Automobile Industry Association, 2021 New Registration Status Analysis

Last Year New Car Sales 1.735 Million Units... Lowest in 5 Years

Amount Exceeds 69 Trillion Won, Record High

Average Price per Vehicle 40.15 Million Won... 12% Increase from 35.9 Million Won Last Year

[Asia Economy Reporter Choi Dae-yeol] Last year, the average price of new cars purchased by South Korean consumers exceeded 40 million KRW. This figure rose by double digits compared to the previous year, marking the highest level ever recorded. To put it in perspective, if the mid-to-large sedan Grandeur, which has become a national car, was purchased without any optional features in 2020, last year it was effectively bought as a ‘full option’ model with increased engine displacement and other enhancements.

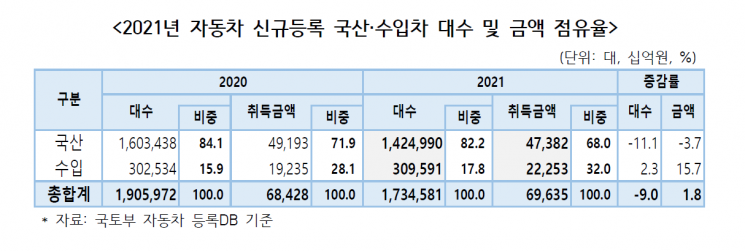

According to the analysis of new registrations compiled by the Korea Automobile Manufacturers Association on the 15th, the number of new registrations last year was 1,734,581 units, down about 9% compared to the previous year (1,905,972 units). Although the number of units decreased, spending increased. The amount spent on acquiring cars last year was 69.635 trillion KRW, about 2% higher than the record high of 68.428 trillion KRW in 2020.

The association explained, "In terms of volume, it is the lowest level in the past five years, but in terms of sales value, it is the highest ever," adding, "This is the result of intensified demand concentration on luxury cars such as imported cars, large SUVs, and electric vehicles."

When calculated by average price per unit, last year’s figure was 40.15 million KRW. This is the first time it has exceeded 40 million KRW. It rose about 12% compared to 35.9 million KRW in 2020. This level surpasses that of most passenger cars.

Among passenger cars, the Hyundai Grandeur mid-trim (Le Blanc), which has been the best-selling model in recent years, costs 35.34 million KRW when delivered without options (based on the facelift model and a 3.5% individual consumption tax). This is similar to the average new car price in 2020. Adding optional features such as increasing engine displacement to 3.3L, electric power steering, exclusive wheels and tires (Performance Package 3.95 million KRW), and a sunroof (1.1 million KRW) brings the price to about 40.39 million KRW, close to last year’s average new car price.

Imported cars saw 309,591 new registrations last year, breaking the previous record of 302,534 units set a year earlier. According to association data, domestic cars accounted for about 82% of registrations, while imported cars made up about 18%. In terms of acquisition amount, domestic cars shrank to 68%, and imports accounted for about 32%. Last year was the first time the market share of imported cars exceeded 30% based on value.

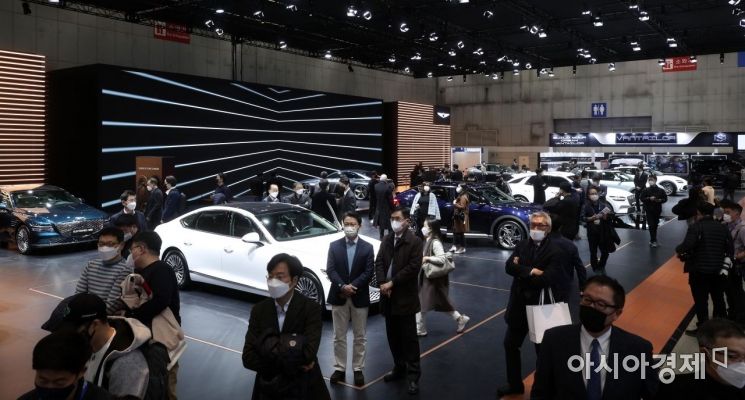

The Genesis exhibition hall at the 2021 Seoul Mobility Show held last year./Goyang Photo by Hyunmin Kim kimhyun81@

The Genesis exhibition hall at the 2021 Seoul Mobility Show held last year./Goyang Photo by Hyunmin Kim kimhyun81@

Increase in Sales of High-End Cars such as Imported Cars, Large SUVs, and Electric Vehicles

Imported Cars: 18% by Volume, 32% by Value

85% of Ultra-Luxury Cars Over 380 Million KRW Purchased by Corporations

By power source, gasoline still accounted for nearly half at 48.9%, while diesel dropped 6 percentage points from the previous year to 24%. Hybrid vehicles increased from 9.1% to 13.8%, and electric vehicles more than doubled their market share from 2.4% to 5.8%. The overall market share of electric-powered vehicles (excluding mild hybrids) rose from 10.8% in 2020 to 16.9% last year.

Electric vehicle sales surpassed 100,000 units annually for the first time. This was due to expanded government subsidies and other promotion programs, as well as an increase in new models. The total number of electric vehicles in operation surged to 230,000 units. Among passenger electric vehicles, Hyundai and Kia released new models consecutively, selling about 46,000 units, surpassing imported cars (25,000 units). Among imported cars, Tesla accounted for a significant share with 18,000 units.

While individual purchases declined, corporate and business passenger car purchases continued to increase last year. In particular, many expensive vehicles such as high-end sports cars were purchased by corporations. For ultra-luxury imported cars with an average price exceeding 380 million KRW, new registrations increased by more than 24% compared to the previous year. Most ultra-luxury vehicles (85%) were purchased by corporations. As President-elect Yoon Suk-yeol is considering a plan to separately identify license plates for corporate-purchased vehicles, it is expected that the ultra-luxury car market will be partially affected in the future.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)