Surpassing Intel to Become World's No.1 Semiconductor Market Leader in 3 Years

Sales Expected to Exceed 300 Trillion Won This Year, 'Green Light'

[Asia Economy Reporters Sunmi Park, Hyeyoung Lee] Riding the semiconductor boom, Samsung Electronics announced record-breaking results last year with sales of 279.6 trillion KRW and operating profit of 51.63 trillion KRW. The sales figure is the highest since the company's founding, and the operating profit ranks third all-time. Notably, the semiconductor division recorded sales exceeding 94 trillion KRW last year, surpassing U.S. company Intel to reclaim the world's number one position in the semiconductor market after three years. Although global IT demand is expected to recover this year, making it possible to exceed 300 trillion KRW in sales, the lack of a finalized semiconductor-focused capital expenditure plan remains a point of regret.

On the 27th, Samsung Electronics stated during its earnings conference call that "this year's semiconductor capital expenditure (CAPEX) plan is still under discussion due to various uncertainties." However, the company affirmed that it will maintain its existing investment policy of flexible capital expenditure. Regarding last year's semiconductor capital investment, Samsung explained, "Capital expenditure increased compared to 2020, with a particularly high proportion allocated to DRAM and NAND sectors. We expanded capacity to meet demand growth that exceeded early-year forecasts and made proactive investments in high-cost next-generation technologies such as EUV (Extreme Ultraviolet) lithography at a technological inflection point."

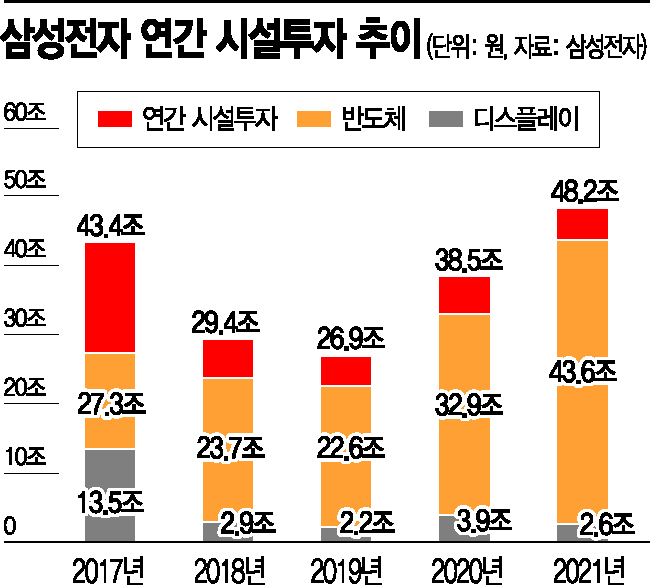

Last year, Samsung Electronics executed capital investments totaling 48.2 trillion KRW, approximately 10 trillion KRW more than in 2020. Of this, 43.6 trillion KRW was invested in semiconductors and 2.6 trillion KRW in displays, reflecting a focus on semiconductor investments.

So far, the semiconductor division has been the driving force behind Samsung Electronics' performance. Last year, Samsung posted sales of 279.6 trillion KRW and operating profit of 51.63 trillion KRW, representing increases of 18.1% and 43.5% year-over-year, respectively. The company recorded its highest quarterly sales in all four quarters last year and set a new all-time annual sales record, approaching the milestone of 300 trillion KRW. Particularly, the semiconductor division achieved sales exceeding 94 trillion KRW last year, surpassing Intel to become the global leader in semiconductor sales.

This year, although uncertainties such as component supply issues exist in the memory segment of the semiconductor division, demand is expected to increase due to expanded IT investments by companies and the introduction of new CPUs. Accordingly, Samsung plans to focus on portfolio optimization by expanding sales of advanced process and high value-added products in response to the recovery of server and PC demand. The company intends to strengthen market leadership by expanding the supply of high-performance products and proactively applying EUV processes. Capital investments are already underway centered on Pyeongtaek and Xi'an expansions and process transitions to meet demand for advanced processes such as EUV-based 15nm DRAM and V6 NAND, as well as infrastructure investments in the Pyeongtaek P3 line.

Additionally, the System LSI division will focus on supplying key components such as SoCs (System on Chips) and CIS (Image Sensors) for flagship products of major customers, while the Foundry division plans to expand supply through advanced process production and yield stability improvements. The Foundry aims to exceed market average growth by expanding technology leadership through mass production of the first-generation GAA (Gate-All-Around) process and increasing supply to global customers.

Meanwhile, Samsung Electronics decided on a cash dividend of 361 KRW per common share and 362 KRW per preferred share. The dividend yield is 0.5%, with total dividends amounting to approximately 2.45 trillion KRW. Samsung previously announced in its shareholder return policy that it will maintain a policy of returning 50% of free cash flow to shareholders over the next three years and increase the regular dividend size from the existing 9.6 trillion KRW annually to 9.8 trillion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)