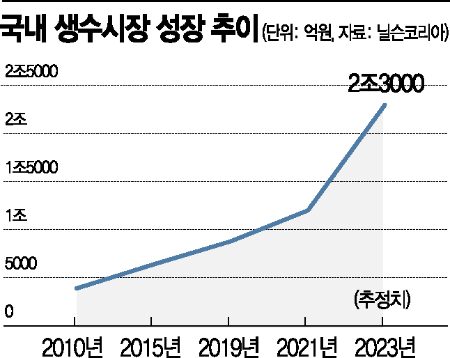

Projected 2.3 Trillion Growth Next Year

Jeju Samdasoo Leads for 24 Years

Rival Companies Intensify Pursuit

Murabel Products Bring New Competitive Wave

[Asia Economy Reporter Eunmo Koo] As the domestic bottled water market shows rapid growth, competition among companies vying for the upcoming "2 trillion won era" is intensifying. While Jeju Samdasoo firmly holds the throne with its long-established brand power and quality, competing companies are also stepping up their challenges by removing labels such as "no-label" bottles.

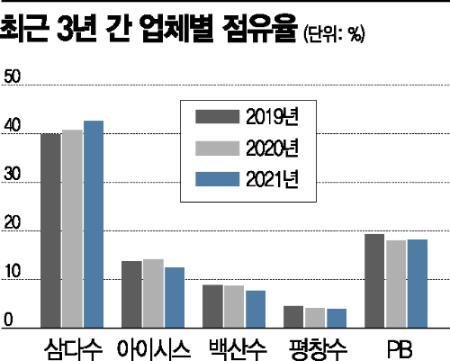

According to Nielsen Korea on the 22nd, as of the end of last year, Jeju Development Corporation's Samdasoo holds a dominant market share of 42.6% in the domestic bottled water market. Following are Lotte Chilsung Beverage's Icis (12.4%), Nongshim's Baeksansu (7.7%), and Haitai htb's Gangwon Pyeongchang Water (4.0%). Samdasoo's market share, which was 39.9% in 2019, rose to 40.7% in 2020 and achieved nearly an additional 2 percentage points growth last year. During this period, the market shares of the 2nd to 4th ranked companies all shrank, further widening the gap with the number one.

Since its launch in 1998, Samdasoo has been the absolute leader in the bottled water market for 24 years. Last year, it became the first domestic bottled water brand to surpass 300 billion won in sales. Although the variety of bottled water options has increased, consumers seem to continue seeking the familiar and consistently maintained taste of water.

Although Samdasoo's market share is overwhelming, the growth trend in the bottled water market is clear, and competition and challenges from rival companies are intensifying. The domestic bottled water market, which was around 390 billion won in 2010, expanded to 1.2 trillion won last year and is expected to grow to 2.3 trillion won in 2023.

Recently, the spread of no-label products, which make it easier for new brands to enter the market, is acting as a new wind in bottled water market competition. Since labels that allow instant brand recognition have disappeared, the brand power held by existing leading companies may somewhat diminish in product selection. However, top companies seem largely unconcerned. An industry insider explained, "No-label bottled water packaging still sufficiently displays logos or company identifiers, and since many purchases are made online, the confusion among customers intending to buy a specific brand is not significant."

The private brand (PB) offensive by distribution companies emphasizing low-price strategies also continues. Currently, over 300 bottled water brands compete in the domestic market, and it is estimated that more than 100 products are sold under PB. However, the industry views PB products as competing mainly on low price, while top companies emphasize quality aspects such as water composition, thus seeing the market as somewhat segmented even within the bottled water sector.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)