Mirae Asset Surpasses 1 Trillion Won in Net Profit for the First Time

Meritz and NH Also Achieve Record High Performance

Stock Prices Plummet Due to US Shock

Mirae Asset Returns 188.1 Billion Won in Cash Dividends to Shareholders

Will Other Securities Firms Follow?

[Asia Economy Reporter Ji Yeon-jin] Domestic securities firms, which achieved record-breaking performance last year, have faced the tightening storm from the U.S. since the beginning of the year. As stock prices have been hitting 52-week lows day after day and suffering downward pressure, they are implementing large-scale shareholder return policies.

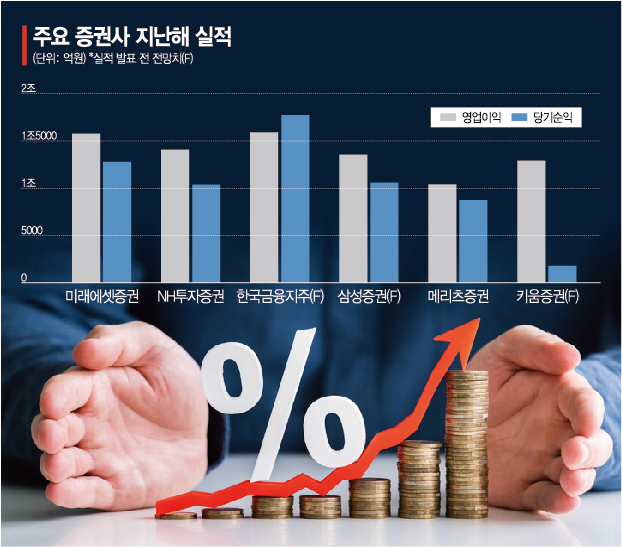

According to the financial investment industry on the 28th, Mirae Asset Securities announced the day before that its provisional consolidated operating profit for last year reached 1.4858 trillion KRW. This marks the first time in the securities industry to surpass 1 trillion KRW in operating profit for two consecutive years. Net profit also exceeded 1 trillion KRW for the first time.

Meritz Securities, which announced its performance on the same day, recorded a consolidated operating profit of 948.9 billion KRW and net profit of 782.9 billion KRW. This represents an increase of 14.6% and 38.5% respectively compared to the same period last year, setting an all-time high. Earlier, NH Investment & Securities, which announced its results on the 21st of this month, saw operating profit surge 67.2% to 1.3166 trillion KRW, and net profit rose 64.3% to 947.9 billion KRW.

Korea Financial Group, which has yet to announce its results, already achieved a cumulative operating profit of 1.2461 trillion KRW and cumulative net profit of 1.4559 trillion KRW up to the third quarter of last year. Its operating profit for last year is expected to be 1.4991 trillion KRW, with net profit projected at 1.6804 trillion KRW. Samsung Securities and Kiwoom Securities are also expected to exceed 1 trillion KRW in operating profit this year, marking their highest performance since establishment.

However, despite these strong performances, securities stocks have been on a continuous decline since the beginning of the year. Especially on the 27th (local time), the U.S. Federal Open Market Committee (FOMC) concluded its meeting and mentioned the possibility of raising interest rates starting in March, which struck the market with tightening fears. Most securities stocks fell to their lowest points this year the day before. Mirae Asset Securities dropped to 8,060 KRW during trading. Korea Financial Group plunged to 69,800 KRW, and Kiwoom Securities fell to 87,200 KRW. All these stocks hit 52-week lows. NH Investment & Securities and Samsung Securities fell to levels seen at the end of February last year when concerns about inflation triggered a correction in the domestic stock market.

Target prices are also being revised downward. KB Securities lowered the target price for Mirae Asset Securities by 6.5% to 15,000 KRW, citing significant stock-related valuation losses in the weak stock market during the fourth quarter of last year. Hana Financial Investment also cut its target price from 14,000 KRW to 13,000 KRW, a 7.14% decrease. Park Hye-jin, a researcher at Daishin Securities, said, "Securities firms are burdened by last year's record-high performance, stock price trends inevitably linked to trading volume, and an inevitable profit decline this year, so we are lowering the investment opinion to neutral."

Securities firms are announcing large-scale shareholder return policies to defend their stock prices. Mirae Asset Securities plans to pay cash dividends worth 188.1 billion KRW and retire 20 million treasury shares. This amounts to a shareholder return policy worth approximately 362.2 billion KRW. As U.S. tightening is expected to fully begin this year, increasing downward pressure on the stock market, other large securities firms are also likely to implement active shareholder-friendly policies. In fact, Meritz Securities repurchased more than 300 billion KRW worth of treasury shares three times last year, and while most securities stocks have shown weakness this year, Meritz Securities' year-to-date return has exceeded 20%.

Lee Hong-jae, a researcher at Hana Financial Investment, said, "Active shareholder return policies will secure downside rigidity in the recent difficult stock market environment." Baek Doo-san, a researcher at Korea Investment & Securities, said, "Mirae Asset Securities guarantees a certain level of profit based on a diversified business model amid difficult securities market conditions and is showing active shareholder-friendly moves," maintaining it as the top pick among securities stocks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.