National Assembly Budget Office Releases 1st Supplementary Budget Analysis Report

Equity Controversy Repeats... 1.8 Trillion Won Remaining in Support Fund

Advance Payment of Loss Compensation Likely to Convert Mostly into Debt

Measures Needed for Principal and Interest Repayment to Prevent Fiscal Burden

Small business owners are receiving consultations at the Seoul Jungbu Center of the Small Enterprise and Market Service in Jongno-gu, Seoul. Photo by Hyunmin Kim kimhyun81@

Small business owners are receiving consultations at the Seoul Jungbu Center of the Small Enterprise and Market Service in Jongno-gu, Seoul. Photo by Hyunmin Kim kimhyun81@

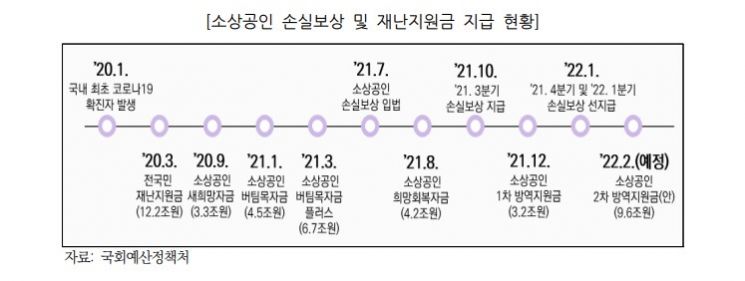

The government’s disaster relief fund program, which provided support to small business owners affected by the COVID-19 pandemic, has an unspent balance amounting to 2.5 trillion KRW. This discrepancy of several trillion won between the budgeted amount and the actual expenditure occurred due to inaccurate predictions of the support volume.

According to the “Analysis of the 1st Supplementary Budget for 2022” released by the National Assembly Budget Office on the 7th, the Ministry of SMEs and Startups recorded an unspent balance totaling 2.5 trillion KRW from disaster relief programs conducted so far, including 500 billion KRW for Saehopeum Fund, 200 billion KRW for Buteemok Fund, and 1.8 trillion KRW for Buteemok Fund Plus. The budget was not fully utilized due to inaccurate forecasting of the required support volume during budget planning. In particular, Buteemok Fund Plus was expected to be paid to 3.85 million businesses, but only 2.91 million businesses actually received the support. The Budget Office stated, “For the second round of quarantine support funds, the appropriateness of the supplementary budget size should be reviewed based on precise demand forecasting to minimize inefficiencies caused by overestimation of the budget.”

Additionally, concerns have been raised that the advance payment system for loss compensation, which converts excess payments over actual compensation into debt, could impose a financial burden on the state, highlighting the need to establish a legal basis for it. Separate from this year’s disaster relief funds, an advance payment of 5 million KRW per business is being made for loss compensation. If a business receives more in advance payments than the actual loss compensation due, it must repay the excess as a loan (1.0% interest rate, 2-year grace period, 3-year repayment). It is expected that a significant number of businesses will later convert these advances into principal and interest repayments. According to the loss compensation payment records for the third quarter of last year, 50.1% (323,000 businesses) received loss compensation between 100,000 KRW and less than 1 million KRW, the largest group.

If there are difficulties in repaying the principal and interest, the normal operation of the loss compensation system will be jeopardized, potentially leading to financial burdens due to defaults. The Budget Office noted, “There is a lack of clear legal grounds for advance payment of loss compensation,” and recommended, “The Ministry of SMEs and Startups should thoroughly establish and implement a settlement plan to ensure that follow-up measures such as principal and interest repayments proceed without issues.”

There were also opinions emphasizing the need for post-management of overpayments and fraudulent claims related to quarantine support funds. The current method provides quarantine support funds by considering businesses that previously received disaster relief funds as having experienced sales declines, but this approach risks providing support to businesses whose sales actually increased. The Budget Office stated, “During the recent national audit, it was found that a significant number of businesses that received disaster relief funds had increased sales in 2020 compared to 2019, raising concerns about the need for expenditure inspections,” and added, “Recognizing sales declines solely because a business previously received disaster relief funds may cause inefficiencies in budget use due to overpayments.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)