US Prepares Sanctions on Russian Aluminum Firms... Futures Prices Near All-Time High

Prices of Tin, Copper, and Zinc All Rise This Year... Wheat Prices Up 19% in One Year

[Asia Economy Reporter Park Byung-hee] Major raw material prices are showing unstable trends amid overlapping issues such as the US-China conflict, carbon neutrality efforts, and the Ukraine crisis. Aluminum prices have reached their highest level since 2008, while prices of grains like wheat and corn are also fluctuating. Analysts suggest that the Ukraine crisis is fueling price increases amid ongoing supply-demand imbalances.

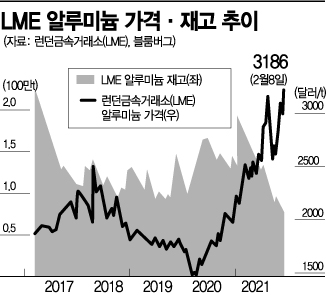

According to Bloomberg on the 8th (local time), aluminum futures prices at the London Metal Exchange (LME) rose 1.7% from the previous trading day to $3,186 per ton. During the session, prices surged as much as 3.3% to $3,236 per ton. This marks the highest level since 2008, approaching the all-time high of $3,380.

◆ Russian Aluminum Firms Expected to Be Included in US Sanctions Candidates = The Ukraine crisis is a key factor driving aluminum price increases. The US and Europe are preparing economic sanctions against Russia, which has hinted at a possible invasion of Ukraine. It is expected that Russian major aluminum producer Rusal will be included in the list of companies subject to sanctions. Concerns over aluminum supply disruptions are intensifying, further driving up prices. Russia is the world’s second-largest aluminum producer after China, accounting for 13% of global aluminum production excluding China.

The rise in natural gas prices due to the Ukraine crisis is causing secondary supply disruption concerns across the raw materials market. As natural gas prices increase, electricity costs rise, leading raw material producers unable to bear production costs to reduce output one after another.

On this day, Slovak aluminum smelter Slovalco announced plans to cut aluminum production by about 60%, citing rising electricity costs. Dutch aluminum producer Aldel has already reduced aluminum production since October last year due to increased production costs from higher electricity prices.

The scale of aluminum production disruptions in Europe is estimated to have already exceeded 800,000 tons. In China, aluminum production disruptions due to large-scale factory shutdowns caused by power shortages at the end of last year are estimated to be close to 3 million tons. Amid this situation, aluminum demand is increasing as consumption recovers mainly in developed countries and automakers expand electric vehicle production.

Goldman Sachs has raised its 12-month aluminum price forecast to $4,000 per ton. Goldman Sachs diagnosed that aluminum demand in developed countries is unusually high amid production disruptions in China and Europe.

◆ Tin Up 10% This Year... Wheat Up 19% Compared to a Year Ago = The Ukraine crisis is broadly affecting the raw materials market beyond aluminum. Russia is a resource-rich country, ranking first in natural gas exports worldwide and second in oil production after Saudi Arabia.

At the LME, aluminum has risen 13% this year, recording the highest increase among major non-ferrous metals. Tin prices have also risen 10.4% this year, with copper and zinc prices showing slight increases. International oil prices, which recently surpassed $90, are forecasted to reach $120, and European natural gas prices have quadrupled compared to a year ago.

Russia is also a major exporter of key grains such as wheat, soybeans, and corn. Russia and Ukraine rank first and fifth respectively as wheat exporters, with their combined wheat exports accounting for about one-third of global exports.

Wheat prices on the US Chicago Board of Trade (CBOT) have risen 19% compared to a year ago. Corn and soybean prices have also increased by 14% and 12%, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.