If the Corporate Olympics Were Held, Korea Would Rank 9th... Only One Medal from Samsung Electronics

Evidence of Lack of Systems and Talent to Drive Advanced Industries

CEOs and Chairpersons Mobilize to Secure Key Talent

[Asia Economy Reporters Sunmi Park, Kiho Sung, Hyeyoung Lee, Jinho Kim] An analysis shows that if the top 500 global companies competed in a "Corporate Olympics" instead of national athletes in the sports field, South Korea would rank only 9th with Samsung Electronics winning the sole silver medal. The fact that no other Korean companies secured medals indicates how severely lacking the systems and talent are to drive advanced industries. Especially, the fierce competition among semiconductor and IT companies in the U.S. and China, which attract global talent with their massive capital and influence, and the global race to nurture future talent, pose a crisis for Korean companies with their extremely limited talent pool.

Corporate Olympics Reveal Talent Shortage as a Competitiveness Issue

On the 7th, the Federation of Korean Industries analyzed the competitiveness of countries based on industry classification and sales of the top 500 global companies. South Korea won only one silver medal (Samsung Electronics) in 20 events among 31 countries, ranking 9th overall. While the U.S. and China won 122 and 135 medals respectively, accounting for 70.2% of all medals, South Korea’s sole medal was from Samsung Electronics.

Among the 27 companies participating in the Corporate Olympics for the first time ever, U.S. and Chinese companies accounted for 8 and 16 respectively, showing the dominance of the G2. Since LG Chem’s first participation in 2019, South Korea has failed to discover new representative companies. This is attributed to high-level industrial regulations that slow down nurturing representative companies in advanced and new industries, as well as the slower pace of talent development compared to competing countries to drive new growth engines.

In Korea’s leading advanced industries such as semiconductors and artificial intelligence (AI) in the IT sector, securing talent is severely insufficient. According to the Ministry of Trade, Industry and Energy, to become a powerhouse in system semiconductors by 2030, the semiconductor industry workforce, which was about 36,000 in 2019, needs to increase to over 50,000 in ten years. The automotive industry faces a similarly severe IT labor shortage. Especially with the advent of the AI-based autonomous driving era, urgent large-scale recruitment is needed. According to the Software Policy Research Institute, the shortage of IT developers surged from 4,967 in 2020 to 9,453 last year and 14,514 this year. The concentration of talent in large IT companies like Naver and Kakao amid this supply shortage is causing even greater concern.

Professor Pilsoo Kim of Daelim University’s Department of Automotive Engineering said, "While a small number of talents are concentrated in large IT companies, the automotive industry requires more specialized and customized personnel in IT fields such as autonomous driving and AI, making talent supply difficult." He added, "Considering that Korea is about three years behind advanced countries in expanding IT personnel relative to automobile production, a mid- to long-term strategy is urgently needed."

No Clear Escape from K-Advanced Industry Talent Shortage

Unlike competing countries actively securing talent to lead advanced industries, Korea’s policies and systems are far from sufficient to fill the talent gap.

Although the Korean government has plans to expand semiconductor industry personnel, the reality is bleak due to declining high school senior student numbers and strong restrictions under metropolitan area-related laws and higher education laws. The only alternative is ‘contract departments’ established in partnership with some universities. This contrasts with Taiwan, where most universities have semiconductor departments; China, which is significantly expanding the number of universities specializing only in semiconductors; and Japan, which plans to establish semiconductor courses in eight technical colleges across six metropolitan areas as talent hubs.

Based on a broad talent pool, Taiwan’s TSMC, the world’s number one foundry (semiconductor contract manufacturer), plans to invest up to $44 billion (about 52.7 trillion won) in semiconductor facilities this year and hire about 8,000 semiconductor personnel. The industry expects TSMC to consistently hire 7,000 to 8,000 people annually until 2025.

In contrast, Korea’s semiconductor industry faces limits in increasing numbers due to the scarcity of excellent talent. Samsung Electronics’ Device Solutions (DS) division increased its workforce by about 3,000 annually from 2016 to 2020, and SK Hynix added 6,700 over four years. Due to insufficient supply, fierce competition to poach talent from existing pools is ongoing. This environment leads companies to bear the burden of high salaries and bonuses to retain talent. The Korea Institute for International Economic Policy (KIEP) recently advised in a report that "urgent measures are needed to expand semiconductor R&D personnel through establishing semiconductor graduate schools and comprehensive research institutes to secure technological capabilities."

