[Asia Economy Reporter Ji Yeon-jin] As the waste management market size is expected to reach 23.7 trillion KRW by 2025, domestic companies are actively entering the waste management acquisition battles.

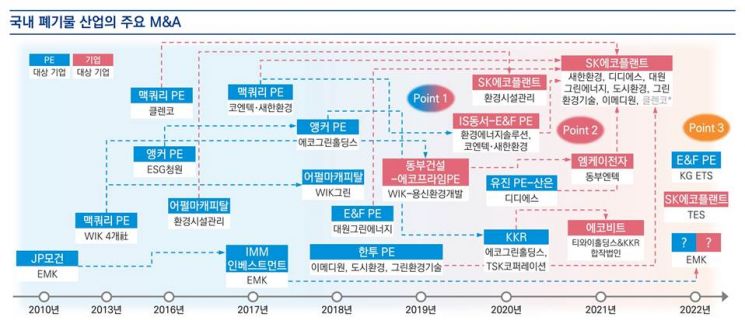

According to the report "In the ESG Era, Who Owns the Waste Management Industry?" published on the 15th by Samjong KPMG (Chairman Kim Gyo-tae), in major mergers and acquisitions (M&A) deals in the domestic waste industry, companies participated as private equity funds (PE) and consortiums with expertise in waste management investment to minimize investment risks. However, since 2019, newly merged companies have emerged and entered the acquisition competition.

The average enterprise value of major domestic waste management companies increased by 280% in 2020 compared to 2017. Private equity funds had already anticipated the high enterprise value of the waste management industry since 2010. Because the waste industry has high entry barriers, the increasing demand for waste management is concentrated on existing waste management companies. The value enhancement effect through bolt-on acquisitions is significant, and companies that have already grown through bolt-ons face less burden from additional acquisitions and investments.

As the growth potential and stability of the waste management industry have emerged, domestic companies are independently engaging in waste M&A, expecting business diversification, synergy with existing businesses, and profit generation, such as SK Ecoplant's acquisition of EMC Holdings (now Environmental Facilities Management) in 2020.

Samjong KPMG cited the following reasons why companies have recently shown interest in waste management assets: ▲growth potential of the waste industry ▲scarcity of waste management companies ▲means to improve profitability ▲foundation for waste-to-energy ▲improvement of ESG management.

The daily waste generation volume increased from 357,000 tons in 2009 to 534,000 tons in 2020, rising by more than 170,000 tons per day over about ten years. The increase in national income levels and the development of non-face-to-face industries are driving the growth of the waste industry. Additionally, the expansion of medical service demand and housing development activation are expected to sustain the growth trend of the waste industry.

However, the shortage of self-treatment facilities (self-incineration and landfill facilities) to process the increasing waste highlights the scarcity of existing private waste management companies. Furthermore, waste treatment fees have steadily increased over the past five years. The rise in waste treatment fees due to supply shortages is expected to drive corporate revenues. In particular, the waste management industry does not require inventory management and has solid cash flow, which is analyzed to help improve the profitability of acquiring companies.

Waste treatment facilities are ultimately developing toward recycling and energy recovery of waste. Domestic companies can use waste management as a foothold to enter the waste business, secure future energy source creation capabilities through acquisitions of related companies, and establish growth engines, thereby creating a comprehensive environmental company value chain. Moreover, with the Ministry of Trade, Industry and Energy's announcement of the ‘K-ESG Guideline’ in December last year, which includes environmental management promotion systems, companies are showing interest in entering the waste industry through waste industry M&A by reviewing dedicated organization operations and environmental investment budgets to improve ESG evaluations.

Lee Dong-geun, Executive Director of Samjong KPMG, emphasized, “As ESG becomes a megatrend and interest in the environmental industry intensifies, it is necessary to consider M&A in the waste management industry as a future growth engine.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)