Stock and Cryptocurrency Markets Continue to Decline, Young Investors Sigh

"Should I Go to Mapo Bridge?" Posts Hinting at Extreme Choices Emerge

2030 Generation Starting Investment as 'Joorini' and 'Donghak Ants'

Lack Experience with Volatile Bear Markets

Experts Advise "Avoid High-Risk Investments"

[Asia Economy Reporter Lim Ju-hyung] As the decline in asset markets such as the stock market and cryptocurrencies continues, the distress of investors who have lost unrealized gains is growing. In particular, among the 2030 generation who started investing for the first time since the COVID-19 pandemic in 2020, some are reportedly mentioning extreme choices.

Recently, as the U.S. Federal Reserve (Fed) is expected to tighten monetary policy by raising the benchmark interest rate in response to the sharp rise in inflation, investor sentiment is rapidly freezing.

On the 25th (local time), all three major indices of the representative stock market, the New York Stock Exchange, closed lower. The Dow Jones Industrial Average closed at 34,297.73, down 66.77 points (0.19%) from the previous day, the S&P 500 index fell 53.68 points (1.22%) to 4,356.45, and the Nasdaq index also dropped 315.83 points (2.28%) to end at 13,539.29.

On the afternoon of the 25th, when the KOSPI fell more than 2%, an employee was walking past the electronic display board in the dealing room at the Hana Bank headquarters in Jung-gu, Seoul. / Photo by Yonhap News

On the afternoon of the 25th, when the KOSPI fell more than 2%, an employee was walking past the electronic display board in the dealing room at the Hana Bank headquarters in Jung-gu, Seoul. / Photo by Yonhap News

It is not only the U.S. stock market that is experiencing recent sluggishness. The KOSPI index also broke below the 3,000 mark on the 29th of last month and then fell below the 2,800 level on the 24th, currently trading in the 2,700 range. The KOSPI falling below 2,800 is the first time since the end of 2020.

The cryptocurrency market, which attracted attention after the pandemic, is also struggling. According to data compiled by CoinMarketCap, Bitcoin, a representative cryptocurrency, reached an all-time high of around $69,000 in November last year but has since dropped to about $37,000, nearly halving in about two months.

A post from the official Twitter account of 'CoinMarketCap,' a cryptocurrency trading volume ranking analysis site. Along with a character illustration wearing a McDonald's uniform hat, it said, "See you at the night shift change." / Photo by Twitter capture

A post from the official Twitter account of 'CoinMarketCap,' a cryptocurrency trading volume ranking analysis site. Along with a character illustration wearing a McDonald's uniform hat, it said, "See you at the night shift change." / Photo by Twitter capture

Given this situation, investors' worries are growing. Especially in domestic and international stock and cryptocurrency-related online communities mainly used by the 2030 generation investors, self-deprecating jokes such as "I should quickly look for a part-time job at McDonald's" have surfaced. Cryptocurrency community users are known to use the metaphor 'McDonald's part-time job' to mean stopping investment and focusing on their livelihood.

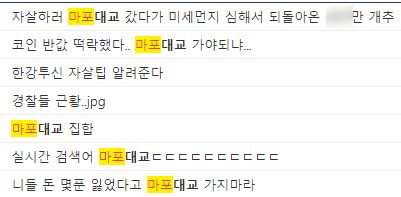

On the other hand, more serious distress has been expressed, sparking controversy. On social networking services (SNS) and communities, some netizens posted messages implying extreme choices such as 'Mapo Bridge.' Searching 'Mapo Bridge' in Bitcoin-related communities mostly yielded posts written in a joking, lighthearted tone, but it appears that young people are indeed stressed by the continuous bear market.

In some Bitcoin-related communities, posts mentioning extreme choices were also uploaded. / Photo by Internet Community Capture

In some Bitcoin-related communities, posts mentioning extreme choices were also uploaded. / Photo by Internet Community Capture

Youths who have experienced the crash of stocks and cryptocurrencies they invested in expressed their disappointment. A 20-something office worker, Mr. A, said, "A year ago, my friends around me made big money from stock investments, so I took the plunge, but I only lost my money," adding, "The more I invest, the more scared I am of the price dropping, so I can't even focus on my main job. I plan not to look at stock investments for a while."