Domestic conglomerates have started recruitment early this year to urgently secure talent. Samsung Electronics’ semiconductor division has already begun hiring this first half of the year, recruiting experienced professionals in semiconductor process development, evaluation and analysis, material development, package development, and semiconductor equipment technology until the 17th of this month. SK Hynix, considering the semiconductor labor shortage, has advanced its hiring schedule and is recruiting hundreds of new and experienced employees this month.

Hyundai Motor Company has been conducting R&D new graduate and experienced recruitment since last month. Especially in the IT sector, the goal is triple-digit hiring across 53 detailed fields. They also created a dedicated recruitment site targeting core future vehicle personnel.

Global Talent Recruitment: CEOs and Chairpersons Personally Engaged

To secure key talent for future growth industries, domestic companies have become so fierce that not only CEOs but also chairpersons themselves are directly involved in the competition. This is based on the judgment that cutting-edge technology development and all related processes ultimately depend on ‘people.’ Samsung, LG, SK, and other major Korean companies are no exception. To secure superior talent and prevent competitors from poaching, they are making every effort, including establishing dedicated teams to respond.

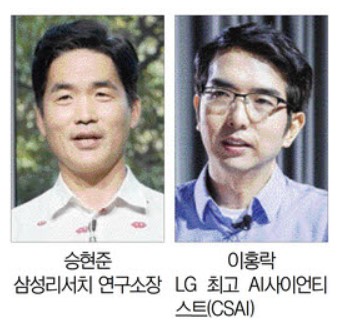

A representative case is Sebastian Seung (Korean name Seung Hyun-joon), currently head of Samsung Research, Samsung Electronics’ integrated research organization, who is drawing the blueprint for the new Samsung. His decision to join Samsung Electronics from being a professor at Princeton University reflected Vice Chairman Lee Jae-yong’s strong recruitment will.

Since resuming management activities in 2018, Vice Chairman Lee has traveled overseas to North America and Europe, meeting global scholars to discuss future technologies and personally engaging in recruiting key talent in related fields.

Seung was the first recruit after Vice Chairman Lee announced the ‘New Samsung Vision.’ Besides Seung, Lee continuously meets and invites world-renowned scholars in AI and other focus areas of the group, playing a key role in Samsung’s talent acquisition.

LG Group Chairman Koo Kwang-mo has also focused heavily on talent acquisition to secure a leading position in the AI ecosystem. In 2020, LG announced the establishment of an AI research institute and an investment of 200 billion won, officially recruiting Lee Hong-rak, a former Google AI expert and professor at the University of Michigan, recognized as a global AI scholar.

LG was the first in the industry to create a ‘C-level’ AI Scientist position and promised exceptional treatment and compensation systems to attract top global AI talent, countering global competitors. Chairman Koo personally led this entire process, even visiting global talent with LG Electronics executives.

At the AI research institute’s launch, Chairman Koo emphasized, "I will support and encourage the gathering of the best talents and partners to freely challenge the world’s toughest problems and develop into the center of the global AI ecosystem."

SK Group Chairman Chey Tae-won also rolled up his sleeves early to secure talent. He established Gauss Labs, an AI R&D company in Silicon Valley, appointing Professor Kim Young-han as its head. Professor Kim is a fellow of the IEEE and a world-renowned data science expert. SK Group is supporting Kim’s research on AI-based semiconductor manufacturing process innovation and the exploration of the ‘post-semiconductor’ sector without hesitation.

When SK Hynix achieved record sales of 43 trillion won last year, the recruitment of CEO Lee Seok-hee was reportedly strongly influenced by Chairman Chey. Lee is a ‘star engineer’ who worked at Intel for 10 years, receiving the Intel Achievement Award (IAA) three times. To prevent losing him while he was a KAIST professor, Chairman Chey and SK Group executives made special efforts to successfully recruit him.

This corporate talent competition is expected to accelerate as the advanced industry scale grows. According to the Korea Employers Federation, information and communication industries and professional, scientific, and technical services are commonly among the top three high-wage sectors in Korea, Japan, and the European Union (EU). Especially in Korea, which suffers from chronic talent shortages, the average monthly wage in scientific and technical services and information and communication industries is about $5,755 (approximately 6.9 million won), and this is expected to rise further as competition for talent intensifies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.