Global Supply Chain Shaken by Ukraine Crisis... South Korea's Economy on High Alert

Rare Gas Prices for Semiconductors Soar... Already Twice Last Year's Average

Nickel and Aluminum Prices Surge... Account for 50% of Battery Costs

'Rice of Petrochemicals' Naphtha Also in Crisis... Profitability Deterioration Inevitable

[Asia Economy Sejong=Reporter Lee Jun-hyung] "The Ukraine crisis has become the greatest risk to the global supply chain, surpassing the pandemic."

This is the diagnosis given by the international credit rating agency Moody's regarding the Ukraine crisis. It means that the shockwaves caused by Russia's invasion of Ukraine are spreading across the global economy in all directions. Moody's sees that most industries are not free from the influence of the Ukraine crisis. The situation is even more serious for South Korea, which focuses on manufacturing. This is because key domestic industries such as semiconductors, automobiles, petrochemicals, and steel, as well as future core industries like secondary batteries and electric vehicles, have come within the crisis's reach. We have conducted an in-depth check on the supply chain status of key raw materials affected by the Ukraine crisis.

Rare gases for semiconductors: Krypton, Neon, Xenon

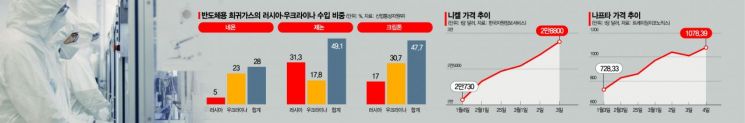

The semiconductor industry was the first to become highly alert. This is because a significant portion of rare gases needed for semiconductor photolithography and etching processes?Neon, Krypton, and Xenon?are dependent on Russia and Ukraine. According to the Ministry of Trade, Industry and Energy, 28% of the Neon imported by South Korea last year came from Russia (5%) and Ukraine (23%). The dependency on Xenon (Russia 31.3%, Ukraine 17.8%) and Krypton (Russia 17%, Ukraine 31%) was also high.

Domestic semiconductor companies such as Samsung Electronics are reported to have secured 3 to 4 months' worth of rare gases. However, if the war prolongs, the problem becomes serious. Although the semiconductor industry increased its rare gas stockpile by 3 to 4 times the usual amount before the Ukraine crisis to cope with supply disruptions, it is difficult to find alternatives after the war. In the case of Neon, where Ukraine's production is overwhelmingly high, Russia, the United States, China, and France also produce it, but supply chain bottlenecks are intensifying, making it unlikely to secure the desired inventory.

Fortunately, POSCO and the specialty gas company TEMC recently succeeded in domestic production of Neon gas. Full-scale mass production will begin in the second half of this year. However, production capacity accounts for only about 15% of domestic demand. TEMC is also promoting domestic production of Krypton and Xenon together with POSCO, but the timing of mass production is uncertain.

Prices are already on the rise. The import price of Neon gas recorded $121,964 per ton in January this year, when tensions around Ukraine escalated, more than double the average price last year ($58,747). Import prices of Xenon and Krypton also surged by 83% and 52%, respectively. In China, the spot price of Neon increased by 65% compared to early this year.

Black Smoke Rises from Ukrainian Oil Depot Bombed by Russian Forces

Black Smoke Rises from Ukrainian Oil Depot Bombed by Russian Forces(Chernihiv, Reuters=Yonhap News) On the 3rd (local time), black smoke is rising from an oil depot in Chernihiv, northern Ukraine, following a bombing by Russian forces. On the eighth day of the invasion, Russian troops are advancing toward the capital Kyiv despite strong Ukrainian resistance and are concentrating attacks on the second-largest city, Kharkiv. [Provided by Ukraine State Emergency Service] 2022.3.3

sungok@yna.co.kr

(End)

<Copyright(c) Yonhap News Agency, Unauthorized reproduction and redistribution prohibited>

Key materials for secondary batteries: Nickel and Aluminum

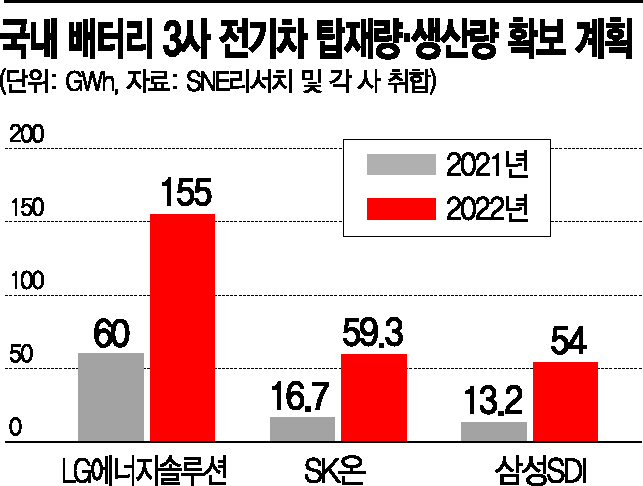

Prices of nickel and aluminum, which account for 50% of the manufacturing cost of secondary batteries, are soaring. Russia is the third-largest resource-rich country in terms of production of both nickel and aluminum.

Nickel is a key material for cathodes that determine battery output. With the spread of electric vehicles, nickel prices have been steadily rising, and the Ukraine crisis has acted as a catalyst. According to the Korea Resources Information Service, the price of nickel was $28,800 per ton on March 3, up 39% from $20,730 per ton on January 4. Compared to three years ago ($13,160), it has more than doubled.

The price of aluminum, a core material for battery packs, reached an all-time high of $3,728.5 per ton as of March 3. Considering that aluminum was priced at $2,815.5 per ton on January 4 this year, the price rose by nearly $1,000 per ton in just two months.

The cost burden on the battery industry is inevitably increasing. Battery companies usually include clauses linking the prices of key cathode materials such as lithium and nickel to the battery supply price when signing supply contracts with automakers. However, aluminum is mostly excluded from such linkage clauses.

'Rice of petrochemicals' Naphtha

Naphtha, the item South Korea imported most from Russia last year, is also in an emergency. Known as the 'rice of petrochemicals,' naphtha is a basic raw material derived from refining crude oil and is used in the production of consumer goods such as rubber, fibers, and plastics. According to the Korea International Trade Association, South Korea's naphtha imports from Russia amounted to $4.383 billion last year, accounting for 25.3% of all imports from Russia.

The problem is that naphtha accounts for 70% of the cost of petrochemical products. This means that the ripple effects of naphtha supply disruptions could spread to almost all consumer goods used in daily life. Due to the impact of the Ukraine crisis, naphtha prices surpassed $1,000 per ton for the first time in 14 years since 2008. On March 4, naphtha futures were priced at $1,078.39 per ton, a 48% increase compared to $728.33 per ton on January 3 this year.

The next step is a deterioration in profitability for the petrochemical industry. Companies with naphtha cracking facilities (NCC) such as LG Chem and Lotte Chemical face cost burdens proportional to naphtha prices.

Essential raw material for steelmaking: Ferrosilicon

Steelmakers are focusing on ferrosilicon, for which dependence on Russian imports is about 35%. Ferrosilicon is an alloy used in steelmaking to remove impurities or adjust the composition of molten iron. The price of ferrosilicon has already risen more than 50% compared to the same period last year. The industry expects further price increases due to the Ukraine crisis.

Some companies have started diversifying supply sources, considering alternatives from countries like China, which produces 70% of the world's ferrosilicon. However, Chinese ferrosilicon is less price-competitive than Russian products. A steel industry official said, "Ferrosilicon is usually imported by container ship," adding, "Container shipping rates have risen since last year, increasing procurement costs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)