[Russia's Invasion of Ukraine]

Raw Material Prices Soar and Supply Shortages

Russia's Aluminum and Nickel Production

Electric Vehicle and Battery Industries Monitor Situation Closely

[Asia Economy Reporters Oh Hyung-gil, Sung Ki-ho, Moon Chae-seok] The invasion of Ukraine by Russia has brought the raw material supply shortage into reality. With signs of a sharp rise in international oil prices, red flags have been raised for the import of raw materials such as special gases necessary for semiconductor production. As the cost of imported raw materials rises and supply disruptions become inevitable, there are concerns about a comprehensive impact on the domestic industrial sector.

According to the refining industry on the 25th, the price of Russian crude oil imported into Korea has soared 56% over the past year. It jumped from an average of $55.70 per barrel in January last year to $86.24, the highest level among importing countries.

Last month, Korean refineries imported 5.241 million barrels of Russian crude oil, accounting for 5.5% of the total imports (94.792 million barrels). It ranks sixth after Saudi Arabia (31.6 million), the United States (15.08 million), Kuwait (11.83 million), Qatar (5.62 million), and the United Arab Emirates (5.32 million). There are forecasts that the already sharply rising international oil price could reach $150 per barrel due to the Russia-Ukraine situation.

The Korea Energy Economics Institute predicted that if Russia's oil and gas supply to Europe is disrupted, instability in the international energy market and increased demand for oil as a substitute for gas could push international oil prices up to $150 per barrel based on Dubai crude.

The rise in international oil prices can lead to an increase in the prices of major domestic products. According to the Korea International Trade Association, if the import price of petrochemical raw materials rises by 10%, domestic product prices increase by 0.25%.

On the 24th, as concerns over potential disruptions in raw material supply due to the Ukraine crisis emerged, Yeohangoo, Director General for Trade Negotiations at the Ministry of Trade, Industry and Energy, presided over the "Meeting to Strengthen Cooperation in Raw Material Supply Chains" held at Lotte Hotel in Jung-gu, Seoul. Ambassadors to Korea from nine resource-rich countries with high mutual dependence on South Korea, including Indonesia, Canada, Brazil, the United Arab Emirates (UAE), Mexico, Vietnam, Malaysia, Chile, and the Philippines, attended the meeting. Photo by Moon Honam munonam@

On the 24th, as concerns over potential disruptions in raw material supply due to the Ukraine crisis emerged, Yeohangoo, Director General for Trade Negotiations at the Ministry of Trade, Industry and Energy, presided over the "Meeting to Strengthen Cooperation in Raw Material Supply Chains" held at Lotte Hotel in Jung-gu, Seoul. Ambassadors to Korea from nine resource-rich countries with high mutual dependence on South Korea, including Indonesia, Canada, Brazil, the United Arab Emirates (UAE), Mexico, Vietnam, Malaysia, Chile, and the Philippines, attended the meeting. Photo by Moon Honam munonam@

The electric vehicle battery industry, regarded as a next-generation core industry, is also deeply concerned. Prices of essential raw materials such as aluminum and nickel, which have already risen significantly, may increase further.

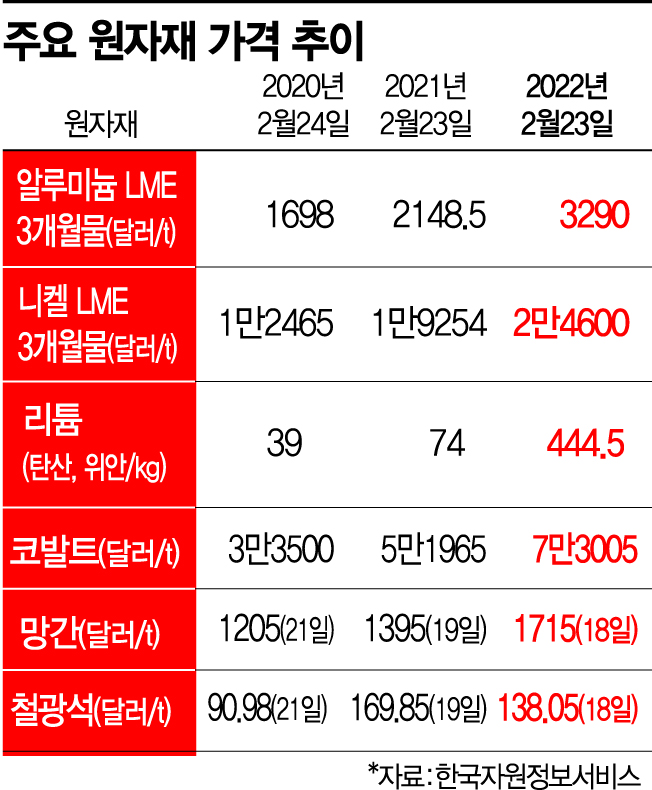

According to the Korea Resource Information Service, on the 23rd, lithium prices on the London Metal Exchange (LME) surged more than tenfold from 39 yuan per kg to 444.5 yuan. Nickel and aluminum prices also doubled. Cobalt, used as a raw material for ternary batteries, soared from $33,500 to $73,005, and manganese rose from $1,205 to $1,715.

Russia is a major producer of aluminum (second largest in the world), nickel, and other materials. Due to risks in Eastern Europe, battery production costs may rise, potentially increasing the production costs of finished vehicles. The rise in raw material prices leads to higher battery prices for electric vehicles, which directly results in increased electric vehicle prices.

As battery raw material prices continue to rise, the burden on the automotive industry is growing. The increase in raw material prices leads to higher battery prices for electric vehicles, which directly translates into higher electric vehicle prices. Batteries account for 40% of the cost of electric vehicles.

Overseas companies have already started raising prices. Tesla increased the price of its Model 3 Long Range by nearly 10 million KRW within a year. China's BYD also raised prices of some models by more than $1,000 last month.

Most companies expect global supply chain instability to continue. According to a recent survey by the Korea Chamber of Commerce and Industry of 300 companies sourcing raw materials and parts overseas, 88.4% of respondents said that supply chain instability will continue or worsen this year compared to last year.

Although global supply chain instability is intensifying, companies' preparations remain insufficient. Only 9.4% of companies have established concrete measures against supply chain risks, while more than half (53.0%) responded that they have no measures.

An automotive industry official said, "Prices of minerals used as battery raw materials have been rising since last year, and related companies have secured stockpiles through long-term contracts," adding, "However, if the Ukraine situation prolongs and raw material prices themselves rise, it could negatively affect additional supply contracts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)