The Biggest Cause of Yesterday's KOSPI Plunge: 'LG Energy Solution Listing'

KOSPI Falls 3.5%... PER Rises from 10.54 to 10.71

"High Valuation Poses Burden on KOSPI Rebound"

No Signs of Rising US High-Yield Spread

Low Possibility of US Stock Market Entering Bear Market

[Asia Economy Reporter Hwang Yoon-joo] Hanwha Investment & Securities advised focusing on index rebounds rather than individual stocks in this year's KOSPI investment strategy until the inflationary pressures in the U.S. ease. The firm also maintained its previous view that if the growth of big tech slows this year, growth opportunities can be found in sectors with expanding external scale.

Researcher Park Seung-young of Hanwha Investment & Securities stated on the 28th, "We recommend reducing the number of stocks held until the inflationary pressure in the U.S. eases."

Park explained, "The narrowing of intraday fluctuations in the index signals that the downside of the index is becoming more resilient," adding, "It is advisable to confirm the reduction in volatility and then increase positions."

Park predicted that the decline in U.S. inflation this year will be limited. He said, "The consumer price inflation rate will remain in the 4% range until the end of the year," and "We maintain the view that the FOMC will raise the benchmark interest rate three times this year."

On the 26th (local time), Jerome Powell, Chair of the U.S. Federal Reserve (Fed), mentioned that the FOMC might raise the benchmark interest rate at every meeting after March, which increased volatility in global stock markets. As a result, the KOSPI index plunged 3.5% the following day. This reflected the possibility of the FOMC raising rates six times this year. Park expects that once inflation passes its peak, the expected number of rate hikes will shift from six to around three or four.

Park emphasized the U.S. high-yield spread as a key indicator to watch going forward. He assessed that since there are no signs of an increase in the U.S. high-yield spread, it is difficult to see the U.S. stock market entering a bear market.

Park analyzed, "The reason the stock market fears rising interest rates is the concern that it might trigger deleveraging," adding, "While governments and households worldwide may reduce leverage this year, companies are relatively less likely to do so."

He stated, "Looking at the Fed's tightening cycles since 1990, which led to corporate profit declines and bear markets, the rise in high-yield spreads triggered corporate deleveraging and profit reductions, but this year, no increase in high-yield spreads has been observed yet."

He added, "Historically, during periods when profits do not decline, the U.S. stock market's downturn has been limited to around 10%."

Park cited the reasons for the KOSPI's decline the previous day as ▲ the listing of LG Energy Solution ▲ global tightening concerns. Among these, he evaluated the LG Energy Solution listing more negatively.

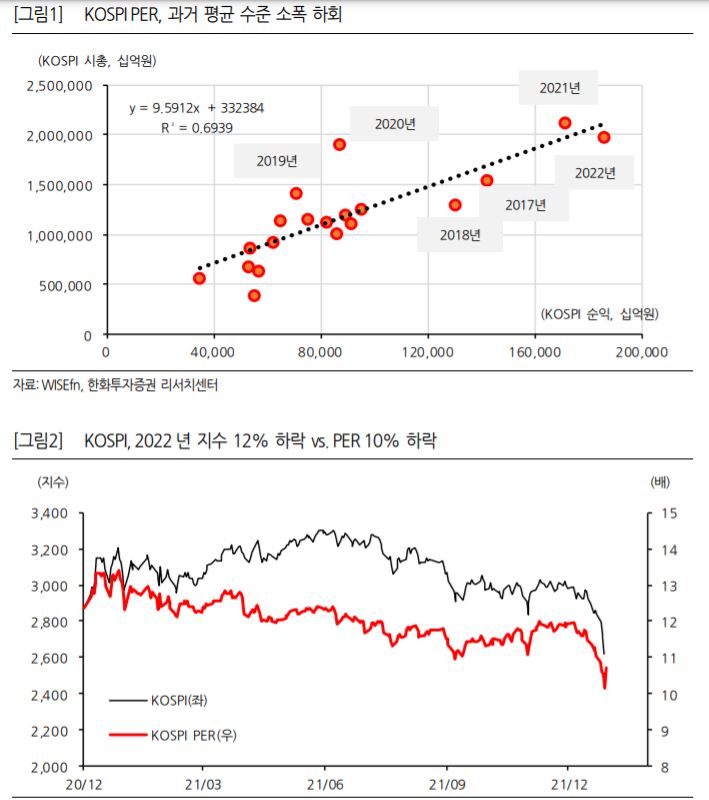

Park pointed out, "LG Energy Solution was included in the KOSPI at yesterday's closing price. Before inclusion, the KOSPI market capitalization was KRW 1,866 trillion, with an expected net profit of KRW 184 trillion this year, resulting in an estimated 2022 PER of 10.1 times. After inclusion, the KOSPI market capitalization rose to KRW 1,984 trillion, an increase of KRW 118 trillion, but the expected net profit only increased by KRW 1 trillion."

Park explained, "In August last year, when the KOSPI experienced a significant correction, large initial public offerings (IPOs) such as KakaoBank and Krafton began in earnest. Although the direct cause of the recent correction in major Asian stock markets was likely the hawkish FOMC, when market volatility subsides and attempts a rebound later, high valuations could become a burden."

In fact, although the KOSPI fell 3.5% the previous day, the PER rose from 10.54 times to 10.71 times.

He added, "The KOSPI has fallen to a level where a technical rebound is possible, but investors may be reluctant to hold stocks during the holiday period and might hedge their positions, so the technical rebound is expected to be postponed until next month," adding, "After the technical rebound, buying will be concentrated in stocks with favorable earnings prospects."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.