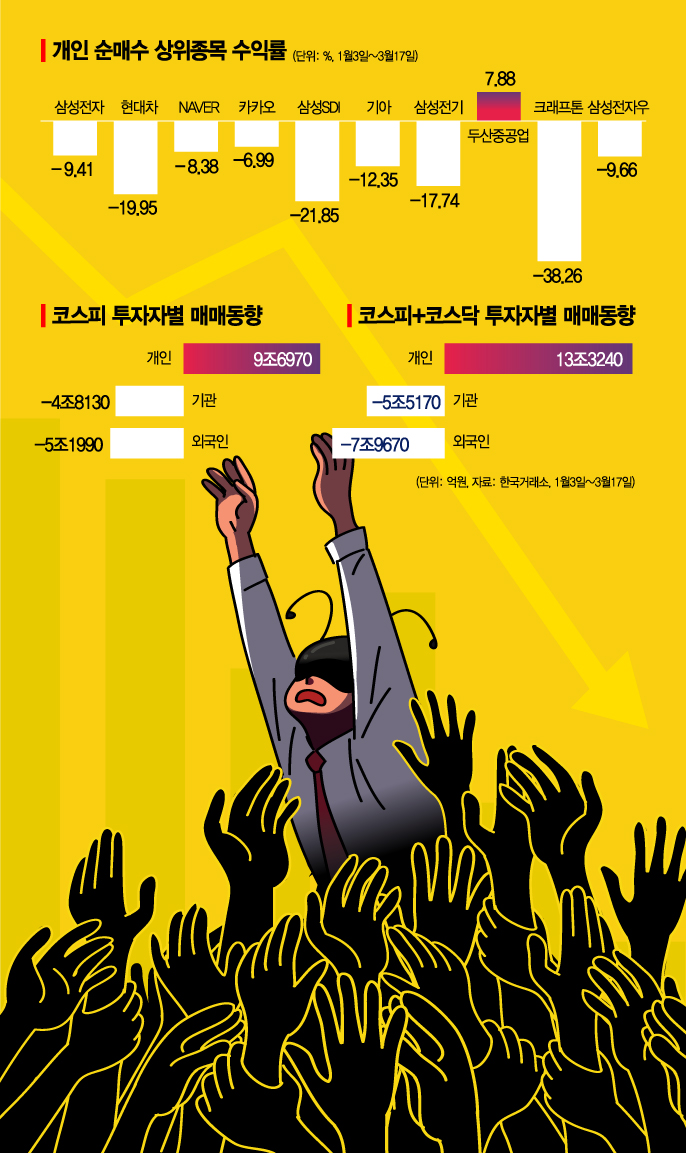

Since all the top net buying stocks by individuals declined compared to the beginning of the year, it is estimated that individuals incurred negative returns. Samsung Electronics, the top net buying stock by individuals, traded at 78,600 KRW on January 3, the first trading day of the year, but fell 9.41% to 71,200 KRW as of the closing price on the 17th. Hyundai Motor, which had the second highest net buying by individuals, dropped from 210,500 KRW to 168,500 KRW, showing a 19.95% decline. Other top net buying stocks such as ▲NAVER (-8.38%) ▲Kakao (-6.99%) ▲Samsung SDI (-21.85%) ▲Kia (-12.35%) ▲Samsung Electro-Mechanics (-17.74%) also could not escape the downward trend.

The aggressive net buying by Donghak Ants is because they are confident in the bottom. The main reason is that the market has entered an 'oversold zone' where prices have fallen excessively compared to corporate earnings. Shin Young Securities cited reasons why there is no practical benefit to selling stocks at the KOSPI 2600 level, including ▲the index decline reaching a technically oversold phase ▲solid momentum for economic reopening despite inflation concerns. Lee Jae-sun, a researcher at Hana Financial Investment, also evaluated, "Currently, the KOSPI has fallen by about 10% compared to the same period last year, which is a somewhat excessive adjustment comparable to the financial crisis period of 2007-2008."

Nevertheless, the securities industry raises warnings. While long-term index corrections can be used as opportunities for phased buying, they emphasize that in the current situation of ongoing external uncertainties, it is a time to respond conservatively without hastily assuming the bottom.

Lee Kyung-min, head of the investment strategy team at Daishin Securities, stressed, "If the Russia-Ukraine peace agreement is delayed or news of a surge in COVID-19 cases in China emerges, the stock market can fall at any time, so it is not a time to rush." Na Jung-hwan, a researcher at Cape Investment & Securities, also warned, "Supply chain disruptions continue due to lockdowns in Shenzhen, China; inflation has not trended downward; and the war is unpredictable."

The trend of foreigners' net selling (selling Korea) must also be watched carefully. Hwang Se-woon, senior researcher at the Korea Capital Market Institute, analyzed, "The Ukraine crisis and concerns over monetary tightening have led to liquidity securing and risk asset avoidance sentiment, causing foreigners to reduce their holdings of domestic stocks." Accordingly, there is a strong call to watch for a shift in foreigners' stance. Lee Kyung-soo, a researcher at Hana Financial Investment, advised, "It is not too late to increase stock holdings after foreigners switch to buying."

◆ United We Stand: "A National Petition to Abolish Capital Gains Tax" = Donghak Ants are not only buying stocks but also taking collective action to resolve the Korea Discount. As President-elect Yoon Seok-yeol's pledge to abolish the stock capital gains tax (CGT) has been embroiled in fairness controversies and is expected to be difficult to implement, they have started urging its execution.

The stock community "Sanghanmun," with 20,000 members, is actively campaigning for participation in the Blue House national petition supporting the abolition of the stock capital gains tax. On the 15th, a petition titled "President Yoon Seok-yeol, please abolish the stock capital gains tax" was posted on the Blue House national petition site. As of 9:30 a.m. that day, more than 800 people had participated. Jeong Eui-jung, representative of the Korea Stock Investors Union, which has 50,000 members, also emphasized, "Ultimately, the market is moved by big players, so if funds leave the stock market due to the capital gains tax, small investors will inevitably suffer losses," stressing that abolition must be achieved.

There is also a strong voice calling for improvements to the short-selling system. The national petition for short-selling system reform, which started on February 14, has currently gathered over 2,350 supporters. Economists and influencers have united and actively participate in the Save KOSPI campaign, which began in February. A petition titled "Please introduce eight laws and systems to protect shareholder rights" has gained over 35,000 supporters so far. Lee Hyo-seok, director of Uprise, and Kim Kyu-sik, chairman of the Korea Corporate Governance Forum, who lead Save KOSPI, announced plans to unite with more influencers and expand campaign bases to urge legislative and financial supervisory institutions for institutional reforms.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)