Another office worker, Mr. B (31), said, "I started investing when COVID-19 began in 2020, but now I barely broke even," and lamented, "I studied hard and invested, barely making money, but it feels like all my efforts have gone to waste."

Many 2030 investors first jumped into investing early last year. In February 2020, when the spread of COVID-19 became serious in Korea, the KOSPI plunged from 2,200 to 1,600 amid concerns about economic downturn. Seeing this as an opportunity, the number of 2030 generation opening their first stock accounts began to increase, and online spaces nicknamed them 'Joorini (stock + child)' and 'Donghak Ants.'

Some netizens referred to the situation where individual investors buy stocks in a market from which foreigners and foreign investors have withdrawn as the "Donghak Ant Movement." / Photo by Internet Community Capture

Some netizens referred to the situation where individual investors buy stocks in a market from which foreigners and foreign investors have withdrawn as the "Donghak Ant Movement." / Photo by Internet Community Capture

According to data from the Korea Financial Investment Association as of March 18, 2020, the number of active stock trading accounts reached 30,238,046, surpassing 30 million for the first time. Some securities firms estimated that 60% of these newly created accounts were opened by customers in their 20s and 30s.

Cases of borrowing money to invest in stocks also increased. According to statistics from the Korea Financial Investment Association, the balance of credit loans for stock trading (the amount investors borrowed from securities firms to buy stocks) was 9.2133 trillion won at the end of 2019, just before the COVID-19 outbreak, but increased by more than 1 trillion won to 10.3726 trillion won two months later.

The youth also played a major role in cryptocurrency investment. According to the status of investors at Korea's four major cryptocurrency exchanges (Bithumb, Upbit, Korbit, Coinone) last year, among 2,495,289 newly established real-name accounts in the first quarter (January to March), those in their 20s and 30s accounted for 32.7% (816,039) and 30.8% (768,775), respectively. In other words, six out of ten new cryptocurrency investors were from the 2030 generation.

The problem is that many of these new investors have only experienced a so-called 'bull market.' Buying stocks or cryptocurrencies cheaply after a crash and doing well when prices rise is fine, but when the market becomes unstable, the skill of properly diversifying investments, known as 'risk hedge,' is necessary. However, young people, who lack both experience and knowledge compared to older generations who have invested for a long time, may be vulnerable to the upcoming bear market.

Mr. C, a 40-something office worker who has been investing steadily for over 20 years, said, "No one really knows which direction the stock price will go, but I think there is a difference due to the gap in experience. People who started investing in 2020 have only seen bull markets, so when the market crashes or gets stuck in a box range, they might panic sell because they don't know how to cope," adding, "They should take the money lost this year as an expensive lesson and learn that there is no easy and quick way to accumulate assets."

Meanwhile, experts recommend refraining from high-risk investments in the current situation of increased stock market volatility. Nam Gil-nam, head of the Capital Market Research Institute at the Korea Capital Market Institute, said at the '2022 Capital Market Outlook and Major Issues Seminar' held on the 25th, "In the current situation of increased stock market volatility, the proportion of small-cap stocks with credit loan balances exceeding 5% rose to 25% as of November last year. Although it decreased in December, it remains relatively high."

He continued, "While the balance of direct overseas stock investments by individual investors has expanded more than 30 times over the past 10 years, the balance of overseas fund sales is on a downward trend. Individual investors seem to perceive overseas stocks not as part of diversified investment but as high-return, high-risk investments."

He emphasized, "Currently, stock market volatility is increasing. The higher the investment risk of a stock, the more its volatility can increase. Caution is necessary."

※ If you have difficult feelings such as depression or know someone around you who is struggling, you can receive 24-hour professional counseling through suicide prevention hotline ☎ 1393, mental health counseling ☎ 1577-0199, Hope Call ☎ 129, Lifeline ☎ 1588-9191, Youth Hotline ☎ 1388, youth mobile counseling app 'Da Deureojul Gae,' KakaoTalk, and others.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)