Need to Control National Debt Speed through Fiscal Rule Legislation and Expenditure Restructuring

[Asia Economy Reporter Park Sun-mi] South Korea is maintaining a high level of fiscal deficit, and it is predicted that by 2026, four years from now, the national debt ratio will be the third highest among 17 non-reserve currency countries in the Organisation for Economic Co-operation and Development (OECD). South Korea's long-term fiscal soundness is significantly threatened, making it urgent to devise measures to resolve this risk.

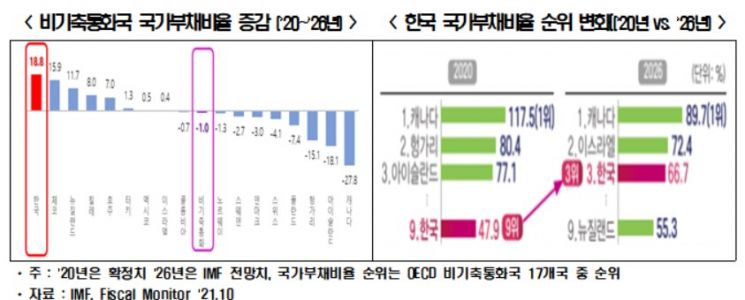

On the 17th, the Korea Economic Research Institute (KERI) analyzed fiscal forecasts for non-reserve currency countries from 2020, when COVID-19 broke out, to 2026. Unlike other non-reserve currency countries, South Korea is expected to see the fastest increase in national debt among OECD countries due to a sustained high level of fiscal deficit. Non-reserve currency countries are those that do not use reserve currencies such as the dollar, euro, yen, pound, or yuan as their legal tender (based on the IMF Special Drawing Rights currency basket), and 17 out of 37 OECD countries fall into this category.

From 2020 to 2026, South Korea's national debt-to-GDP ratio is projected to increase by 18.8 percentage points, the highest among OECD non-reserve currency countries. In contrast, during the same period, the national debt ratios of non-reserve currency countries such as Canada, Iceland, and Hungary are expected to decrease by an average of 1.0 percentage point. As South Korea's national debt ratio surges from 47.9% in 2020 to 66.7% in 2026, its ranking among the 17 non-reserve currency countries is expected to jump six places from 9th (in 2020) to 3rd (in 2026).

South Korea's fiscal expenditure level, which increased due to COVID-19 from 2022 to 2026, is expected to be almost maintained. In contrast, except for Turkey, other non-reserve currency countries are expected to reduce government spending during the same period to manage fiscal soundness. Assuming fiscal expenditure relative to GDP was 100 in 2020-2021, South Korea's fiscal expenditure relative to GDP is projected to be 98.6 in 2022-2026, while other non-reserve currency countries average 91.0. Furthermore, unlike other non-reserve currency countries, South Korea is expected to maintain a high level of fiscal deficit from 2022 to 2026. This contrasts with other non-reserve currency countries, where fiscal deficits are expected to significantly decrease during this period.

KERI pointed out that although non-financial public enterprise debt, which should be considered government debt as it is effectively guaranteed by the government, is not included in the general government debt used for international comparisons, South Korea ranks second highest among OECD countries in this regard. Additionally, the potentially enormous future costs of reunification also represent a latent risk factor.

Choo Kwang-ho, Director of Economic Policy at KERI, stated, “As South Korea is a non-reserve currency country without issuing authority, securing fiscal soundness in preparation for emergencies is a very important issue for macroeconomic stability.” He added, “Given the recent rapid deterioration of fiscal soundness and significant long-term national debt risks such as low birth rates and aging population, it is urgent to legislate fiscal rules and actively restructure expenditures.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.